Special Purpose Acquisition Companies (SPACs) are investment vehicles that raise capital through an initial public offering to acquire or merge with an existing company, while Business Development Companies (BDCs) are publicly traded firms that invest in small and mid-sized businesses, providing them with debt or equity financing. SPACs offer a faster route for private companies to go public compared to traditional IPOs, whereas BDCs focus on generating income through dividends funded by their portfolio of operating companies. Explore more about the unique investment strategies and risk profiles of SPACs and BDCs.

Why it is important

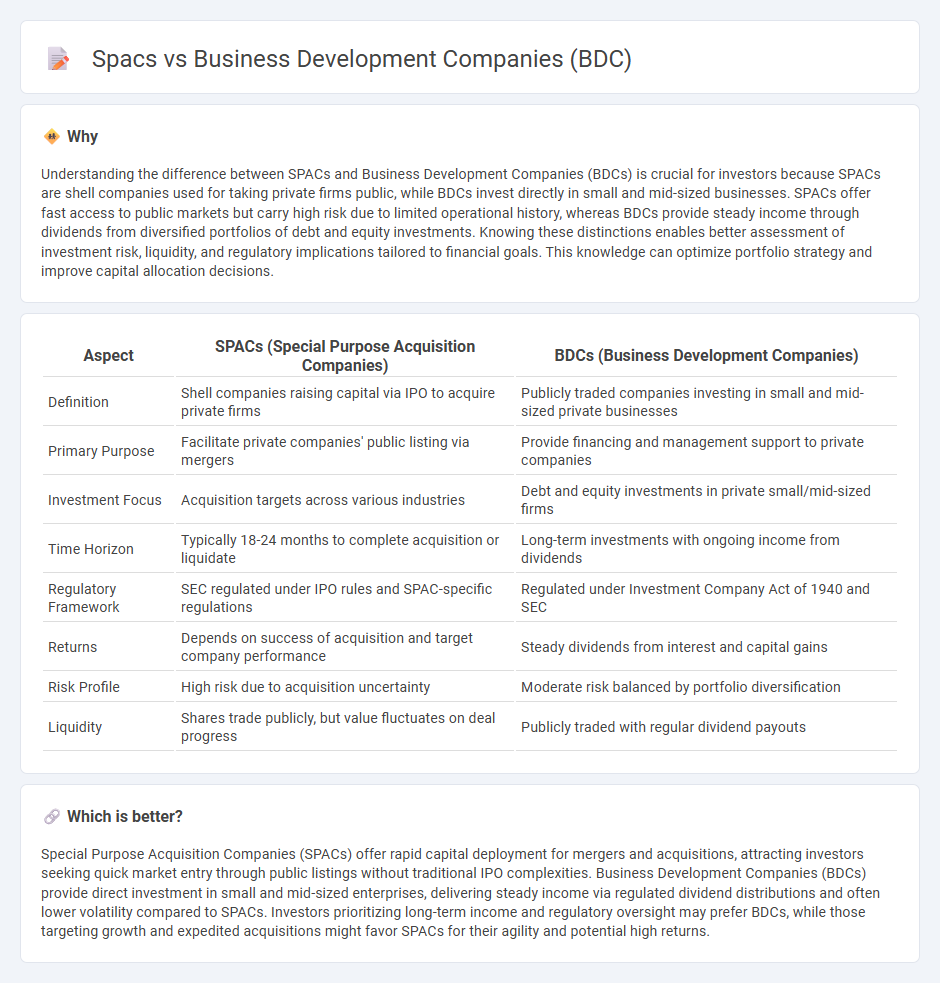

Understanding the difference between SPACs and Business Development Companies (BDCs) is crucial for investors because SPACs are shell companies used for taking private firms public, while BDCs invest directly in small and mid-sized businesses. SPACs offer fast access to public markets but carry high risk due to limited operational history, whereas BDCs provide steady income through dividends from diversified portfolios of debt and equity investments. Knowing these distinctions enables better assessment of investment risk, liquidity, and regulatory implications tailored to financial goals. This knowledge can optimize portfolio strategy and improve capital allocation decisions.

Comparison Table

| Aspect | SPACs (Special Purpose Acquisition Companies) | BDCs (Business Development Companies) |

|---|---|---|

| Definition | Shell companies raising capital via IPO to acquire private firms | Publicly traded companies investing in small and mid-sized private businesses |

| Primary Purpose | Facilitate private companies' public listing via mergers | Provide financing and management support to private companies |

| Investment Focus | Acquisition targets across various industries | Debt and equity investments in private small/mid-sized firms |

| Time Horizon | Typically 18-24 months to complete acquisition or liquidate | Long-term investments with ongoing income from dividends |

| Regulatory Framework | SEC regulated under IPO rules and SPAC-specific regulations | Regulated under Investment Company Act of 1940 and SEC |

| Returns | Depends on success of acquisition and target company performance | Steady dividends from interest and capital gains |

| Risk Profile | High risk due to acquisition uncertainty | Moderate risk balanced by portfolio diversification |

| Liquidity | Shares trade publicly, but value fluctuates on deal progress | Publicly traded with regular dividend payouts |

Which is better?

Special Purpose Acquisition Companies (SPACs) offer rapid capital deployment for mergers and acquisitions, attracting investors seeking quick market entry through public listings without traditional IPO complexities. Business Development Companies (BDCs) provide direct investment in small and mid-sized enterprises, delivering steady income via regulated dividend distributions and often lower volatility compared to SPACs. Investors prioritizing long-term income and regulatory oversight may prefer BDCs, while those targeting growth and expedited acquisitions might favor SPACs for their agility and potential high returns.

Connection

Special Purpose Acquisition Companies (SPACs) and Business Development Companies (BDCs) intersect through their shared focus on providing capital to growing businesses, with SPACs raising funds via IPOs to acquire private companies and BDCs offering financing and management expertise to small and mid-sized enterprises. Both structures attract investors seeking alternative avenues to traditional public equity markets and emphasize the importance of robust due diligence and regulatory compliance under SEC guidelines. The synergy between SPACs' acquisition strategies and BDCs' ongoing investment management creates opportunities for enhanced value creation and liquidity in the private equity and credit markets.

Key Terms

Investment Structure

Business Development Companies (BDCs) operate as regulated investment vehicles that raise capital through public offerings to invest primarily in small and mid-sized private companies, with strict regulatory requirements including leverage limits and dividend distribution mandates. Special Purpose Acquisition Companies (SPACs) function as shell companies formed to raise equity capital via IPOs for the sole purpose of acquiring or merging with an existing business, with funds held in trust until a target is identified. Explore further to understand how these distinct investment structures impact risk, governance, and returns.

Regulatory Framework

Business Development Companies (BDCs) operate under the Investment Company Act of 1940, requiring stringent regulatory compliance, including asset diversification and distribution mandates to maintain tax advantages. Special Purpose Acquisition Companies (SPACs) are governed by SEC regulations pertinent to blank-check companies, emphasizing disclosure requirements during IPOs and de-SPAC transactions but with relatively fewer operational restrictions post-merger. Explore further to understand the nuanced regulatory differences impacting investment strategies and risk profiles between BDCs and SPACs.

Exit Strategy

Business Development Companies (BDC) typically provide growth capital to small and mid-sized businesses with a clear exit strategy through dividends or share buybacks, ensuring steady investor returns. Special Purpose Acquisition Companies (SPACs) are blank-check entities designed for a quick public market exit via a reverse merger with a private company, often aiming for rapid liquidity within 18-24 months. Explore detailed insights on how these exit strategies impact investor outcomes and market performance.

Source and External Links

Business Development Company - Wikipedia - A Business Development Company (BDC) is a closed-end investment company created by U.S. Congress in 1980 to provide capital access to small and mid-sized businesses, investing at least 70% of assets in qualifying smaller U.S. companies, and offering tax advantages by distributing 90% or more of income to investors.

BDCs Work for America - Small Business Investor Alliance - BDCs are regulated investment companies under the Investment Company Act of 1940, offering investment opportunities to everyday investors and providing capital to middle market companies, thus bridging the capital gap for smaller businesses.

Business Development Companies (BDCs) - Charles Schwab - BDCs are specialty finance companies investing mainly debt and equity in small- to mid-size U.S. companies, often registered as Regulated Investment Companies to avoid entity-level tax and typically paying high dividends taxed as regular income.

dowidth.com

dowidth.com