Shadow banking involves non-bank financial intermediaries that provide credit and liquidity outside traditional banking regulations, often encompassing entities like hedge funds and money market funds. Credit unions are member-owned, not-for-profit financial cooperatives offering banking services primarily focused on community development and member benefits. Explore more to understand their distinct roles and risks within the financial ecosystem.

Why it is important

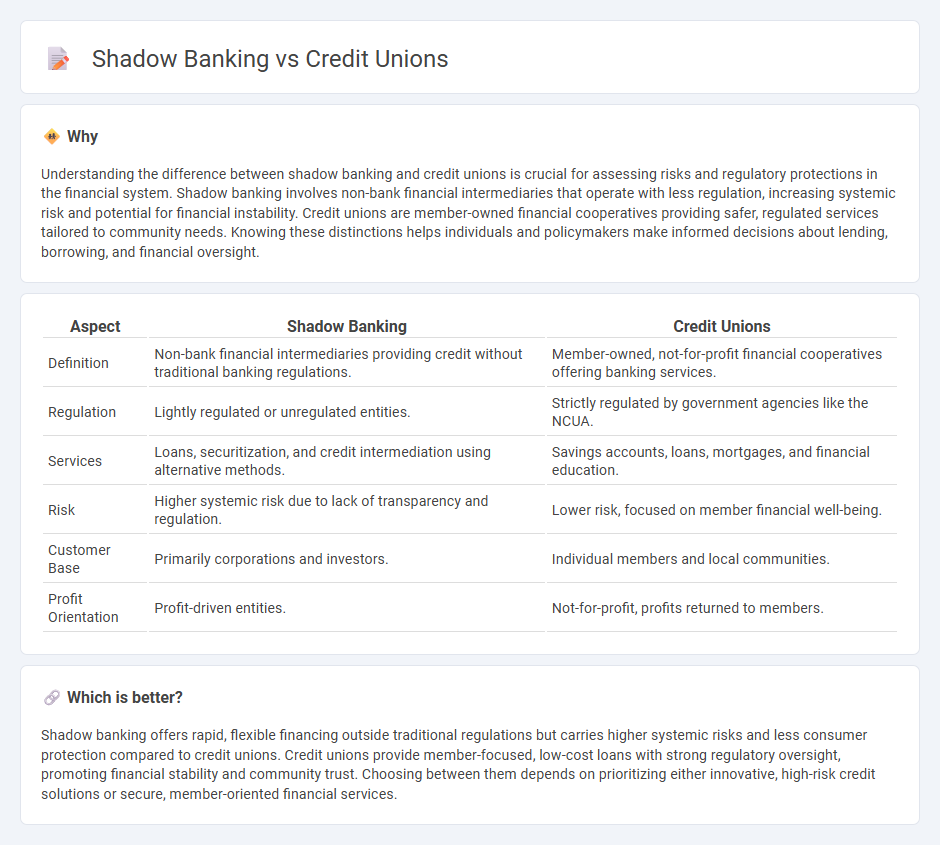

Understanding the difference between shadow banking and credit unions is crucial for assessing risks and regulatory protections in the financial system. Shadow banking involves non-bank financial intermediaries that operate with less regulation, increasing systemic risk and potential for financial instability. Credit unions are member-owned financial cooperatives providing safer, regulated services tailored to community needs. Knowing these distinctions helps individuals and policymakers make informed decisions about lending, borrowing, and financial oversight.

Comparison Table

| Aspect | Shadow Banking | Credit Unions |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit without traditional banking regulations. | Member-owned, not-for-profit financial cooperatives offering banking services. |

| Regulation | Lightly regulated or unregulated entities. | Strictly regulated by government agencies like the NCUA. |

| Services | Loans, securitization, and credit intermediation using alternative methods. | Savings accounts, loans, mortgages, and financial education. |

| Risk | Higher systemic risk due to lack of transparency and regulation. | Lower risk, focused on member financial well-being. |

| Customer Base | Primarily corporations and investors. | Individual members and local communities. |

| Profit Orientation | Profit-driven entities. | Not-for-profit, profits returned to members. |

Which is better?

Shadow banking offers rapid, flexible financing outside traditional regulations but carries higher systemic risks and less consumer protection compared to credit unions. Credit unions provide member-focused, low-cost loans with strong regulatory oversight, promoting financial stability and community trust. Choosing between them depends on prioritizing either innovative, high-risk credit solutions or secure, member-oriented financial services.

Connection

Shadow banking and credit unions are connected through their roles in providing alternative financial services outside traditional banking regulations. Shadow banking involves non-bank entities offering credit and liquidity, often intersecting with credit unions that serve niche or underserved markets with member-focused lending. Both systems impact financial stability by expanding credit access but pose regulatory challenges due to differing oversight mechanisms.

Key Terms

Regulation

Credit unions operate under strict regulatory frameworks established by federal and state agencies, ensuring member protections and financial stability through oversight by the National Credit Union Administration (NCUA). In contrast, shadow banking entities, such as hedge funds and non-bank finance companies, generally face less stringent regulation, increasing systemic risk due to reduced transparency and limited government supervision. Explore the nuanced differences in regulatory environments that shape the behaviors and stability of credit unions versus shadow banking.

Deposit Insurance

Credit unions offer members federally insured deposits through institutions like the National Credit Union Administration (NCUA), ensuring protection up to $250,000 per account. Shadow banking entities operate outside this traditional insurance framework, exposing depositors to higher risks without federal backing. Explore how deposit insurance impacts financial security across these systems to deepen your understanding.

Securitization

Credit unions operate within regulated financial institutions, offering securitization primarily through traditional lending and member-focused loan portfolios, ensuring transparency and member protection. Shadow banking entities engage heavily in securitization by transforming illiquid assets into tradeable securities, often without the same regulatory oversight, increasing systemic risk. Explore how securitization in both credit unions and shadow banking impacts financial markets and consumer security.

Source and External Links

Credit union - Wikipedia - A credit union is a member-owned nonprofit cooperative financial institution offering services like savings accounts, loans, and credit, with a focus on serving members' financial well-being and usually providing better terms than commercial banks.

What is a Credit Union? - MyCreditUnion.gov - Credit unions are not-for-profit financial institutions owned and controlled by members, offering reduced fees, higher savings rates, and lower loan rates, often requiring members to share a common bond such as employment or geographic location.

World Council of Credit Unions - WOCCU is the global trade association representing credit unions worldwide, promoting collaboration, financial inclusion, and leadership development to support credit unions' growth and impact in global markets.

dowidth.com

dowidth.com