Trader funding programs provide capital to skilled traders, enabling them to access larger market positions without risking personal funds, which enhances profit potential and risk diversification. Pension funds manage retirement savings by investing in a diverse portfolio, focusing on long-term stability and consistent returns to secure beneficiaries' financial futures. Discover how these distinct financial vehicles operate and contribute to wealth management by exploring their unique strategies and benefits.

Why it is important

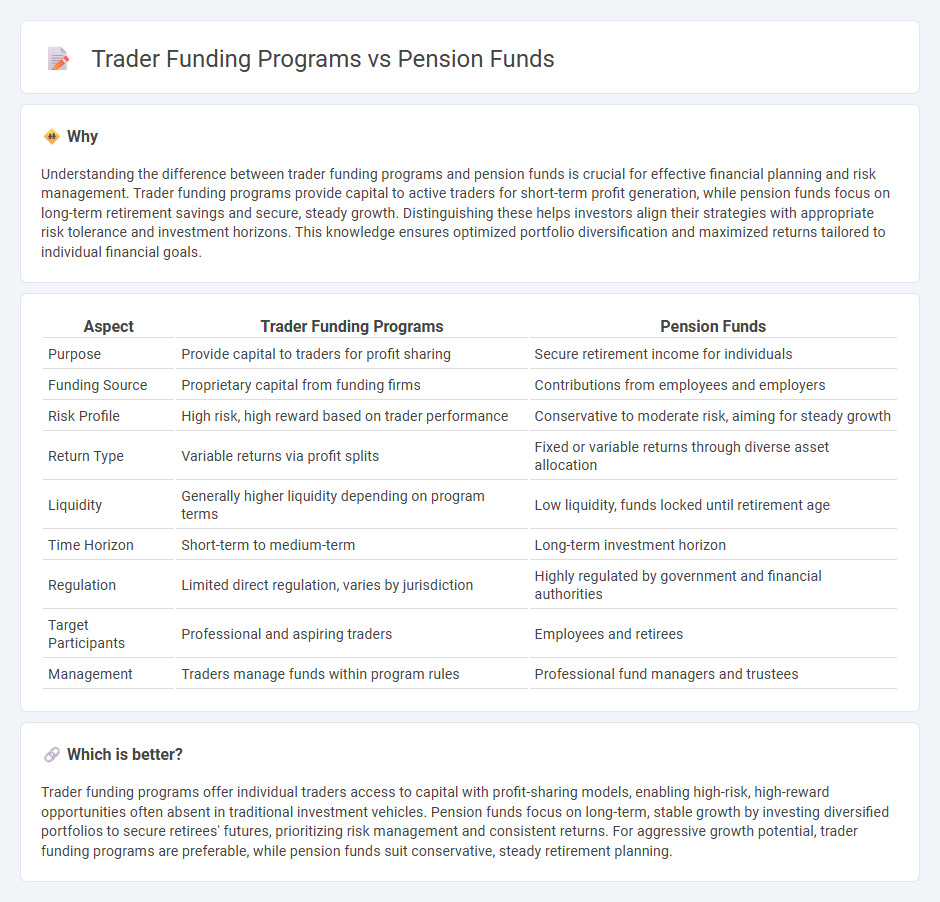

Understanding the difference between trader funding programs and pension funds is crucial for effective financial planning and risk management. Trader funding programs provide capital to active traders for short-term profit generation, while pension funds focus on long-term retirement savings and secure, steady growth. Distinguishing these helps investors align their strategies with appropriate risk tolerance and investment horizons. This knowledge ensures optimized portfolio diversification and maximized returns tailored to individual financial goals.

Comparison Table

| Aspect | Trader Funding Programs | Pension Funds |

|---|---|---|

| Purpose | Provide capital to traders for profit sharing | Secure retirement income for individuals |

| Funding Source | Proprietary capital from funding firms | Contributions from employees and employers |

| Risk Profile | High risk, high reward based on trader performance | Conservative to moderate risk, aiming for steady growth |

| Return Type | Variable returns via profit splits | Fixed or variable returns through diverse asset allocation |

| Liquidity | Generally higher liquidity depending on program terms | Low liquidity, funds locked until retirement age |

| Time Horizon | Short-term to medium-term | Long-term investment horizon |

| Regulation | Limited direct regulation, varies by jurisdiction | Highly regulated by government and financial authorities |

| Target Participants | Professional and aspiring traders | Employees and retirees |

| Management | Traders manage funds within program rules | Professional fund managers and trustees |

Which is better?

Trader funding programs offer individual traders access to capital with profit-sharing models, enabling high-risk, high-reward opportunities often absent in traditional investment vehicles. Pension funds focus on long-term, stable growth by investing diversified portfolios to secure retirees' futures, prioritizing risk management and consistent returns. For aggressive growth potential, trader funding programs are preferable, while pension funds suit conservative, steady retirement planning.

Connection

Trader funding programs provide capital to skilled traders, enabling them to access larger market positions without risking personal funds, which can enhance portfolio diversification for pension funds seeking alternative investments. Pension funds often allocate capital to these programs to achieve higher risk-adjusted returns through professional trading strategies, benefiting from the traders' expertise and risk management. Integrating trader funding initiatives into pension fund portfolios aligns with their objective to grow assets sustainably while managing market volatility.

Key Terms

**Pension Funds:**

Pension funds manage large pools of capital to provide long-term retirement income, primarily investing in diversified portfolios including stocks, bonds, and real estate to ensure steady growth and risk mitigation. They operate under strict regulatory frameworks and prioritize capital preservation and sustainable returns, often leveraging actuarial data and demographic trends for strategic allocation. Explore how pension funds differ from trader funding programs in objectives, scale, and risk tolerance to better understand investment dynamics.

Asset Allocation

Pension funds emphasize long-term asset allocation strategies, diversifying across equities, bonds, real estate, and alternative investments to ensure stable retirement income and mitigate risk. Trader funding programs typically allocate capital to active traders, focusing on short-term trading performance and leveraging high-risk, high-reward opportunities. Explore the detailed impact of asset allocation choices on performance and risk profiles between these funding models for a deeper understanding.

Beneficiaries

Pension funds primarily benefit retirees by providing a stable, long-term income sourced from pooled retirement savings, ensuring financial security during retirement years. Trader funding programs, on the other hand, offer capital to active traders, allowing them to leverage proprietary funds for potential profit without risking personal capital, benefiting skilled individuals seeking growth opportunities. Explore more to understand which option aligns best with your financial goals and risk tolerance.

Source and External Links

Pension Fund - Overview, How It Works, Open vs Closed Funds - A pension fund accumulates capital from employee and employer contributions to pay out retirement pensions and invests this capital in various markets to generate returns, with common types including defined benefit plans and distinctions like open versus closed funds.

Pension fund - Wikipedia - Pension funds provide retirement income by investing contributions in diverse assets such as stocks, bonds, real estate, and increasingly alternative investments, with trends moving toward passive investment strategies like index funds and ETFs to balance returns and risks.

Pension funds' assets - OECD - Pension funds are pools of assets held as independent legal entities, strictly for financing pension benefits, with holdings measured worldwide in trillions of USD and viewed as critical components of national retirement systems.

dowidth.com

dowidth.com