Impact investing focuses on generating measurable social and environmental benefits alongside financial returns by directing capital to businesses promoting sustainable development. Microfinance provides financial services like small loans and savings to underserved populations to empower economic growth at the grassroots level. Explore how these strategies transform communities and drive inclusive economic progress.

Why it is important

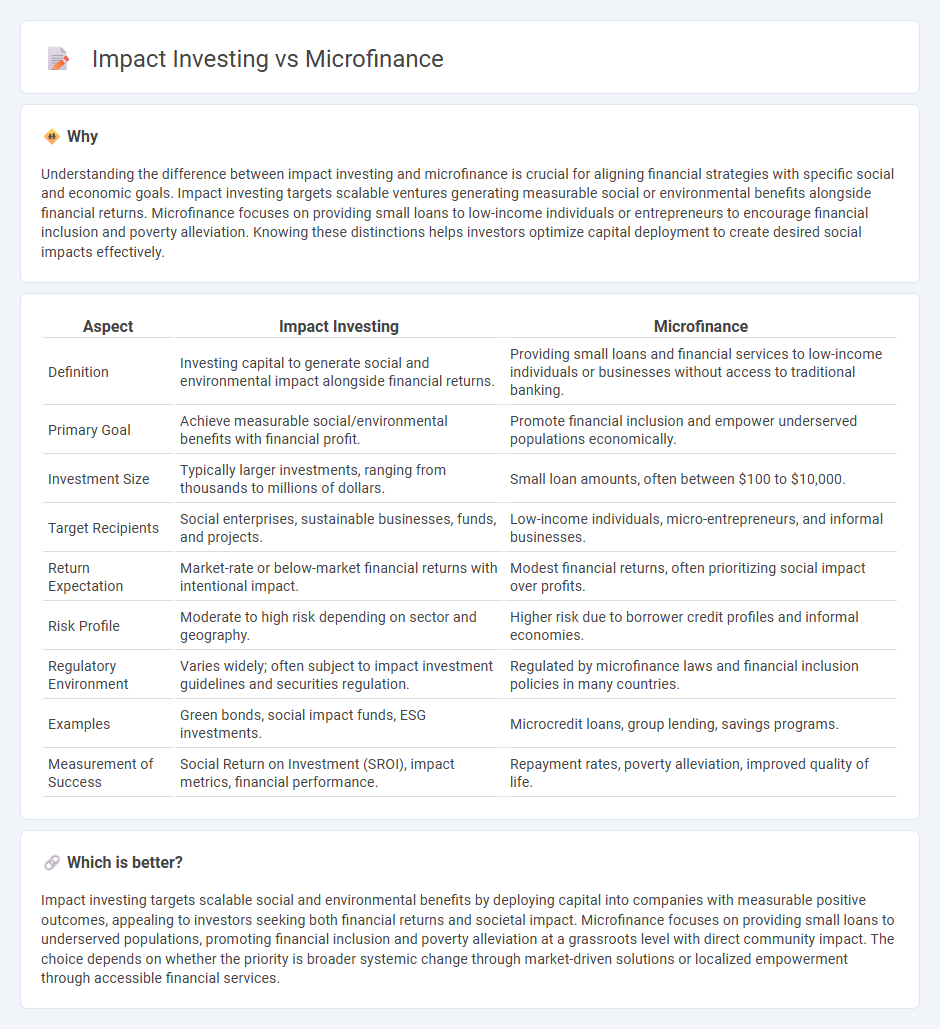

Understanding the difference between impact investing and microfinance is crucial for aligning financial strategies with specific social and economic goals. Impact investing targets scalable ventures generating measurable social or environmental benefits alongside financial returns. Microfinance focuses on providing small loans to low-income individuals or entrepreneurs to encourage financial inclusion and poverty alleviation. Knowing these distinctions helps investors optimize capital deployment to create desired social impacts effectively.

Comparison Table

| Aspect | Impact Investing | Microfinance |

|---|---|---|

| Definition | Investing capital to generate social and environmental impact alongside financial returns. | Providing small loans and financial services to low-income individuals or businesses without access to traditional banking. |

| Primary Goal | Achieve measurable social/environmental benefits with financial profit. | Promote financial inclusion and empower underserved populations economically. |

| Investment Size | Typically larger investments, ranging from thousands to millions of dollars. | Small loan amounts, often between $100 to $10,000. |

| Target Recipients | Social enterprises, sustainable businesses, funds, and projects. | Low-income individuals, micro-entrepreneurs, and informal businesses. |

| Return Expectation | Market-rate or below-market financial returns with intentional impact. | Modest financial returns, often prioritizing social impact over profits. |

| Risk Profile | Moderate to high risk depending on sector and geography. | Higher risk due to borrower credit profiles and informal economies. |

| Regulatory Environment | Varies widely; often subject to impact investment guidelines and securities regulation. | Regulated by microfinance laws and financial inclusion policies in many countries. |

| Examples | Green bonds, social impact funds, ESG investments. | Microcredit loans, group lending, savings programs. |

| Measurement of Success | Social Return on Investment (SROI), impact metrics, financial performance. | Repayment rates, poverty alleviation, improved quality of life. |

Which is better?

Impact investing targets scalable social and environmental benefits by deploying capital into companies with measurable positive outcomes, appealing to investors seeking both financial returns and societal impact. Microfinance focuses on providing small loans to underserved populations, promoting financial inclusion and poverty alleviation at a grassroots level with direct community impact. The choice depends on whether the priority is broader systemic change through market-driven solutions or localized empowerment through accessible financial services.

Connection

Impact investing and microfinance are interconnected through their shared goal of generating positive social and financial returns, primarily by providing capital to underserved communities. Impact investing channels funds into microfinance institutions that offer small loans and financial services to entrepreneurs lacking access to traditional banking. This synergy promotes economic development and financial inclusion by empowering low-income individuals and fostering sustainable business growth.

Key Terms

Financial Inclusion

Microfinance provides small loans to underserved populations, enabling financial inclusion by empowering low-income individuals and micro-entrepreneurs to access credit and build assets. Impact investing directs capital towards companies and projects generating measurable social impact alongside financial returns, often targeting scalable solutions to poverty and inequality. Explore how these financial strategies complement each other to advance global financial inclusion goals.

Social Return

Microfinance channels small loans to underserved populations, generating social return by empowering entrepreneurs and fostering economic inclusion. Impact investing targets businesses and projects with measurable social and environmental benefits alongside financial returns, emphasizing scalability and systemic change. Explore deeper insights into how these financial strategies maximize social impact effectively.

Capital Deployment

Microfinance channels small loans to underserved populations, promoting financial inclusion and local economic growth, while impact investing targets scalable enterprises that generate measurable social and environmental benefits alongside financial returns. Capital deployment in microfinance often involves disbursing numerous small loans, whereas impact investing allocates larger sums to projects with significant social impact potential and risk-adjusted profitability. Explore how these strategies optimize capital allocation to drive sustainable development.

Source and External Links

Microfinance - Definition, Benefits, Drawbacks, Models - Microfinance refers to financial services such as small loans, savings accounts, and insurance offered to individuals with low income or no access to traditional banking, aiming to support entrepreneurship and economic development in underserved communities.

Microfinance 101: All you need to know - Kiva - Microfinance is a range of financial products--including loans, savings, and insurance--designed for people excluded from conventional banking, often due to poverty, lack of collateral, or systemic barriers, with the goal of fostering financial inclusion and opportunity.

Microfinance - Wikipedia - Microfinance targets individuals and small businesses without access to mainstream financial services, providing them with essential financial tools to improve their livelihoods and support local economic growth.

dowidth.com

dowidth.com