Basis trading exploits the price difference between futures contracts and their underlying assets to generate profits through convergence at contract expiration. Exchange arbitrage involves capitalizing on price discrepancies for the same asset across different exchanges by simultaneously buying low and selling high. Explore the nuances and strategies behind these trading methods to enhance your financial acumen.

Why it is important

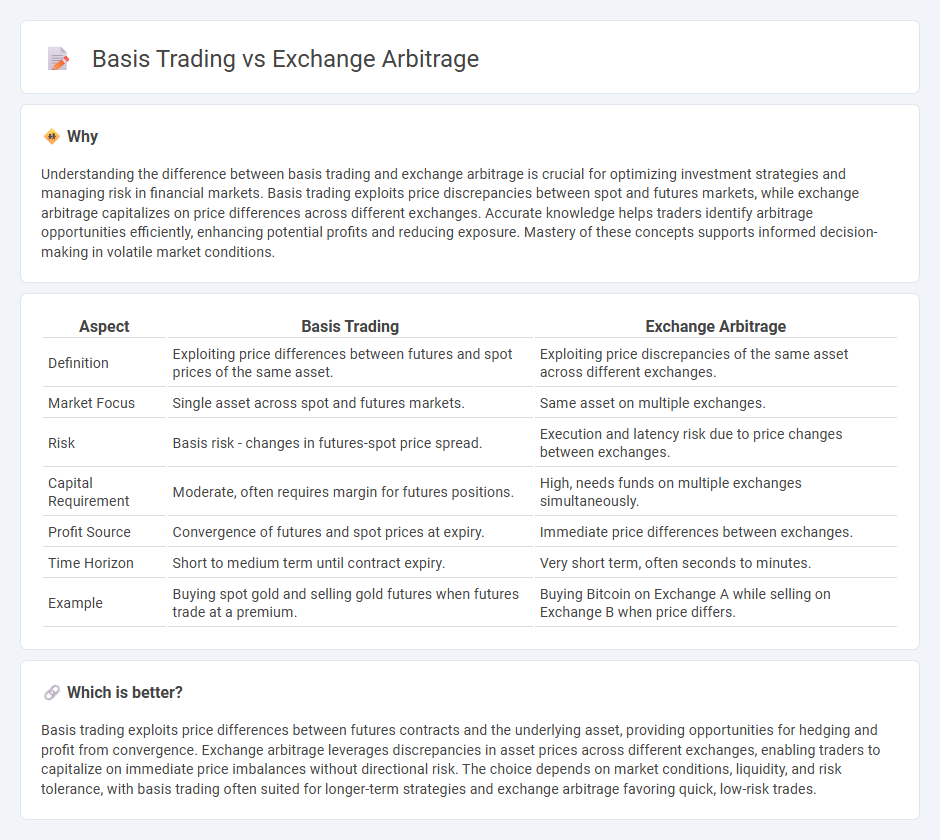

Understanding the difference between basis trading and exchange arbitrage is crucial for optimizing investment strategies and managing risk in financial markets. Basis trading exploits price discrepancies between spot and futures markets, while exchange arbitrage capitalizes on price differences across different exchanges. Accurate knowledge helps traders identify arbitrage opportunities efficiently, enhancing potential profits and reducing exposure. Mastery of these concepts supports informed decision-making in volatile market conditions.

Comparison Table

| Aspect | Basis Trading | Exchange Arbitrage |

|---|---|---|

| Definition | Exploiting price differences between futures and spot prices of the same asset. | Exploiting price discrepancies of the same asset across different exchanges. |

| Market Focus | Single asset across spot and futures markets. | Same asset on multiple exchanges. |

| Risk | Basis risk - changes in futures-spot price spread. | Execution and latency risk due to price changes between exchanges. |

| Capital Requirement | Moderate, often requires margin for futures positions. | High, needs funds on multiple exchanges simultaneously. |

| Profit Source | Convergence of futures and spot prices at expiry. | Immediate price differences between exchanges. |

| Time Horizon | Short to medium term until contract expiry. | Very short term, often seconds to minutes. |

| Example | Buying spot gold and selling gold futures when futures trade at a premium. | Buying Bitcoin on Exchange A while selling on Exchange B when price differs. |

Which is better?

Basis trading exploits price differences between futures contracts and the underlying asset, providing opportunities for hedging and profit from convergence. Exchange arbitrage leverages discrepancies in asset prices across different exchanges, enabling traders to capitalize on immediate price imbalances without directional risk. The choice depends on market conditions, liquidity, and risk tolerance, with basis trading often suited for longer-term strategies and exchange arbitrage favoring quick, low-risk trades.

Connection

Basis trading exploits the price difference between a futures contract and its underlying asset, while exchange arbitrage involves capitalizing on price discrepancies of the same asset across different exchanges. Both strategies rely on identifying and profiting from market inefficiencies, leveraging the relationship between spot prices, futures prices, and exchange quotations. Successful execution of these trades requires real-time data analysis, low transaction costs, and efficient execution to capture arbitrage margins before market adjustments occur.

Key Terms

Price Differential

Exchange arbitrage exploits price differentials by simultaneously buying an asset on one exchange and selling it on another to capitalize on temporary imbalances in asset prices. Basis trading targets the difference between the spot price and futures price of the same asset, profiting from convergence as the futures contract approaches maturity. Explore detailed strategies and risk factors in exchange arbitrage and basis trading to enhance your understanding of price differential opportunities.

Spot vs. Futures

Spot vs. futures arbitrage exploits price discrepancies between a cryptocurrency's immediate market value (spot) and its futures contract prices, optimizing profit through temporal pricing inefficiencies. Basis trading, a specific form of futures arbitrage, focuses on the basis--the difference between the spot price and futures price--capitalizing on convergence or divergence trends over contract lifetimes. Explore more to master the nuances of risk management and timing in exchange arbitrage and basis trading strategies.

Market Efficiency

Exchange arbitrage exploits price differences of identical assets across multiple exchanges to capture risk-free profits, promoting market efficiency by aligning prices. Basis trading involves exploiting the spread between futures prices and underlying asset prices, enhancing price discovery and reducing mispricing in derivatives markets. Explore detailed strategies and their impact on market efficiency to understand which approach suits your investment goals.

Source and External Links

Triangular Arbitrage Opportunity - Definition and Example - Exchange arbitrage, often referred to as triangular arbitrage, involves exploiting discrepancies in exchange rates among three currencies by consecutively trading them to profit from price differences, generally requiring large transaction volumes due to small price mismatches.

Market Arbitrage - Features - Market arbitrage or exchange arbitrage allows traders to profit from price differences of cryptocurrency pairs within the same exchange or across multiple exchanges without transferring funds, enabling quick arbitrage trades 24/7.

Arbitrage using Bellman-Ford Algorithm - Exchange arbitrage can be detected algorithmically by identifying cycles in currency exchange graphs where the product of exchange rates exceeds one, indicating that starting with one currency and cycling through trades returns a profit arbitrage opportunity.

dowidth.com

dowidth.com