Green bonds are debt securities specifically issued to finance projects with clear environmental benefits, such as renewable energy or pollution control. Sustainability bonds, while also focused on environmental impact, extend their scope to include social projects like affordable housing and education. Discover the distinct advantages and applications of each to enhance your sustainable investment strategy.

Why it is important

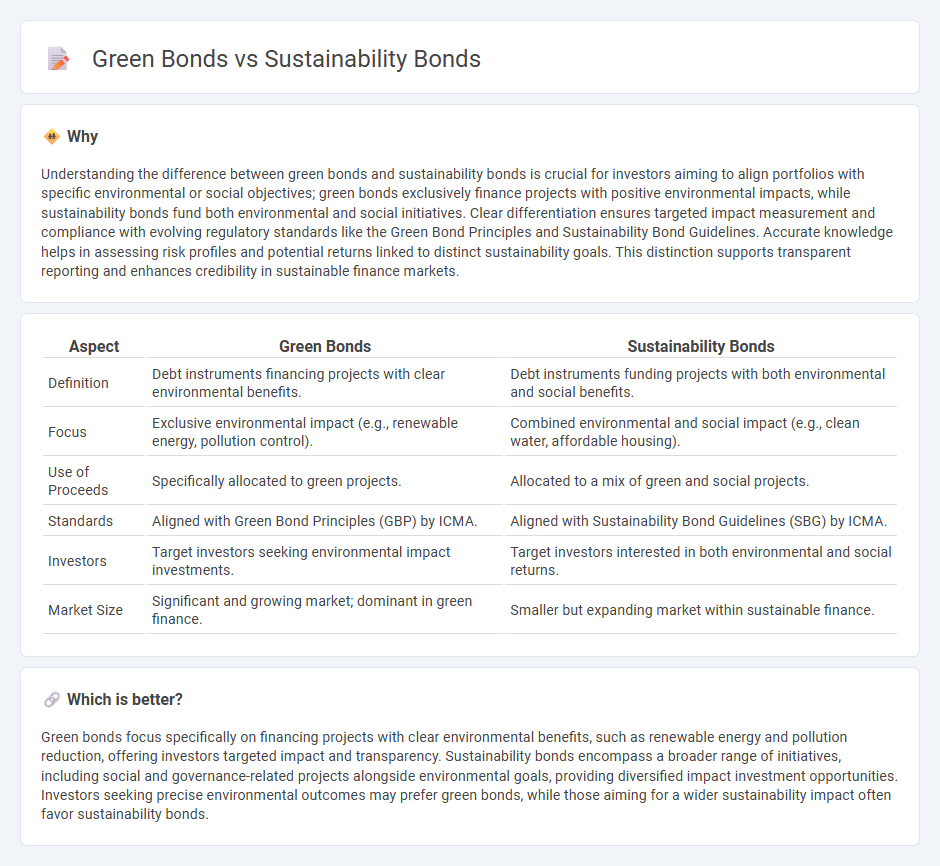

Understanding the difference between green bonds and sustainability bonds is crucial for investors aiming to align portfolios with specific environmental or social objectives; green bonds exclusively finance projects with positive environmental impacts, while sustainability bonds fund both environmental and social initiatives. Clear differentiation ensures targeted impact measurement and compliance with evolving regulatory standards like the Green Bond Principles and Sustainability Bond Guidelines. Accurate knowledge helps in assessing risk profiles and potential returns linked to distinct sustainability goals. This distinction supports transparent reporting and enhances credibility in sustainable finance markets.

Comparison Table

| Aspect | Green Bonds | Sustainability Bonds |

|---|---|---|

| Definition | Debt instruments financing projects with clear environmental benefits. | Debt instruments funding projects with both environmental and social benefits. |

| Focus | Exclusive environmental impact (e.g., renewable energy, pollution control). | Combined environmental and social impact (e.g., clean water, affordable housing). |

| Use of Proceeds | Specifically allocated to green projects. | Allocated to a mix of green and social projects. |

| Standards | Aligned with Green Bond Principles (GBP) by ICMA. | Aligned with Sustainability Bond Guidelines (SBG) by ICMA. |

| Investors | Target investors seeking environmental impact investments. | Target investors interested in both environmental and social returns. |

| Market Size | Significant and growing market; dominant in green finance. | Smaller but expanding market within sustainable finance. |

Which is better?

Green bonds focus specifically on financing projects with clear environmental benefits, such as renewable energy and pollution reduction, offering investors targeted impact and transparency. Sustainability bonds encompass a broader range of initiatives, including social and governance-related projects alongside environmental goals, providing diversified impact investment opportunities. Investors seeking precise environmental outcomes may prefer green bonds, while those aiming for a wider sustainability impact often favor sustainability bonds.

Connection

Green bonds and sustainability bonds are financial instruments designed to fund projects with environmental benefits, with green bonds exclusively targeting climate-related initiatives such as renewable energy and pollution reduction. Sustainability bonds encompass a broader scope, financing both environmental and social projects, including clean water, affordable housing, and community development. Both bond types support the global shift towards sustainable finance by directing capital to projects aligned with Environmental, Social, and Governance (ESG) criteria, enhancing investment portfolios focused on long-term impact and risk management.

Key Terms

Use of Proceeds

Sustainability bonds fund projects with positive environmental and social benefits, while green bonds specifically target environmentally friendly initiatives such as renewable energy, clean transportation, and pollution prevention. The Use of Proceeds in sustainability bonds combines environmental and social eligible projects, offering broader impact compared to green bonds' exclusively ecological focus. Explore in-depth differences and investment strategies to understand which bond aligns with your sustainability goals.

Environmental vs. Social Impact

Sustainability bonds fund projects with both environmental and social benefits, addressing broader sustainability goals, while green bonds specifically target environmentally-focused initiatives such as renewable energy and pollution control. Sustainability bonds often include projects related to social housing, education, and healthcare, offering a dual impact approach. Discover more about how these bonds drive targeted investments for a sustainable future.

Eligibility Criteria

Sustainability bonds finance projects with combined environmental and social benefits, requiring eligibility criteria that include both green and social impact metrics, whereas green bonds focus solely on environmentally sustainable projects such as renewable energy or pollution prevention. Eligibility for sustainability bonds demands comprehensive assessment frameworks that address climate resilience and social inclusion, reflecting broader criteria than green bonds, which typically rely on standards like the Green Bond Principles emphasizing environmental projects only. Explore deeper distinctions and eligibility standards to better understand how these bonds target sustainable development goals.

Source and External Links

Sustainability Bonds - Wikipedia - Sustainability bonds are fixed-income instruments where proceeds are exclusively used to finance or refinance a combination of green and social projects, following the core ICMA principles including use of proceeds, project evaluation, management of proceeds, and reporting requirements.

Understanding Green, Social and Sustainability Bonds - PIMCO - Sustainability bonds fund a mix of green and social projects, allowing investors to align with both environmental and social goals, and differ from sustainability-linked bonds, which tie financing conditions to issuer sustainability performance rather than specific project funding.

Sustainable bonds and loans - Societe Generale Wholesale Banking - Sustainable bonds involve an issuer's commitment to use bond proceeds for environmental or social projects, with reporting to investors, and can fund either type of project, whereas green and social bonds are restricted to their respective categories.

dowidth.com

dowidth.com