Regenerative finance focuses on restoring and enhancing natural, social, and economic systems through investments that prioritize long-term ecological and community health. Circular economy finance emphasizes funding models that support the continuous reuse, recycling, and reduction of waste in production and consumption processes to create sustainable value. Explore how these innovative financial approaches are transforming sustainable investment strategies.

Why it is important

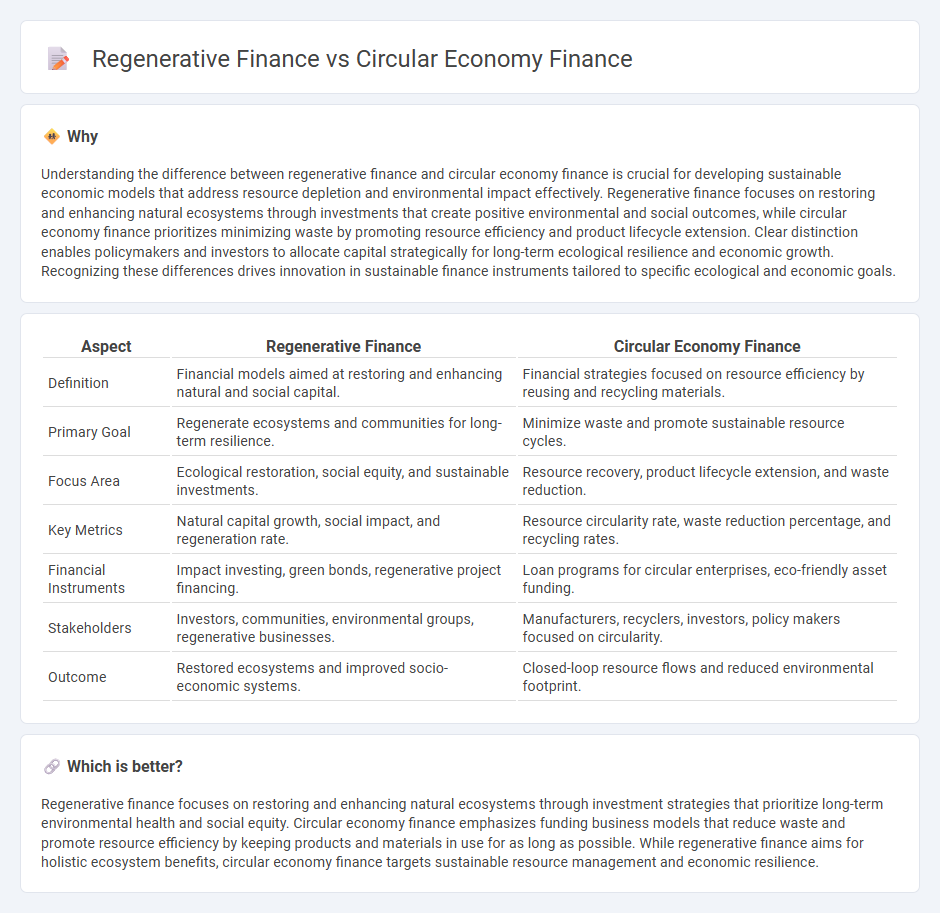

Understanding the difference between regenerative finance and circular economy finance is crucial for developing sustainable economic models that address resource depletion and environmental impact effectively. Regenerative finance focuses on restoring and enhancing natural ecosystems through investments that create positive environmental and social outcomes, while circular economy finance prioritizes minimizing waste by promoting resource efficiency and product lifecycle extension. Clear distinction enables policymakers and investors to allocate capital strategically for long-term ecological resilience and economic growth. Recognizing these differences drives innovation in sustainable finance instruments tailored to specific ecological and economic goals.

Comparison Table

| Aspect | Regenerative Finance | Circular Economy Finance |

|---|---|---|

| Definition | Financial models aimed at restoring and enhancing natural and social capital. | Financial strategies focused on resource efficiency by reusing and recycling materials. |

| Primary Goal | Regenerate ecosystems and communities for long-term resilience. | Minimize waste and promote sustainable resource cycles. |

| Focus Area | Ecological restoration, social equity, and sustainable investments. | Resource recovery, product lifecycle extension, and waste reduction. |

| Key Metrics | Natural capital growth, social impact, and regeneration rate. | Resource circularity rate, waste reduction percentage, and recycling rates. |

| Financial Instruments | Impact investing, green bonds, regenerative project financing. | Loan programs for circular enterprises, eco-friendly asset funding. |

| Stakeholders | Investors, communities, environmental groups, regenerative businesses. | Manufacturers, recyclers, investors, policy makers focused on circularity. |

| Outcome | Restored ecosystems and improved socio-economic systems. | Closed-loop resource flows and reduced environmental footprint. |

Which is better?

Regenerative finance focuses on restoring and enhancing natural ecosystems through investment strategies that prioritize long-term environmental health and social equity. Circular economy finance emphasizes funding business models that reduce waste and promote resource efficiency by keeping products and materials in use for as long as possible. While regenerative finance aims for holistic ecosystem benefits, circular economy finance targets sustainable resource management and economic resilience.

Connection

Regenerative finance focuses on restoring and enhancing natural, social, and economic systems through sustainable investments and innovative financial models. Circular economy finance supports this by funding initiatives that promote resource efficiency, waste reduction, and product lifecycle extension, aligning financial incentives with regenerative outcomes. Together, they create a complementary framework driving sustainable economic growth and environmental resilience.

Key Terms

**Circular Economy Finance:**

Circular Economy Finance prioritizes investment strategies that support resource efficiency, waste reduction, and sustainable product lifecycle management, driving economic growth with minimal environmental impact. It channels capital into projects that promote recycling, reuse, and the extension of product value, fostering a system where materials continuously circulate within the economy. Discover how Circular Economy Finance can transform sustainable investment portfolios and contribute to a resilient green economy.

Resource Efficiency

Circular economy finance prioritizes optimizing resource efficiency by minimizing waste and promoting the reuse, refurbishment, and recycling of materials within closed-loop systems. Regenerative finance goes beyond efficiency, aiming to restore and enhance natural systems while integrating socio-economic benefits through innovative investment models. Explore how these financial approaches drive sustainable resource management and ecological regeneration.

Closed-Loop Systems

Circular economy finance prioritizes investment in closed-loop systems that minimize waste through material recycling and resource efficiency, supporting sustainable industrial processes. Regenerative finance goes beyond by funding initiatives that restore ecosystems and enhance natural capital alongside economic returns. Discover how these innovative financial models drive sustainability by promoting closed-loop and restorative practices.

Source and External Links

IFC and Partners Release New Harmonized Circular Economy Finance Guidelines - The International Finance Corporation (IFC) published harmonized guidelines in 2025 to help investors and financial institutions identify and finance projects supporting the circular economy, aiming to standardize and scale global investment opportunities beyond traditional recycling models.

Mobilizing Financing for the Circular Economy - UNECE - This document outlines relevant sustainable finance instruments like green bonds, transition bonds, and sustainability-linked loans tailored to circular economy projects, emphasizing resource efficiency, waste reduction, and decarbonization in key industries.

Finance Programme - Circle Economy - Circle Economy's Finance Programme focuses on addressing challenges in financing circular business models by fostering collaboration, harmonization, and knowledge sharing to improve capital allocation toward circular economy initiatives.

dowidth.com

dowidth.com