Finfluencers leverage social media platforms to provide accessible financial insights and investment tips to a broad audience, often emphasizing real-time trends and personal experiences. Fund managers, by contrast, utilize rigorous analytical techniques and portfolio management strategies to optimize returns for institutional or high-net-worth clients within regulated frameworks. Explore the key differences and advantages of each approach to enhance your financial decision-making.

Why it is important

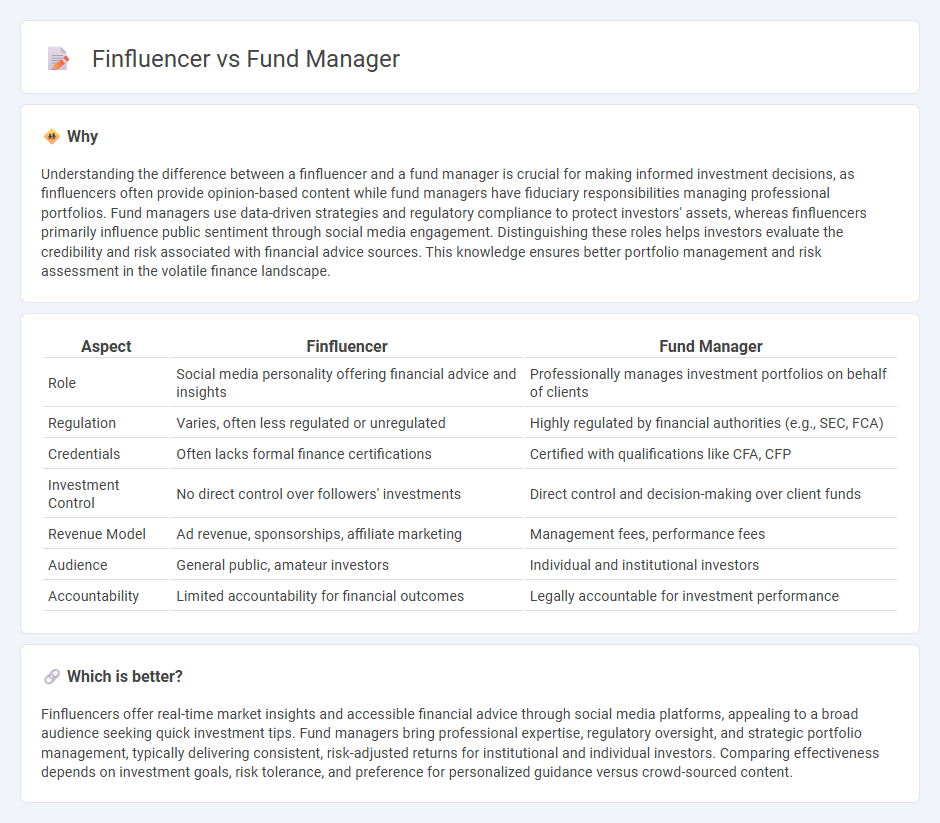

Understanding the difference between a finfluencer and a fund manager is crucial for making informed investment decisions, as finfluencers often provide opinion-based content while fund managers have fiduciary responsibilities managing professional portfolios. Fund managers use data-driven strategies and regulatory compliance to protect investors' assets, whereas finfluencers primarily influence public sentiment through social media engagement. Distinguishing these roles helps investors evaluate the credibility and risk associated with financial advice sources. This knowledge ensures better portfolio management and risk assessment in the volatile finance landscape.

Comparison Table

| Aspect | Finfluencer | Fund Manager |

|---|---|---|

| Role | Social media personality offering financial advice and insights | Professionally manages investment portfolios on behalf of clients |

| Regulation | Varies, often less regulated or unregulated | Highly regulated by financial authorities (e.g., SEC, FCA) |

| Credentials | Often lacks formal finance certifications | Certified with qualifications like CFA, CFP |

| Investment Control | No direct control over followers' investments | Direct control and decision-making over client funds |

| Revenue Model | Ad revenue, sponsorships, affiliate marketing | Management fees, performance fees |

| Audience | General public, amateur investors | Individual and institutional investors |

| Accountability | Limited accountability for financial outcomes | Legally accountable for investment performance |

Which is better?

Finfluencers offer real-time market insights and accessible financial advice through social media platforms, appealing to a broad audience seeking quick investment tips. Fund managers bring professional expertise, regulatory oversight, and strategic portfolio management, typically delivering consistent, risk-adjusted returns for institutional and individual investors. Comparing effectiveness depends on investment goals, risk tolerance, and preference for personalized guidance versus crowd-sourced content.

Connection

Finfluencers impact fund managers by shaping investor sentiment through social media platforms, influencing trading volumes and asset prices. Fund managers monitor finfluencer trends to gauge market sentiment and adjust portfolio strategies accordingly. The interaction between finfluencers and fund managers creates a dynamic feedback loop affecting market liquidity and volatility.

Key Terms

Portfolio Management

Fund managers leverage extensive financial expertise and market analysis to actively manage investment portfolios aimed at maximizing returns and mitigating risk. Finfluencers, while influential on social media, primarily share personal insights and trends without formal fiduciary responsibility or portfolio oversight. Explore the nuanced roles of fund managers and finfluencers to understand their impact on portfolio management strategies.

Social Media Influence

Fund managers leverage extensive financial expertise and portfolio management skills to build credibility and attract sophisticated investors, whereas finfluencers utilize social media platforms like Instagram, TikTok, and YouTube to engage broader audiences through relatable content and investment tips. The impact of social media influence varies, with fund managers emphasizing proven track records and regulatory compliance, while finfluencers rely on follower growth, engagement metrics, and viral content to shape investment trends. Explore the evolving dynamics between these two financial figures and their social media strategies to understand their growing roles in the investment landscape.

Fiduciary Duty

Fund managers bear a critical fiduciary duty to prioritize clients' financial interests through expert asset management and regulatory compliance, ensuring transparent decision-making and risk mitigation. Finfluencers, while often providing accessible financial content and advice via social media, lack formal fiduciary responsibilities and regulatory oversight, which can lead to conflicts of interest and variable information reliability. Explore how fiduciary duty fundamentally differentiates professional fund management from social media financial advice.

Source and External Links

How To Become a Hedge Fund Manager | Indeed.com - A hedge fund manager advises clients on managing hedge fund investments, requiring extensive investment knowledge, financial experience, and often CFA certification or an MBA.

Investment Fund Managers at My Next Move - Investment fund managers plan and coordinate investment strategies to maximize client returns, selecting specific investments and monitoring their performance to meet risk goals.

Investment management - Wikipedia - The term fund manager refers to both firms and individuals responsible for managing investment funds to achieve specified investment goals for institutional or private investors.

dowidth.com

dowidth.com