Special Purpose Acquisition Companies (SPACs) offer a faster route to public markets by merging with private companies, bypassing the lengthy initial public offering (IPO) process. Direct listings allow companies to go public without raising capital, enabling existing shareholders to sell shares directly on the market. Explore the distinct advantages and risks of SPACs versus direct listings to make informed financial decisions.

Why it is important

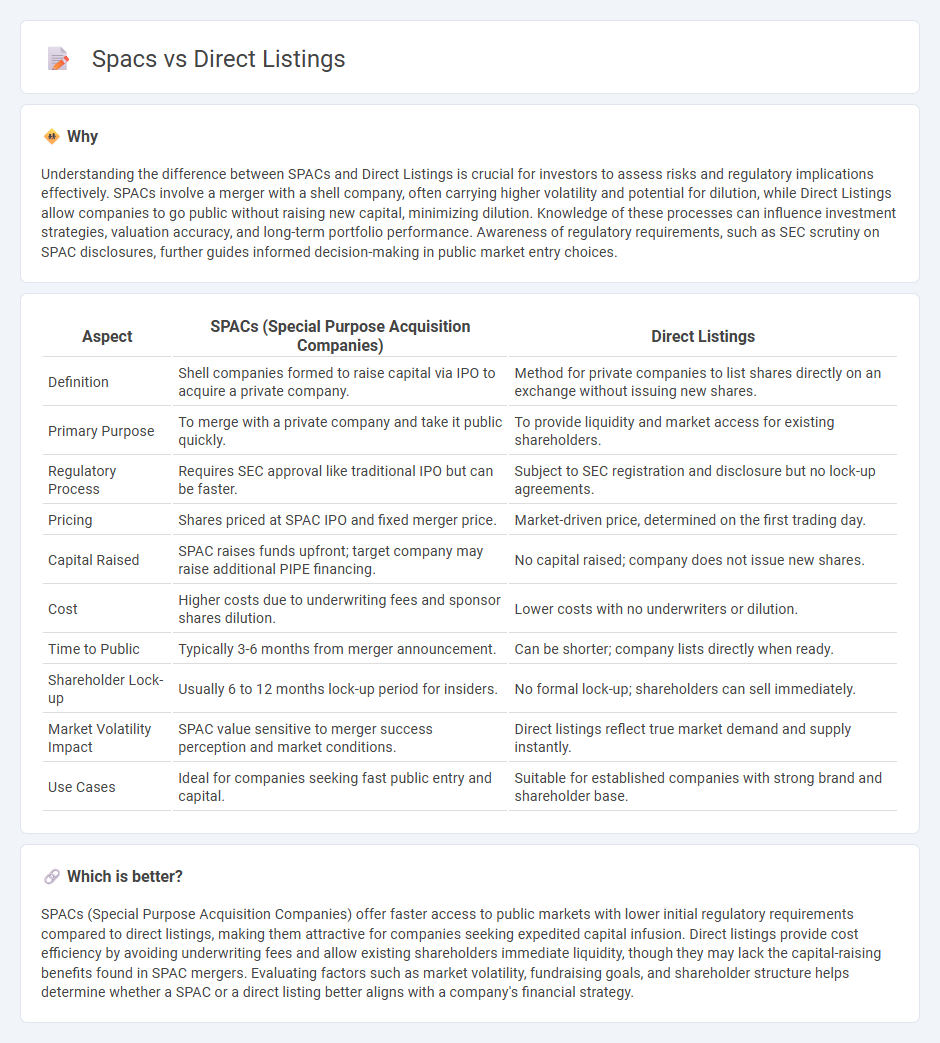

Understanding the difference between SPACs and Direct Listings is crucial for investors to assess risks and regulatory implications effectively. SPACs involve a merger with a shell company, often carrying higher volatility and potential for dilution, while Direct Listings allow companies to go public without raising new capital, minimizing dilution. Knowledge of these processes can influence investment strategies, valuation accuracy, and long-term portfolio performance. Awareness of regulatory requirements, such as SEC scrutiny on SPAC disclosures, further guides informed decision-making in public market entry choices.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | Direct Listings |

|---|---|---|

| Definition | Shell companies formed to raise capital via IPO to acquire a private company. | Method for private companies to list shares directly on an exchange without issuing new shares. |

| Primary Purpose | To merge with a private company and take it public quickly. | To provide liquidity and market access for existing shareholders. |

| Regulatory Process | Requires SEC approval like traditional IPO but can be faster. | Subject to SEC registration and disclosure but no lock-up agreements. |

| Pricing | Shares priced at SPAC IPO and fixed merger price. | Market-driven price, determined on the first trading day. |

| Capital Raised | SPAC raises funds upfront; target company may raise additional PIPE financing. | No capital raised; company does not issue new shares. |

| Cost | Higher costs due to underwriting fees and sponsor shares dilution. | Lower costs with no underwriters or dilution. |

| Time to Public | Typically 3-6 months from merger announcement. | Can be shorter; company lists directly when ready. |

| Shareholder Lock-up | Usually 6 to 12 months lock-up period for insiders. | No formal lock-up; shareholders can sell immediately. |

| Market Volatility Impact | SPAC value sensitive to merger success perception and market conditions. | Direct listings reflect true market demand and supply instantly. |

| Use Cases | Ideal for companies seeking fast public entry and capital. | Suitable for established companies with strong brand and shareholder base. |

Which is better?

SPACs (Special Purpose Acquisition Companies) offer faster access to public markets with lower initial regulatory requirements compared to direct listings, making them attractive for companies seeking expedited capital infusion. Direct listings provide cost efficiency by avoiding underwriting fees and allow existing shareholders immediate liquidity, though they may lack the capital-raising benefits found in SPAC mergers. Evaluating factors such as market volatility, fundraising goals, and shareholder structure helps determine whether a SPAC or a direct listing better aligns with a company's financial strategy.

Connection

Special Purpose Acquisition Companies (SPACs) and Direct Listings both offer alternative pathways for companies to go public without traditional initial public offerings (IPOs). SPACs enable firms to merge with already public shell companies, providing faster access to capital markets, while Direct Listings allow firms to list existing shares directly on stock exchanges. Both methods reflect evolving trends in corporate finance aimed at streamlining public market entry and enhancing liquidity options for shareholders.

Key Terms

Public Market Access

Direct listings offer companies immediate public market access without underwriters, enabling existing shareholders to sell shares directly to investors. SPACs provide a faster route by merging with a shell company already listed on an exchange, bypassing traditional IPO complexities. Discover more about the strategic advantages and risks of each approach to public market entry.

Valuation Methodology

Direct listings determine company valuation through market-driven price discovery, allowing existing shares to trade without underwriters setting initial prices. SPAC mergers use negotiated deal valuations based on pre-arranged terms, often involving PIPE investments and trust account funds to establish the company's worth. Explore the detailed valuation methodologies and implications of direct listings versus SPACs to understand their impact on investor outcomes.

Regulatory Requirements

Direct listings require companies to comply with SEC disclosure mandates, including filing a detailed Form S-1 that outlines financials, risks, and governance without raising new capital. SPACs operate under specific SEC rules designed for blank-check companies, necessitating target company disclosures post-merger and adherence to Securities Act registration requirements. Explore the full regulatory landscape and implications of each approach to make informed strategic decisions.

Source and External Links

Direct Listing | Cooley GO - A direct listing is the process where a company lists shares held by existing stockholders for sale on a public exchange without raising new capital, unlike an IPO, and involves filing an S-1 Registration Statement with the SEC but no underwriters set the price or distribute shares.

IPO vs Direct Listing | DFIN - A direct listing allows companies to go public by listing existing shares without issuing new ones or using underwriters, letting the market set the share price and providing immediate liquidity for existing shareholders without traditional IPO lockup periods.

Comparing Direct Listing vs. IPO - Carta - A direct listing enables a private company to become publicly traded by listing existing shares on an exchange without intermediaries issuing new shares, avoiding ownership dilution and underwriter pricing, with the initial price determined solely by market demand at trading start.

dowidth.com

dowidth.com