Synthetic risk transfer uses derivatives to shift insurance risk without the need to transfer physical assets, enabling more flexible capital management for insurers. Catastrophe bonds are insurance-linked securities that provide capital relief by transferring catastrophe risk to investors in exchange for high yields tied to specific disaster events. Explore these innovative financial instruments to understand how they reshape risk distribution in the insurance industry.

Why it is important

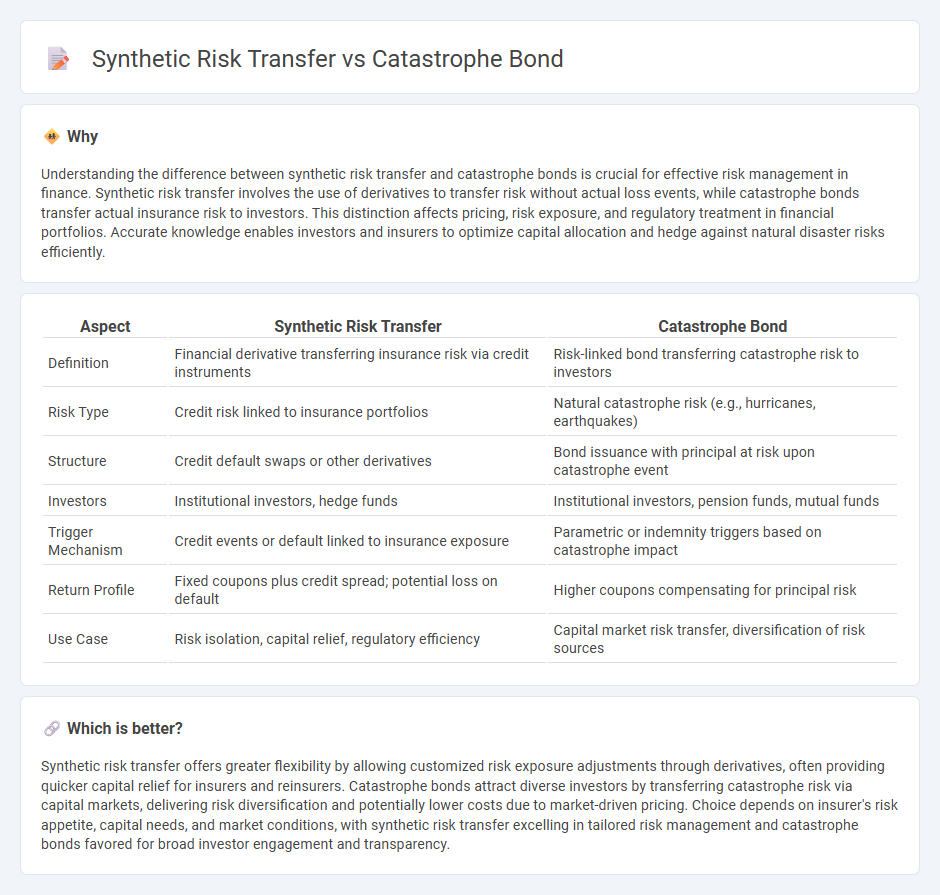

Understanding the difference between synthetic risk transfer and catastrophe bonds is crucial for effective risk management in finance. Synthetic risk transfer involves the use of derivatives to transfer risk without actual loss events, while catastrophe bonds transfer actual insurance risk to investors. This distinction affects pricing, risk exposure, and regulatory treatment in financial portfolios. Accurate knowledge enables investors and insurers to optimize capital allocation and hedge against natural disaster risks efficiently.

Comparison Table

| Aspect | Synthetic Risk Transfer | Catastrophe Bond |

|---|---|---|

| Definition | Financial derivative transferring insurance risk via credit instruments | Risk-linked bond transferring catastrophe risk to investors |

| Risk Type | Credit risk linked to insurance portfolios | Natural catastrophe risk (e.g., hurricanes, earthquakes) |

| Structure | Credit default swaps or other derivatives | Bond issuance with principal at risk upon catastrophe event |

| Investors | Institutional investors, hedge funds | Institutional investors, pension funds, mutual funds |

| Trigger Mechanism | Credit events or default linked to insurance exposure | Parametric or indemnity triggers based on catastrophe impact |

| Return Profile | Fixed coupons plus credit spread; potential loss on default | Higher coupons compensating for principal risk |

| Use Case | Risk isolation, capital relief, regulatory efficiency | Capital market risk transfer, diversification of risk sources |

Which is better?

Synthetic risk transfer offers greater flexibility by allowing customized risk exposure adjustments through derivatives, often providing quicker capital relief for insurers and reinsurers. Catastrophe bonds attract diverse investors by transferring catastrophe risk via capital markets, delivering risk diversification and potentially lower costs due to market-driven pricing. Choice depends on insurer's risk appetite, capital needs, and market conditions, with synthetic risk transfer excelling in tailored risk management and catastrophe bonds favored for broad investor engagement and transparency.

Connection

Synthetic risk transfer techniques use financial instruments to offload risk without transferring the underlying asset, often employing catastrophe bonds to achieve this by linking insurance risk to capital market investors. Catastrophe bonds provide a crucial mechanism within synthetic risk transfer by allowing insurers to manage catastrophic event exposure through risk-linked securities sold to investors. This connection enhances financial markets' ability to absorb and redistribute disaster-related risks, improving overall insurance sector resilience.

Key Terms

Risk Securitization

Catastrophe bonds transfer specific insured risks to capital markets by issuing debt instruments that pay investors high yields unless a predefined catastrophe event occurs, triggering principal loss. Synthetic risk transfer uses derivatives, such as insurance-linked swaps or options, to achieve similar risk reduction by transferring risk without issuing bonds, enabling tailored risk management solutions. Explore these models further to understand how risk securitization innovatively enhances insurance industry resilience.

Credit Derivatives

Catastrophe bonds are insurance-linked securities that transfer catastrophe risk from insurers to investors, providing upfront capital and paying interest if no disaster occurs, while synthetic risk transfers use credit derivatives like collateralized debt obligations (CDOs) to replicate insurance risk exposure without the physical transfer of underlying assets. Credit derivatives facilitate synthetic risk transfer by allowing insurers to hedge credit risk through instruments such as credit default swaps (CDS), offering flexibility and capital relief through financial engineering. Explore detailed comparisons and structural mechanisms of catastrophe bonds and synthetic risk transfers in the context of credit derivatives to understand their risk management roles.

Special Purpose Vehicle (SPV)

Catastrophe bonds (cat bonds) and synthetic risk transfers both utilize Special Purpose Vehicles (SPVs) to isolate financial risk associated with natural disasters, providing insurance companies with capital relief. While cat bonds involve SPVs issuing bonds to investors that pay out based on triggering catastrophic events, synthetic risk transfers use SPVs to enter into derivative contracts like catastrophe swaps, transferring risk without the issuance of bonds. Explore how structured finance through SPVs optimizes risk management in insurance markets.

Source and External Links

Cat Bond Primer - Wharton ESG Initiative - Catastrophe bonds (cat bonds) are insurance-linked securities that transfer catastrophe risk from insurers or other entities to capital market investors via a special purpose vehicle, where investors lose principal if a triggering disaster occurs, otherwise they receive interest and principal back.

Catastrophe bond - Wikipedia - Catastrophe bonds are high-yield bonds created to help insurance companies cover major catastrophic losses by transferring risks to investors, who receive coupons but may lose principal if a specified catastrophe triggers payout.

What is a catastrophe bond? - Artemis - Resource Library - Cat bonds can be structured to cover single catastrophic events or multiple losses, providing insurance or reinsurance protection through triggers based on event occurrence or losses, enabling risk transfer from insurers or corporates to investors.

dowidth.com

dowidth.com