Collateralized reinsurance involves a reinsurer providing coverage backed by collateral assets to secure claim payments, enhancing credit protection for cedents. Insurance-linked securities (ILS) transfer risk to capital markets via tradable instruments, allowing investors to assume insurance-related risks like catastrophe events. Explore these financial tools to understand their distinct roles in risk management and investment diversification.

Why it is important

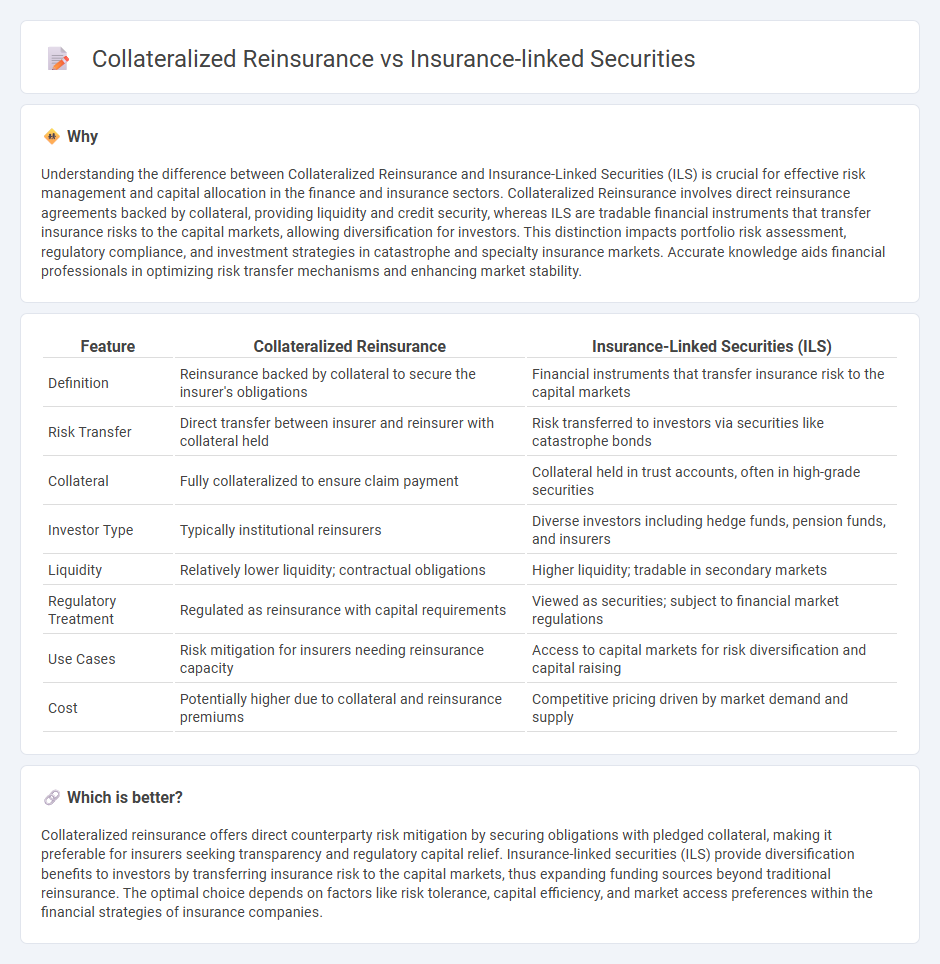

Understanding the difference between Collateralized Reinsurance and Insurance-Linked Securities (ILS) is crucial for effective risk management and capital allocation in the finance and insurance sectors. Collateralized Reinsurance involves direct reinsurance agreements backed by collateral, providing liquidity and credit security, whereas ILS are tradable financial instruments that transfer insurance risks to the capital markets, allowing diversification for investors. This distinction impacts portfolio risk assessment, regulatory compliance, and investment strategies in catastrophe and specialty insurance markets. Accurate knowledge aids financial professionals in optimizing risk transfer mechanisms and enhancing market stability.

Comparison Table

| Feature | Collateralized Reinsurance | Insurance-Linked Securities (ILS) |

|---|---|---|

| Definition | Reinsurance backed by collateral to secure the insurer's obligations | Financial instruments that transfer insurance risk to the capital markets |

| Risk Transfer | Direct transfer between insurer and reinsurer with collateral held | Risk transferred to investors via securities like catastrophe bonds |

| Collateral | Fully collateralized to ensure claim payment | Collateral held in trust accounts, often in high-grade securities |

| Investor Type | Typically institutional reinsurers | Diverse investors including hedge funds, pension funds, and insurers |

| Liquidity | Relatively lower liquidity; contractual obligations | Higher liquidity; tradable in secondary markets |

| Regulatory Treatment | Regulated as reinsurance with capital requirements | Viewed as securities; subject to financial market regulations |

| Use Cases | Risk mitigation for insurers needing reinsurance capacity | Access to capital markets for risk diversification and capital raising |

| Cost | Potentially higher due to collateral and reinsurance premiums | Competitive pricing driven by market demand and supply |

Which is better?

Collateralized reinsurance offers direct counterparty risk mitigation by securing obligations with pledged collateral, making it preferable for insurers seeking transparency and regulatory capital relief. Insurance-linked securities (ILS) provide diversification benefits to investors by transferring insurance risk to the capital markets, thus expanding funding sources beyond traditional reinsurance. The optimal choice depends on factors like risk tolerance, capital efficiency, and market access preferences within the financial strategies of insurance companies.

Connection

Collateralized reinsurance and insurance-linked securities (ILS) are interconnected through their use of capital markets to transfer insurance risk from insurers to investors, enhancing risk distribution and liquidity. Both structures rely on collateral to secure obligations, ensuring that funds are available to cover potential claims, thereby increasing investor confidence. This connection facilitates alternative risk financing by allowing insurance risks to be securitized, providing insurers with additional capacity and investors with diversified exposure to insurance risks.

Key Terms

Risk Transfer

Insurance-linked securities (ILS) provide risk transfer by allowing insurers to pass catastrophe risks to capital market investors, enhancing liquidity and spreading exposure. Collateralized reinsurance offers immediate risk transfer through fully funded agreements where collateral secures the reinsurer's obligations, reducing counterparty risk. Explore how these innovative financial instruments optimize risk management and capital efficiency in insurance portfolios.

Special Purpose Vehicle (SPV)

Insurance-linked securities (ILS) are financial instruments issued by Special Purpose Vehicles (SPVs) that transfer insurance risks to capital markets, allowing investors to gain exposure to catastrophe bonds or other risk-linked assets. Collateralized reinsurance involves an SPV providing direct reinsurance coverage with full collateral posted upfront, enhancing credit quality and minimizing counterparty risk for cedents. Explore the nuances of SPV structures in risk transfer to optimize your understanding of insurance capital markets.

Collateralization

Insurance-linked securities (ILS) and collateralized reinsurance both involve transferring insurance risk to capital markets, but collateralized reinsurance specifically uses fully funded collateral accounts to guarantee policyholder claims, enhancing security and transparency. Collateralization in this context provides immediate claim payments without reliance on reinsurer creditworthiness, reducing counterparty risk and increasing investor confidence. Explore more about how collateralized reinsurance optimizes risk transfer and capital efficiency.

Source and External Links

What are insurance-linked securities (or ILS)? - Insurance-linked securities are financial instruments whose value depends on insured loss events, allowing insurers to transfer risk to capital markets and investors including pension funds and sovereign wealth funds, forming an established alternative asset class since the mid-1990s.

Insurance-linked security - ILS are financial assets driven by insurance loss events, especially natural catastrophes, providing returns uncorrelated with other market assets by enabling insurers to sell portfolios of policies or reinsure them, sharing risks and returns with investors.

What are insurance linked securities (or ILS)? - ILS enable transfer of insurance risk from (re)insurers to capital market investors in exchange for risk transfer premiums, featuring instruments like catastrophe bonds and private notes, offering long-term, inflation-shielded, risk-managed returns.

dowidth.com

dowidth.com