Sovereign debt restructuring involves renegotiating the terms of a country's debt to avoid default and restore financial stability, often through debt rescheduling, reduction, or refinancing. Distressed debt exchange refers to a process where creditors accept new debt instruments with altered terms from an issuer facing financial difficulties, primarily aimed at improving debt sustainability. Explore the nuances and strategies behind sovereign debt restructuring and distressed debt exchanges to better understand debt crisis management.

Why it is important

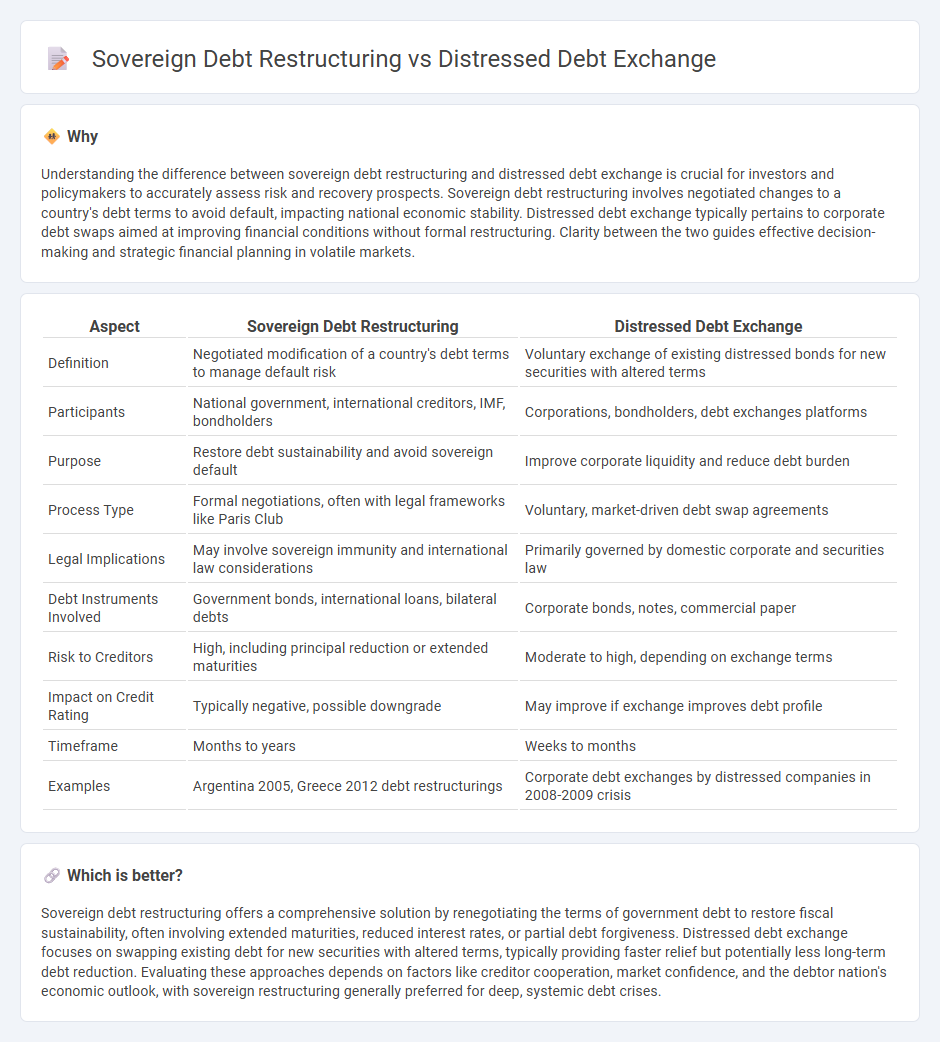

Understanding the difference between sovereign debt restructuring and distressed debt exchange is crucial for investors and policymakers to accurately assess risk and recovery prospects. Sovereign debt restructuring involves negotiated changes to a country's debt terms to avoid default, impacting national economic stability. Distressed debt exchange typically pertains to corporate debt swaps aimed at improving financial conditions without formal restructuring. Clarity between the two guides effective decision-making and strategic financial planning in volatile markets.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Distressed Debt Exchange |

|---|---|---|

| Definition | Negotiated modification of a country's debt terms to manage default risk | Voluntary exchange of existing distressed bonds for new securities with altered terms |

| Participants | National government, international creditors, IMF, bondholders | Corporations, bondholders, debt exchanges platforms |

| Purpose | Restore debt sustainability and avoid sovereign default | Improve corporate liquidity and reduce debt burden |

| Process Type | Formal negotiations, often with legal frameworks like Paris Club | Voluntary, market-driven debt swap agreements |

| Legal Implications | May involve sovereign immunity and international law considerations | Primarily governed by domestic corporate and securities law |

| Debt Instruments Involved | Government bonds, international loans, bilateral debts | Corporate bonds, notes, commercial paper |

| Risk to Creditors | High, including principal reduction or extended maturities | Moderate to high, depending on exchange terms |

| Impact on Credit Rating | Typically negative, possible downgrade | May improve if exchange improves debt profile |

| Timeframe | Months to years | Weeks to months |

| Examples | Argentina 2005, Greece 2012 debt restructurings | Corporate debt exchanges by distressed companies in 2008-2009 crisis |

Which is better?

Sovereign debt restructuring offers a comprehensive solution by renegotiating the terms of government debt to restore fiscal sustainability, often involving extended maturities, reduced interest rates, or partial debt forgiveness. Distressed debt exchange focuses on swapping existing debt for new securities with altered terms, typically providing faster relief but potentially less long-term debt reduction. Evaluating these approaches depends on factors like creditor cooperation, market confidence, and the debtor nation's economic outlook, with sovereign restructuring generally preferred for deep, systemic debt crises.

Connection

Sovereign debt restructuring involves renegotiating the terms of a country's outstanding debt to achieve more sustainable repayment conditions, often amid financial distress. Distressed debt exchange is a specific mechanism within restructuring where existing debt instruments are swapped for new securities with altered terms to alleviate the debtor's burden. Both processes aim to restore fiscal stability and improve creditworthiness by addressing unsustainable debt levels and avoiding default.

Key Terms

Default Risk

Distressed debt exchange (DDE) involves negotiating new debt terms with creditors to reduce default risk without formal bankruptcy, often used by corporations facing liquidity issues. Sovereign debt restructuring addresses default risk by renegotiating debt terms between a sovereign nation and its creditors to avoid sovereign default or insolvency, typically involving international agencies or governments. Explore in-depth analyses of default risk implications in distressed debt exchanges versus sovereign debt restructuring to understand their financial impact and strategies.

Haircut

In distressed debt exchange, creditors often accept a "haircut," a reduction in the debt's face value, to exchange old bonds for new ones with longer maturities or lower interest rates, alleviating the debtor's immediate financial distress. Sovereign debt restructuring involves negotiated haircuts with international creditors to restore the country's debt sustainability while maintaining essential public services. Explore the detailed mechanisms and impacts of haircuts in these processes to understand their role in financial recovery.

Creditor Negotiation

Distressed debt exchange involves negotiations between a distressed company and its creditors to swap existing debt for new debt or equity, often under terms that aim to improve the company's financial stability without complete default. Sovereign debt restructuring entails negotiations between a sovereign state and its creditors to modify debt terms, such as extending maturities or reducing principal, to restore debt sustainability while maintaining sovereign creditworthiness. Explore further to understand the intricacies of creditor negotiation strategies in these complex financial processes.

Source and External Links

An Introduction to Distressed Debt Exchanges - AAM Company - A distressed debt exchange is a company's voluntary offer to exchange existing debt for new securities, typically to avoid bankruptcy, improve liquidity, and reduce debt, often involving a minimum tender condition to ensure broad participation and avoid free riders.

Distressed exchanges to hit all-time high of $50bn this year - Distressed debt exchanges are restructurings done outside bankruptcy where companies negotiate new debt terms at reduced values to prevent default, with 2024 expected to see a record $50 billion in distressed exchanges due to a high default environment.

There's a Boom in Distressed Debt Exchanges to Deal with Leveraged Loan Defaults - Distressed debt exchanges are commonly used alternatives to bankruptcy for companies with unmanageable debts, resulting in debt haircuts and credit downgrades, impacting investors holding leveraged loans, with default rates significantly higher when these exchanges are included.

dowidth.com

dowidth.com