Laddered bond ETFs offer diversified exposure across multiple maturities, reducing interest rate risk compared to holding individual bonds. Individual bonds provide fixed income with known maturity dates but require active management and larger capital to build a laddered portfolio. Explore the advantages and considerations of both strategies to optimize your fixed-income investments.

Why it is important

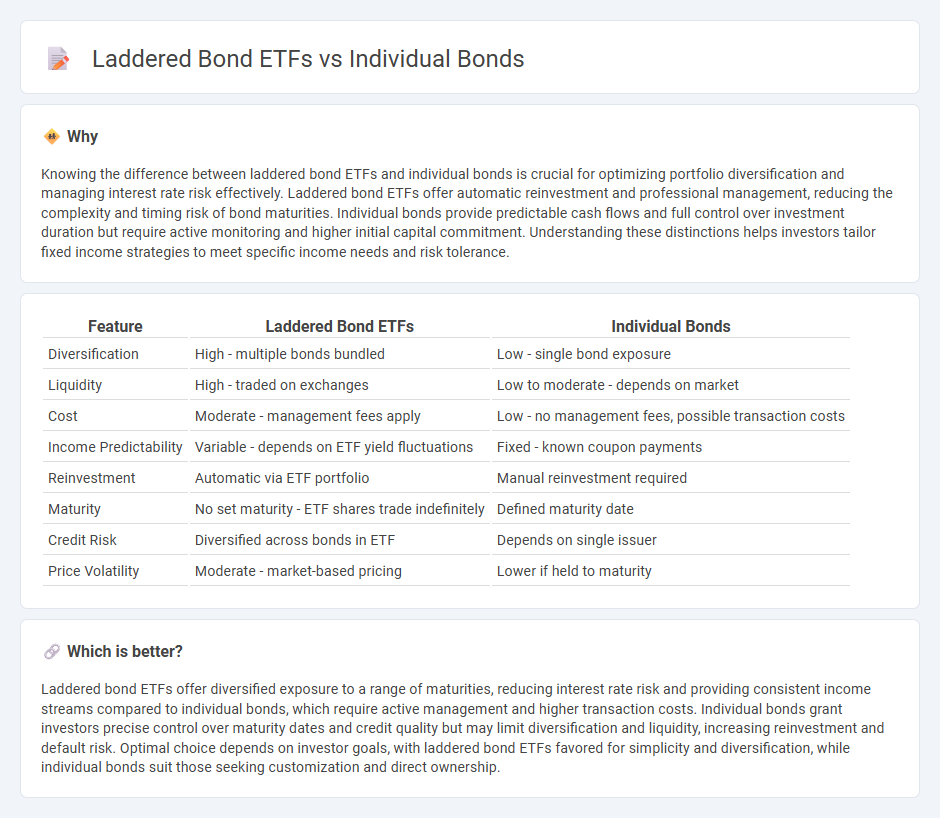

Knowing the difference between laddered bond ETFs and individual bonds is crucial for optimizing portfolio diversification and managing interest rate risk effectively. Laddered bond ETFs offer automatic reinvestment and professional management, reducing the complexity and timing risk of bond maturities. Individual bonds provide predictable cash flows and full control over investment duration but require active monitoring and higher initial capital commitment. Understanding these distinctions helps investors tailor fixed income strategies to meet specific income needs and risk tolerance.

Comparison Table

| Feature | Laddered Bond ETFs | Individual Bonds |

|---|---|---|

| Diversification | High - multiple bonds bundled | Low - single bond exposure |

| Liquidity | High - traded on exchanges | Low to moderate - depends on market |

| Cost | Moderate - management fees apply | Low - no management fees, possible transaction costs |

| Income Predictability | Variable - depends on ETF yield fluctuations | Fixed - known coupon payments |

| Reinvestment | Automatic via ETF portfolio | Manual reinvestment required |

| Maturity | No set maturity - ETF shares trade indefinitely | Defined maturity date |

| Credit Risk | Diversified across bonds in ETF | Depends on single issuer |

| Price Volatility | Moderate - market-based pricing | Lower if held to maturity |

Which is better?

Laddered bond ETFs offer diversified exposure to a range of maturities, reducing interest rate risk and providing consistent income streams compared to individual bonds, which require active management and higher transaction costs. Individual bonds grant investors precise control over maturity dates and credit quality but may limit diversification and liquidity, increasing reinvestment and default risk. Optimal choice depends on investor goals, with laddered bond ETFs favored for simplicity and diversification, while individual bonds suit those seeking customization and direct ownership.

Connection

Laddered bond ETFs and individual bonds share a structured investment approach that staggers maturity dates to manage interest rate risk and provide consistent income streams. Both strategies involve allocating capital across bonds with varying maturities, enhancing portfolio diversification and liquidity. Investors benefit from the steady cash flow and reduced reinvestment risk inherent in a bond ladder, whether through the ETF's pooled assets or direct ownership of individual bonds.

Key Terms

Maturity

Individual bonds offer fixed maturity dates, allowing investors to precisely plan cash flow and reinvestment strategies with predictable returns. Laddered bond ETFs provide diversification across multiple maturities, reducing interest rate risk while maintaining liquidity and reinvestment flexibility. Explore the benefits and risks of each approach to optimize your bond investment strategy.

Diversification

Individual bonds offer targeted exposure and precise control over maturity dates but often require larger capital and involve reinvestment risk at maturity. Laddered bond ETFs provide built-in diversification across various maturities and issuers, reducing credit and interest rate risks while offering liquidity and convenience for smaller investors. Explore the benefits and drawbacks of each strategy to optimize your fixed-income portfolio.

Liquidity

Individual bonds offer predictable cash flows and potential tax advantages but can suffer from lower liquidity, especially in the secondary market. Laddered bond ETFs provide daily liquidity, allowing investors to trade shares easily without worrying about individual bond maturities. Explore further to understand which option aligns best with your investment strategy.

Source and External Links

Individual bonds | Reasons to consider bonds - Fidelity Investments - Individual bonds are interest-bearing securities obligating issuers to pay interest at set intervals and repay principal at maturity, offering benefits like diversification, regular income, potential tax advantages, and principal preservation across types such as U.S. Treasury, agency, municipal, corporate, and high yield bonds.

Bonds vs. Bond Funds: Which is Right for You? | Charles Schwab - Individual bonds typically pay semiannual interest with fixed principal values repaid at maturity, but their market price can fluctuate with interest rates, and holding to maturity helps avoid realized price volatility though with some opportunity cost.

Bonds: Diversify Your Portfolio and Earn More | Vanguard - Individual bonds function like loans to governments or companies, offering regular interest payments and return of principal at maturity; they provide steady income and lower risk relative to stocks but may have lower yields and are exposed to interest rate risk if sold before maturity.

dowidth.com

dowidth.com