Finfluencers provide accessible financial insights through social media, often focusing on personal finance tips and trending investment strategies, attracting a wide online audience. In contrast, CFA charterholders undergo rigorous exams and practical experience requirements, ensuring deep expertise in investment analysis, portfolio management, and ethical standards. Explore the distinct benefits and credibility of finfluencers versus CFAs to make informed decisions in your financial journey.

Why it is important

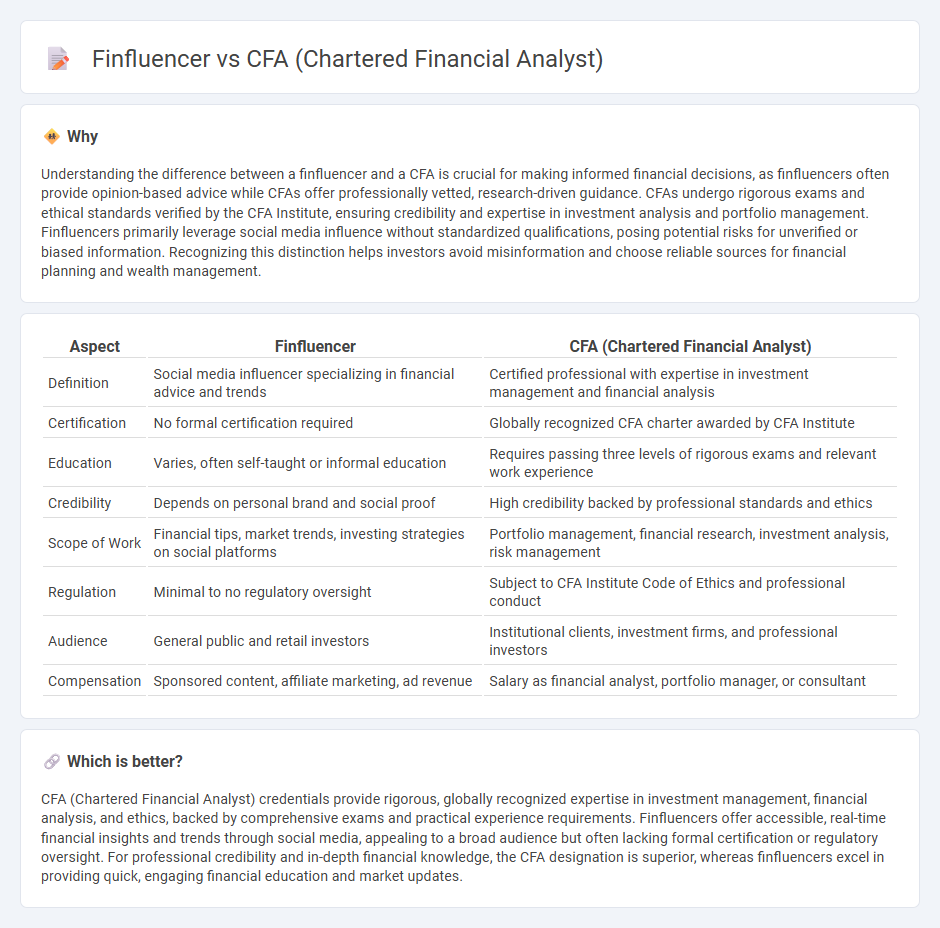

Understanding the difference between a finfluencer and a CFA is crucial for making informed financial decisions, as finfluencers often provide opinion-based advice while CFAs offer professionally vetted, research-driven guidance. CFAs undergo rigorous exams and ethical standards verified by the CFA Institute, ensuring credibility and expertise in investment analysis and portfolio management. Finfluencers primarily leverage social media influence without standardized qualifications, posing potential risks for unverified or biased information. Recognizing this distinction helps investors avoid misinformation and choose reliable sources for financial planning and wealth management.

Comparison Table

| Aspect | Finfluencer | CFA (Chartered Financial Analyst) |

|---|---|---|

| Definition | Social media influencer specializing in financial advice and trends | Certified professional with expertise in investment management and financial analysis |

| Certification | No formal certification required | Globally recognized CFA charter awarded by CFA Institute |

| Education | Varies, often self-taught or informal education | Requires passing three levels of rigorous exams and relevant work experience |

| Credibility | Depends on personal brand and social proof | High credibility backed by professional standards and ethics |

| Scope of Work | Financial tips, market trends, investing strategies on social platforms | Portfolio management, financial research, investment analysis, risk management |

| Regulation | Minimal to no regulatory oversight | Subject to CFA Institute Code of Ethics and professional conduct |

| Audience | General public and retail investors | Institutional clients, investment firms, and professional investors |

| Compensation | Sponsored content, affiliate marketing, ad revenue | Salary as financial analyst, portfolio manager, or consultant |

Which is better?

CFA (Chartered Financial Analyst) credentials provide rigorous, globally recognized expertise in investment management, financial analysis, and ethics, backed by comprehensive exams and practical experience requirements. Finfluencers offer accessible, real-time financial insights and trends through social media, appealing to a broad audience but often lacking formal certification or regulatory oversight. For professional credibility and in-depth financial knowledge, the CFA designation is superior, whereas finfluencers excel in providing quick, engaging financial education and market updates.

Connection

Finfluencers leverage social media platforms to disseminate financial knowledge, often simplifying complex investment concepts that align closely with the rigorous curriculum of the Chartered Financial Analyst (CFA) program. Both finfluencers and CFAs emphasize data-driven analysis, risk assessment, and portfolio management techniques, catering to investors seeking informed decision-making tools. The growing collaboration between finfluencers with CFA credentials enhances credibility and helps bridge the gap between formal financial education and accessible digital content.

Key Terms

CFA (Chartered Financial Analyst):

The CFA (Chartered Financial Analyst) designation is a globally recognized professional credential awarded by the CFA Institute, emphasizing rigorous training in investment management, financial analysis, and ethical standards. CFAs undergo a demanding three-level exam process coupled with relevant work experience, distinguishing them from finfluencers who typically share financial advice on social media without formal certification. Explore the comprehensive benefits and career pathways offered by obtaining the CFA charter to advance your expertise in finance.

Ethics and Professional Standards

The CFA designation emphasizes rigorous Ethics and Professional Standards, mandating adherence to the CFA Institute's Code of Ethics and Standards of Professional Conduct, which ensures integrity and accountability among financial professionals. Finfluencers may not be bound by such stringent formal ethical guidelines, resulting in varied levels of transparency, accuracy, and responsibility in financial advice shared on social media platforms. Explore the distinct ethical frameworks and professional expectations that define CFA charterholders and finfluencers to understand their impact on investor trust and financial education.

Portfolio Management

The CFA designation emphasizes rigorous training in portfolio management, investment analysis, and ethical standards, equipping professionals with deep expertise in asset allocation and risk management. Finfluencers, while influential in social media finance education, often provide generalized advice that lacks the comprehensive analytical framework and credential validation inherent to CFAs. Explore the distinctive advantages of CFA-certified portfolio management for a more structured and reliable investment approach.

Source and External Links

Chartered Financial Analyst - The CFA program is a globally recognized postgraduate certification by the CFA Institute, covering advanced investment analysis and ethics; earning the CFA charter requires passing three exams and fulfilling professional requirements, with over 200,000 charterholders worldwide as of 2024.

What is a Chartered Financial Analyst (CFA) and How to Become One - A CFA specializes in investment management and financial strategy, requiring a bachelor's degree, 4,000 hours of relevant work experience, and passing three rigorous six-hour exams covering economics, finance, and ethics.

CFA(r) Program | Become a Chartered Financial Analyst(r) - The CFA Program consists of three exams testing investment tools, asset valuation, portfolio management, and wealth planning, designed to prepare candidates for senior roles in finance with a strong ethical foundation.

dowidth.com

dowidth.com