Quantitative tightening involves central banks reducing their balance sheets by selling government bonds or letting them mature, which decreases liquidity in the financial system, while an interest rate hike directly increases the cost of borrowing by raising policy rates to control inflation. Both tools aim to cool economic activity but affect markets through different mechanisms: quantitative tightening influences long-term interest rates and asset prices, whereas rate hikes impact short-term borrowing costs. Explore how these monetary policies shape economic growth and investment strategies.

Why it is important

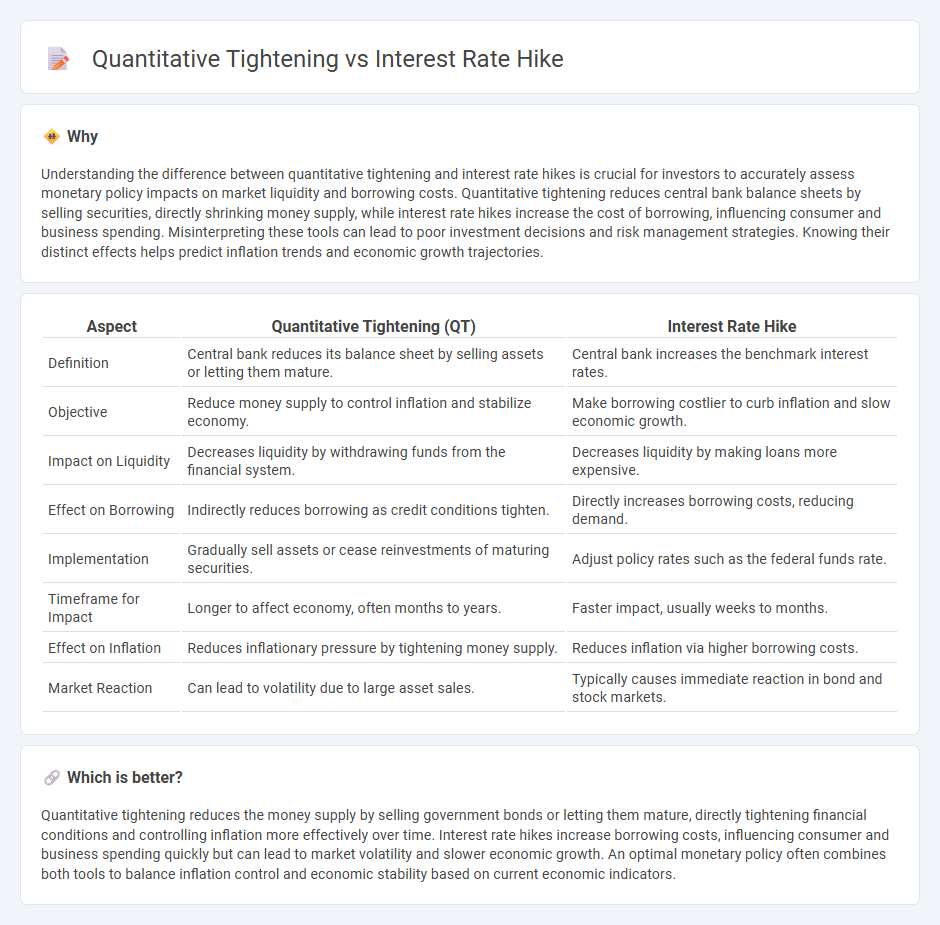

Understanding the difference between quantitative tightening and interest rate hikes is crucial for investors to accurately assess monetary policy impacts on market liquidity and borrowing costs. Quantitative tightening reduces central bank balance sheets by selling securities, directly shrinking money supply, while interest rate hikes increase the cost of borrowing, influencing consumer and business spending. Misinterpreting these tools can lead to poor investment decisions and risk management strategies. Knowing their distinct effects helps predict inflation trends and economic growth trajectories.

Comparison Table

| Aspect | Quantitative Tightening (QT) | Interest Rate Hike |

|---|---|---|

| Definition | Central bank reduces its balance sheet by selling assets or letting them mature. | Central bank increases the benchmark interest rates. |

| Objective | Reduce money supply to control inflation and stabilize economy. | Make borrowing costlier to curb inflation and slow economic growth. |

| Impact on Liquidity | Decreases liquidity by withdrawing funds from the financial system. | Decreases liquidity by making loans more expensive. |

| Effect on Borrowing | Indirectly reduces borrowing as credit conditions tighten. | Directly increases borrowing costs, reducing demand. |

| Implementation | Gradually sell assets or cease reinvestments of maturing securities. | Adjust policy rates such as the federal funds rate. |

| Timeframe for Impact | Longer to affect economy, often months to years. | Faster impact, usually weeks to months. |

| Effect on Inflation | Reduces inflationary pressure by tightening money supply. | Reduces inflation via higher borrowing costs. |

| Market Reaction | Can lead to volatility due to large asset sales. | Typically causes immediate reaction in bond and stock markets. |

Which is better?

Quantitative tightening reduces the money supply by selling government bonds or letting them mature, directly tightening financial conditions and controlling inflation more effectively over time. Interest rate hikes increase borrowing costs, influencing consumer and business spending quickly but can lead to market volatility and slower economic growth. An optimal monetary policy often combines both tools to balance inflation control and economic stability based on current economic indicators.

Connection

Quantitative tightening reduces the money supply by selling government bonds or letting them mature, which increases long-term interest rates and reduces liquidity in financial markets. Interest rate hikes by central banks raise short-term borrowing costs to control inflation, making credit more expensive and slowing economic activity. The combination of quantitative tightening and interest rate hikes tightens overall financial conditions, leading to reduced spending and investment.

Key Terms

Monetary Policy

Interest rate hikes increase the cost of borrowing by raising benchmark rates, directly influencing consumer spending, business investment, and overall economic growth. Quantitative tightening reduces the money supply by shrinking the central bank's balance sheet, leading to higher long-term interest rates and less liquidity in financial markets. Explore how these monetary policy tools differently impact inflation control and economic stability.

Liquidity

Interest rate hikes directly increase borrowing costs, constraining liquidity by reducing loan demand and slowing money circulation in the economy. Quantitative tightening withdraws liquidity more aggressively by selling government bonds or letting them mature, shrinking the central bank's balance sheet and tightening financial conditions. Explore the detailed impacts of these monetary policies on market liquidity and economic growth.

Inflation

Interest rate hikes directly increase borrowing costs, reducing consumer spending and business investments to curb inflation. Quantitative tightening shrinks the central bank's balance sheet by selling assets, tightening financial conditions and lowering liquidity, which also dampens inflationary pressures. Explore how these monetary policies distinctly influence inflation control and economic stability.

Source and External Links

2024 Fed Rate Guide | Rocket Mortgage - Provides an overview of how the Federal Reserve hikes interest rates to control borrowing costs and inflation.

United States Fed Funds Interest Rate | Trading Economics - Offers current and projected fed funds interest rates, including long-term trends and potential changes.

How Much Will the Fed Cut Interest Rates? | Morningstar - Discusses potential future reductions in interest rates based on economic forecasts.

dowidth.com

dowidth.com