Revenue-based financing provides businesses with capital by allowing investors to receive a percentage of future revenue until a predetermined amount is repaid, aligning repayments with business performance. Peer-to-peer lending connects individual borrowers with lenders through online platforms, offering alternative funding sources outside traditional banking systems. Explore the differences in cost, risk, and suitability to determine which financing option best fits your financial strategy.

Why it is important

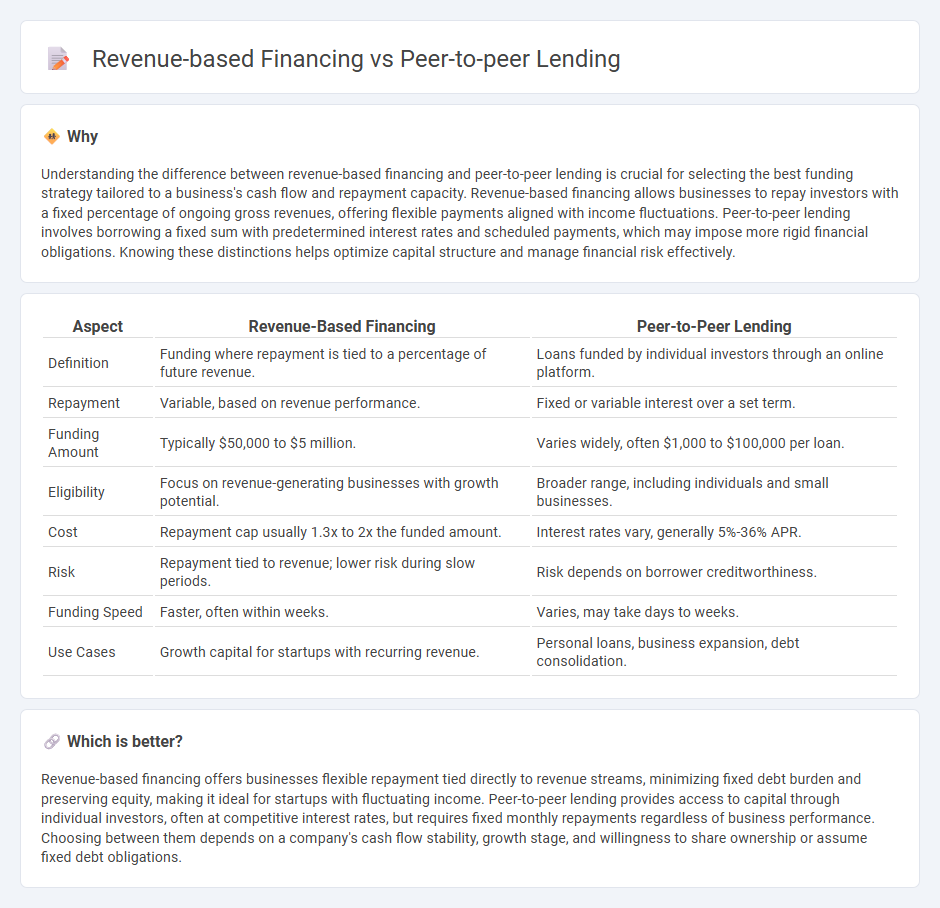

Understanding the difference between revenue-based financing and peer-to-peer lending is crucial for selecting the best funding strategy tailored to a business's cash flow and repayment capacity. Revenue-based financing allows businesses to repay investors with a fixed percentage of ongoing gross revenues, offering flexible payments aligned with income fluctuations. Peer-to-peer lending involves borrowing a fixed sum with predetermined interest rates and scheduled payments, which may impose more rigid financial obligations. Knowing these distinctions helps optimize capital structure and manage financial risk effectively.

Comparison Table

| Aspect | Revenue-Based Financing | Peer-to-Peer Lending |

|---|---|---|

| Definition | Funding where repayment is tied to a percentage of future revenue. | Loans funded by individual investors through an online platform. |

| Repayment | Variable, based on revenue performance. | Fixed or variable interest over a set term. |

| Funding Amount | Typically $50,000 to $5 million. | Varies widely, often $1,000 to $100,000 per loan. |

| Eligibility | Focus on revenue-generating businesses with growth potential. | Broader range, including individuals and small businesses. |

| Cost | Repayment cap usually 1.3x to 2x the funded amount. | Interest rates vary, generally 5%-36% APR. |

| Risk | Repayment tied to revenue; lower risk during slow periods. | Risk depends on borrower creditworthiness. |

| Funding Speed | Faster, often within weeks. | Varies, may take days to weeks. |

| Use Cases | Growth capital for startups with recurring revenue. | Personal loans, business expansion, debt consolidation. |

Which is better?

Revenue-based financing offers businesses flexible repayment tied directly to revenue streams, minimizing fixed debt burden and preserving equity, making it ideal for startups with fluctuating income. Peer-to-peer lending provides access to capital through individual investors, often at competitive interest rates, but requires fixed monthly repayments regardless of business performance. Choosing between them depends on a company's cash flow stability, growth stage, and willingness to share ownership or assume fixed debt obligations.

Connection

Revenue-based financing and peer-to-peer lending are connected through their alternative funding models that provide businesses with flexible capital sources outside traditional banking systems. Both methods leverage investor networks: revenue-based financing offers repayment tied to a company's revenue stream, while peer-to-peer lending connects individual lenders directly with borrowers for fixed repayment schedules. These innovative financing solutions enhance access to capital for startups and small enterprises, aligning investor returns with business performance and risk.

Key Terms

Peer-to-Peer Lending:

Peer-to-peer lending connects borrowers directly with individual investors, often offering lower interest rates than traditional banks by eliminating intermediaries. This financing method provides flexible loan terms and transparency, appealing to small businesses and startups seeking quick capital. Explore detailed comparisons to understand why peer-to-peer lending might be your ideal funding solution.

Marketplace Platform

Marketplace platforms facilitate peer-to-peer lending by connecting individual borrowers with investors, offering transparent loan terms and diversified funding sources, while revenue-based financing platforms provide businesses with capital in exchange for a percentage of future revenue, emphasizing flexibility and alignment with cash flow. Peer-to-peer lending focuses on fixed repayment schedules and credit risk assessment, whereas revenue-based financing prioritizes business performance and revenue tracking through integrated platform analytics. Explore how marketplace platforms optimize these financing models to empower both entrepreneurs and investors efficiently.

Interest Rate

Peer-to-peer lending typically offers fixed interest rates ranging from 5% to 12%, depending on borrower creditworthiness and loan term, providing predictable repayment schedules. Revenue-based financing sets payments as a percentage of ongoing revenue, often between 2% and 10%, resulting in variable repayment amounts aligned with business performance. Explore detailed comparisons to determine which financing method aligns best with your financial goals and cash flow requirements.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work | Equifax - Peer-to-peer (P2P) lending allows borrowers to apply for loans from individual investors instead of banks, through specialized websites that connect lenders with borrowers, offering potentially lower eligibility requirements and flexible terms but carrying risks as loans lack bank protections.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an online financial service where individuals lend money to others without traditional financial intermediaries, characterized by unsecured or secured loans, online platforms, and credit risk managed by P2P companies that facilitate borrower-lender matching and loan servicing.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending is a marketplace where individuals lend money directly to others, earning interest as loans are repaid, but it can be significantly riskier than traditional savings as loans may default and are not protected like bank deposits.

dowidth.com

dowidth.com