Degen Box offers a decentralized trading platform that emphasizes lower fees and faster execution times compared to traditional perpetual futures markets. Perpetual futures provide traders with leveraged exposure and no expiration date, allowing for continuous position management. Explore how these instruments can impact your trading strategy and risk management.

Why it is important

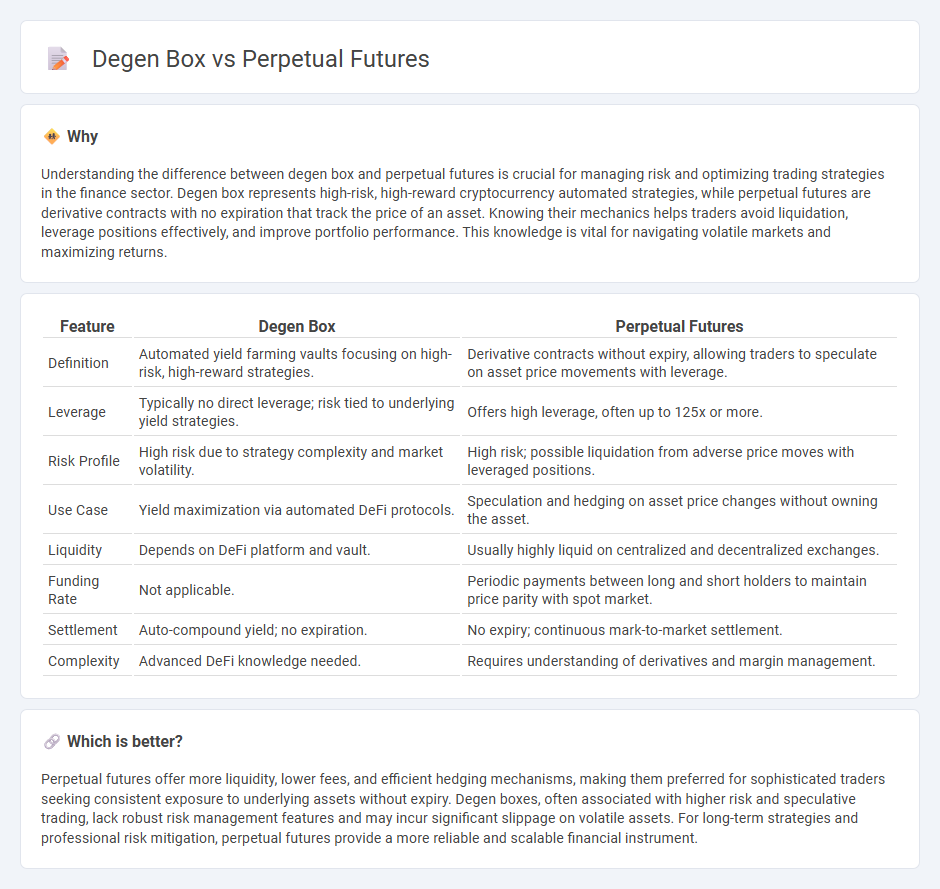

Understanding the difference between degen box and perpetual futures is crucial for managing risk and optimizing trading strategies in the finance sector. Degen box represents high-risk, high-reward cryptocurrency automated strategies, while perpetual futures are derivative contracts with no expiration that track the price of an asset. Knowing their mechanics helps traders avoid liquidation, leverage positions effectively, and improve portfolio performance. This knowledge is vital for navigating volatile markets and maximizing returns.

Comparison Table

| Feature | Degen Box | Perpetual Futures |

|---|---|---|

| Definition | Automated yield farming vaults focusing on high-risk, high-reward strategies. | Derivative contracts without expiry, allowing traders to speculate on asset price movements with leverage. |

| Leverage | Typically no direct leverage; risk tied to underlying yield strategies. | Offers high leverage, often up to 125x or more. |

| Risk Profile | High risk due to strategy complexity and market volatility. | High risk; possible liquidation from adverse price moves with leveraged positions. |

| Use Case | Yield maximization via automated DeFi protocols. | Speculation and hedging on asset price changes without owning the asset. |

| Liquidity | Depends on DeFi platform and vault. | Usually highly liquid on centralized and decentralized exchanges. |

| Funding Rate | Not applicable. | Periodic payments between long and short holders to maintain price parity with spot market. |

| Settlement | Auto-compound yield; no expiration. | No expiry; continuous mark-to-market settlement. |

| Complexity | Advanced DeFi knowledge needed. | Requires understanding of derivatives and margin management. |

Which is better?

Perpetual futures offer more liquidity, lower fees, and efficient hedging mechanisms, making them preferred for sophisticated traders seeking consistent exposure to underlying assets without expiry. Degen boxes, often associated with higher risk and speculative trading, lack robust risk management features and may incur significant slippage on volatile assets. For long-term strategies and professional risk mitigation, perpetual futures provide a more reliable and scalable financial instrument.

Connection

Degen Box acts as a decentralized trading platform enabling leverage and perpetual futures trading with automated risk management. Perpetual futures, which allow traders to hold positions indefinitely without expiry, are integrated within Degen Box's smart contract architecture for efficient margin utilization. This synergy enhances capital efficiency and liquidity in decentralized finance (DeFi) markets.

Key Terms

Leverage

Perpetual futures offer traders flexible leverage options, often up to 125x, allowing significant exposure with limited capital, while degen box strategies typically involve more aggressive, risk-heavy leverage configurations tailored for high-volatility assets. Leverage in perpetual futures is regulated with built-in liquidation mechanisms to protect against extreme losses, whereas degen boxes rely on self-managed risk and dynamic margin calls due to their decentralized and experimental nature. Explore deeper insights into leverage mechanisms and risk management between these two trading models to enhance your strategic approach.

Funding Rate

Perpetual futures contracts feature dynamic funding rates that incentivize price convergence between futures and spot markets, often resulting in periodic payments between long and short positions. Degen box strategies manipulate these funding rates by leveraging borrowing and lending mechanisms within DeFi protocols to generate yield from rate discrepancies. Explore detailed mechanics and strategies behind funding rates to optimize your trading and yield farming approaches.

Yield Farming

Perpetual futures offer leverage trading on crypto assets with continuous contracts that never expire, enabling yield farmers to amplify returns while managing risk. Degen Box, a composable DeFi protocol built on the Fuse platform, integrates yield farming, lending, and borrowing primitives for optimized capital efficiency and innovative strategies. Explore the mechanics and opportunities behind each system to maximize your yield farming potential.

Source and External Links

How Perpetual Futures Differs from Traditional Futures and Why It ... - Perpetual futures are derivative contracts without expiration date that allow continuous speculation on asset prices with high leverage, differing from traditional futures which have set expiry dates and obligations to deliver or receive the asset at expiration.

Perpetual Futures Pricing* - Wharton Finance - Perpetual futures contracts never expire and maintain their price anchored to the spot price through periodic funding payments between long and short positions, allowing their price to be expressed as a risk-neutral expectation of the spot price at a random time linked to the funding dynamics.

What are Perpetual Futures? - Coinbase - Perpetual futures enable leveraged, margin-based trading without expiry dates and offer 24/7 market access especially popular in cryptocurrency markets, allowing traders to hold positions indefinitely if margin requirements are met.

dowidth.com

dowidth.com