Altcoins staking generates passive income by locking coins in a blockchain network, offering rewards based on the staked amount and network performance. Token buy-and-hold relies on price appreciation over time, with investors benefiting from market volatility and potential long-term gains. Discover the advantages and risks of each strategy to optimize your crypto investment portfolio.

Why it is important

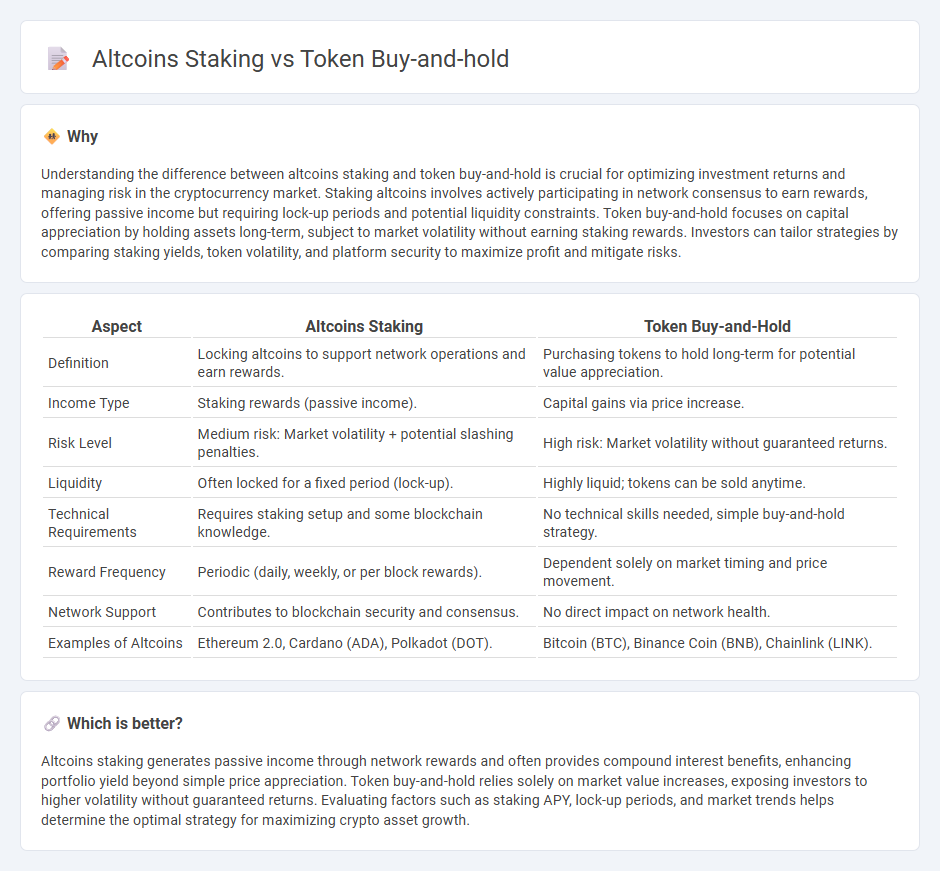

Understanding the difference between altcoins staking and token buy-and-hold is crucial for optimizing investment returns and managing risk in the cryptocurrency market. Staking altcoins involves actively participating in network consensus to earn rewards, offering passive income but requiring lock-up periods and potential liquidity constraints. Token buy-and-hold focuses on capital appreciation by holding assets long-term, subject to market volatility without earning staking rewards. Investors can tailor strategies by comparing staking yields, token volatility, and platform security to maximize profit and mitigate risks.

Comparison Table

| Aspect | Altcoins Staking | Token Buy-and-Hold |

|---|---|---|

| Definition | Locking altcoins to support network operations and earn rewards. | Purchasing tokens to hold long-term for potential value appreciation. |

| Income Type | Staking rewards (passive income). | Capital gains via price increase. |

| Risk Level | Medium risk: Market volatility + potential slashing penalties. | High risk: Market volatility without guaranteed returns. |

| Liquidity | Often locked for a fixed period (lock-up). | Highly liquid; tokens can be sold anytime. |

| Technical Requirements | Requires staking setup and some blockchain knowledge. | No technical skills needed, simple buy-and-hold strategy. |

| Reward Frequency | Periodic (daily, weekly, or per block rewards). | Dependent solely on market timing and price movement. |

| Network Support | Contributes to blockchain security and consensus. | No direct impact on network health. |

| Examples of Altcoins | Ethereum 2.0, Cardano (ADA), Polkadot (DOT). | Bitcoin (BTC), Binance Coin (BNB), Chainlink (LINK). |

Which is better?

Altcoins staking generates passive income through network rewards and often provides compound interest benefits, enhancing portfolio yield beyond simple price appreciation. Token buy-and-hold relies solely on market value increases, exposing investors to higher volatility without guaranteed returns. Evaluating factors such as staking APY, lock-up periods, and market trends helps determine the optimal strategy for maximizing crypto asset growth.

Connection

Altcoins staking involves locking tokens to support blockchain operations, earning rewards that incentivize long-term holding and reduce circulating supply, which can increase token value. Token buy-and-hold strategies complement staking by retaining ownership during market fluctuations, enhancing potential passive income through staking rewards and capital appreciation. The connection between staking and holding strengthens investor commitment, stabilizes altcoin ecosystems, and fosters sustainable growth.

Key Terms

Capital Appreciation

Token buy-and-hold strategies prioritize long-term capital appreciation by leveraging potential market value increases without the need for active management. Altcoins staking generates passive income through network participation rewards while potentially benefiting from price appreciation, albeit with different risk profiles compared to simple holding. Explore the comparative advantages and risks of these investment approaches to optimize your crypto portfolio's growth potential.

Staking Yields

Token buy-and-hold strategies often rely on price appreciation, while altcoins staking generates passive income through staking yields, typically ranging from 5% to 20% annually depending on the network. Staking involves locking tokens in a blockchain protocol to support network operations and earn rewards, which can compound returns over time compared to a static buy-and-hold approach. Explore detailed comparisons of staking yields across different altcoins to optimize your crypto portfolio performance.

Lock-up Period

Token buy-and-hold strategies involve purchasing cryptocurrencies and storing them without active management, typically with no lock-up period, providing liquidity and flexibility. In contrast, altcoin staking requires locking up tokens for a predetermined duration to earn rewards, which can range from days to months, limiting immediate access but offering passive income through network participation. Explore detailed comparisons and staking protocols to optimize your portfolio strategy.

Source and External Links

Day trading vs. long-term cryptocurrency hodling - Cointelegraph - The "buy-and-hold" strategy in crypto, often called "hodling," means purchasing a coin or token and holding it securely for a long time, typically years, to benefit from potential long-term value appreciation rather than short-term trading.

What is HOLD (EARN)| How To Get & Use HOLD - Bitget - HOLD Token employs blockchain technology for secure and anonymous transactions, offering potential benefits for long-term investors who buy and hold the token to enjoy reduced transfer times and financial inclusion.

How to Buy HOLD (HOLD) Guide - Binance - Binance provides a straightforward, fast, and secure platform to buy HOLD tokens, which can then be held as part of a buy-and-hold investment strategy, benefiting from the liquidity and security of a major exchange.

dowidth.com

dowidth.com