ESG integration evaluates environmental, social, and governance factors to enhance sustainable financial performance, while corporate governance focuses on the structures and practices guiding company management and accountability. Effective ESG integration often strengthens corporate governance by promoting transparency, risk management, and stakeholder engagement. Explore the evolving relationship between ESG frameworks and corporate governance to improve investment strategies.

Why it is important

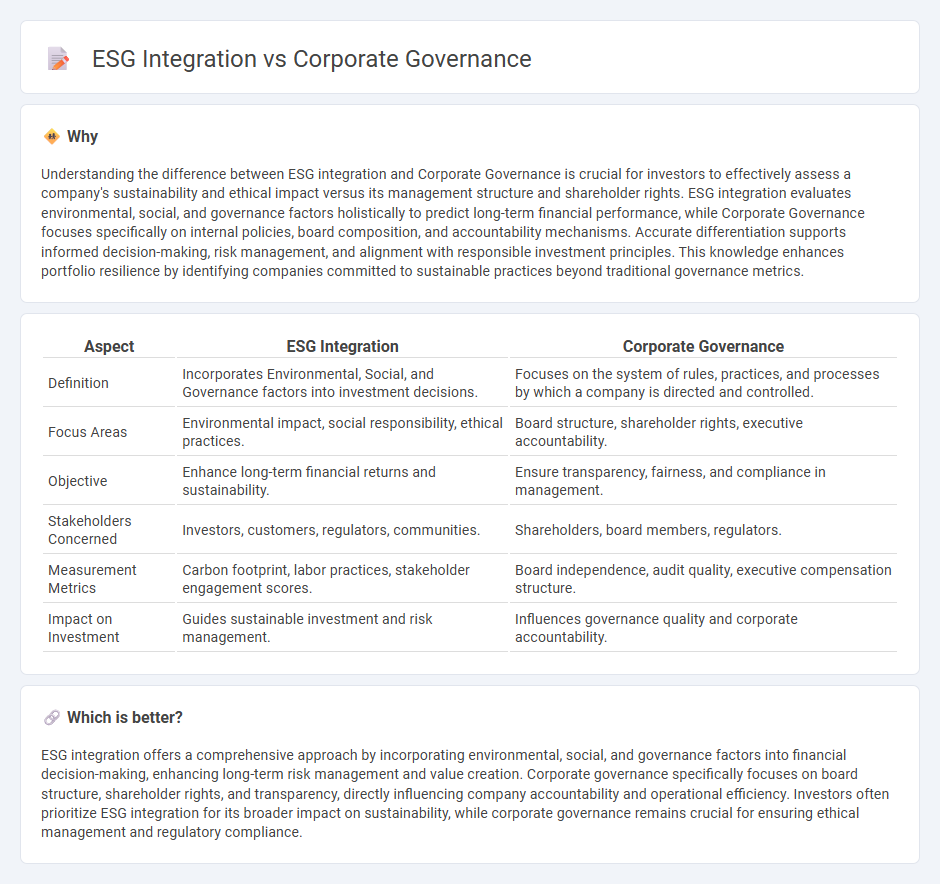

Understanding the difference between ESG integration and Corporate Governance is crucial for investors to effectively assess a company's sustainability and ethical impact versus its management structure and shareholder rights. ESG integration evaluates environmental, social, and governance factors holistically to predict long-term financial performance, while Corporate Governance focuses specifically on internal policies, board composition, and accountability mechanisms. Accurate differentiation supports informed decision-making, risk management, and alignment with responsible investment principles. This knowledge enhances portfolio resilience by identifying companies committed to sustainable practices beyond traditional governance metrics.

Comparison Table

| Aspect | ESG Integration | Corporate Governance |

|---|---|---|

| Definition | Incorporates Environmental, Social, and Governance factors into investment decisions. | Focuses on the system of rules, practices, and processes by which a company is directed and controlled. |

| Focus Areas | Environmental impact, social responsibility, ethical practices. | Board structure, shareholder rights, executive accountability. |

| Objective | Enhance long-term financial returns and sustainability. | Ensure transparency, fairness, and compliance in management. |

| Stakeholders Concerned | Investors, customers, regulators, communities. | Shareholders, board members, regulators. |

| Measurement Metrics | Carbon footprint, labor practices, stakeholder engagement scores. | Board independence, audit quality, executive compensation structure. |

| Impact on Investment | Guides sustainable investment and risk management. | Influences governance quality and corporate accountability. |

Which is better?

ESG integration offers a comprehensive approach by incorporating environmental, social, and governance factors into financial decision-making, enhancing long-term risk management and value creation. Corporate governance specifically focuses on board structure, shareholder rights, and transparency, directly influencing company accountability and operational efficiency. Investors often prioritize ESG integration for its broader impact on sustainability, while corporate governance remains crucial for ensuring ethical management and regulatory compliance.

Connection

ESG integration directly enhances corporate governance by embedding environmental, social, and governance criteria into decision-making processes, thereby improving transparency and accountability. Effective corporate governance frameworks ensure that companies systematically address ESG risks and opportunities, aligning management incentives with sustainable performance goals. This alignment drives long-term value creation and mitigates financial risks associated with poor ESG practices.

Key Terms

Board Structure

Corporate governance emphasizes board structure, ensuring accountability through independent directors, diverse skill sets, and clear committees to oversee risk and compliance. ESG integration incorporates these governance principles while embedding environmental, social, and sustainability criteria directly into board decision-making processes. Explore how evolving board structures drive effective ESG strategies and long-term value creation.

Stakeholder Engagement

Corporate governance focuses on establishing frameworks, policies, and practices to ensure accountability, fairness, and transparency within a company, primarily emphasizing the roles and responsibilities of the board and management. ESG integration extends governance principles by incorporating environmental, social, and governance factors into decision-making processes, fostering proactive stakeholder engagement to address broader societal and sustainability concerns. Discover how aligning corporate governance and ESG strategies enhances stakeholder trust and long-term value creation.

Sustainability Reporting

Corporate governance emphasizes the framework of rules, practices, and processes by which companies are directed and controlled, ensuring accountability and transparency. ESG integration, particularly in sustainability reporting, incorporates environmental, social, and governance factors into financial analysis to assess long-term value and risk management. Explore the differences and impacts of corporate governance and ESG integration on sustainability reporting to enhance your understanding of responsible business practices.

Source and External Links

Corporate Governance: What It Is and Why It Matters - Pitt Law - Corporate governance is the system of rules, practices, and processes by which a company is directed and controlled, focusing on accountability, ethical behavior, and transparency among the board, management, and stakeholders.

Understanding Corporate Governance: The 2025 Guideline - Corporate governance ensures companies operate efficiently, ethically, and in the best interests of all stakeholders, emphasizing decision-making, risk management, and board oversight to build trust and enable long-term success.

What is corporate governance? | Overview - ICAEW - Corporate governance is the system by which companies are directed and controlled by their boards of directors, who set strategic aims, oversee management, and report to shareholders, distinguishing governance from day-to-day operational management.

dowidth.com

dowidth.com