Tokenization of real-world assets leverages blockchain technology to convert physical assets like real estate or commodities into digital tokens, enabling fractional ownership and increased liquidity. Exchange-traded funds (ETFs) offer investors diversified portfolios through shares traded on stock exchanges, providing ease of access but typically less direct asset control. Explore how these innovative financial instruments are reshaping investment strategies and market accessibility.

Why it is important

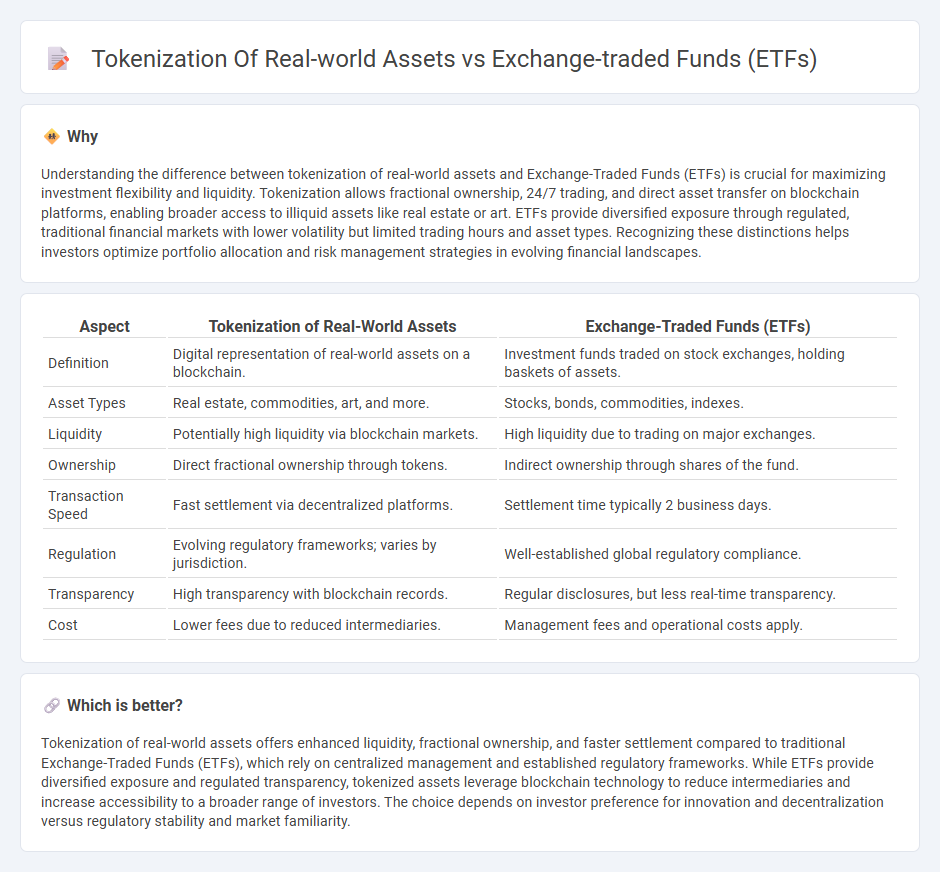

Understanding the difference between tokenization of real-world assets and Exchange-Traded Funds (ETFs) is crucial for maximizing investment flexibility and liquidity. Tokenization allows fractional ownership, 24/7 trading, and direct asset transfer on blockchain platforms, enabling broader access to illiquid assets like real estate or art. ETFs provide diversified exposure through regulated, traditional financial markets with lower volatility but limited trading hours and asset types. Recognizing these distinctions helps investors optimize portfolio allocation and risk management strategies in evolving financial landscapes.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Digital representation of real-world assets on a blockchain. | Investment funds traded on stock exchanges, holding baskets of assets. |

| Asset Types | Real estate, commodities, art, and more. | Stocks, bonds, commodities, indexes. |

| Liquidity | Potentially high liquidity via blockchain markets. | High liquidity due to trading on major exchanges. |

| Ownership | Direct fractional ownership through tokens. | Indirect ownership through shares of the fund. |

| Transaction Speed | Fast settlement via decentralized platforms. | Settlement time typically 2 business days. |

| Regulation | Evolving regulatory frameworks; varies by jurisdiction. | Well-established global regulatory compliance. |

| Transparency | High transparency with blockchain records. | Regular disclosures, but less real-time transparency. |

| Cost | Lower fees due to reduced intermediaries. | Management fees and operational costs apply. |

Which is better?

Tokenization of real-world assets offers enhanced liquidity, fractional ownership, and faster settlement compared to traditional Exchange-Traded Funds (ETFs), which rely on centralized management and established regulatory frameworks. While ETFs provide diversified exposure and regulated transparency, tokenized assets leverage blockchain technology to reduce intermediaries and increase accessibility to a broader range of investors. The choice depends on investor preference for innovation and decentralization versus regulatory stability and market familiarity.

Connection

Tokenization of real-world assets enables fractional ownership and liquidity by converting physical assets into digital tokens on a blockchain. Exchange-traded funds (ETFs) can integrate these digital tokens, enhancing transparency, tradability, and accessibility for investors. This connection accelerates market efficiency by combining blockchain technology with traditional financial instruments.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity by allowing investors to buy and sell shares on major stock exchanges throughout the trading day, benefiting from established market infrastructure and regulatory oversight. Tokenization of real-world assets uses blockchain technology to fractionalize ownership, enabling 24/7 trading on decentralized platforms, potentially increasing liquidity for traditionally illiquid assets like real estate or art. Explore how these two investment vehicles compare in liquidity to optimize your portfolio strategy.

Regulatory Compliance

Exchange-traded funds (ETFs) operate within well-established regulatory frameworks, including stringent adherence to SEC rules and ongoing disclosure requirements, ensuring investor protection and market transparency. Tokenization of real-world assets, while offering enhanced liquidity and fractional ownership through blockchain technology, faces evolving and often unclear regulatory landscapes that demand compliance with securities laws and anti-money laundering standards. Discover how regulatory trends are shaping the future of asset management by exploring detailed comparisons between ETFs and tokenized asset compliance.

Fractional Ownership

Exchange-traded funds (ETFs) enable investors to own fractional shares of a diversified portfolio of assets, offering liquidity and regulated market exposure. Tokenization of real-world assets leverages blockchain technology to provide transparent, secure, and fractional ownership of physical assets such as real estate or commodities, often with lower entry barriers and increased accessibility. Explore the evolving landscape of fractional ownership through ETFs and asset tokenization to understand the future of investment opportunities.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - An ETF is a pooled investment product traded on stock exchanges that combines features of mutual funds and stocks, offering diversified holdings managed by an investment adviser with tax efficiency advantages compared to mutual funds.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs trade like stocks on exchanges, generally track an index, provide diversification across asset classes, offer lower costs than actively managed funds, and are tax efficient with flexible trading options.

Exchange-traded fund - Wikipedia - ETFs are investment funds traded throughout the day on stock exchanges, differing from mutual funds by their intraday trading, transparency, tax efficiency, and typically lower fees due to operational efficiencies.

dowidth.com

dowidth.com