Private credit offers direct lending solutions to mid-market companies, focusing on tailored financing with flexible terms and higher yields compared to traditional bank loans. Leveraged loans, typically provided to highly leveraged companies, are syndicated loans with floating interest rates, often used for acquisitions or refinancing existing debt. Explore the key differences and benefits of private credit versus leveraged loans to optimize your investment strategy.

Why it is important

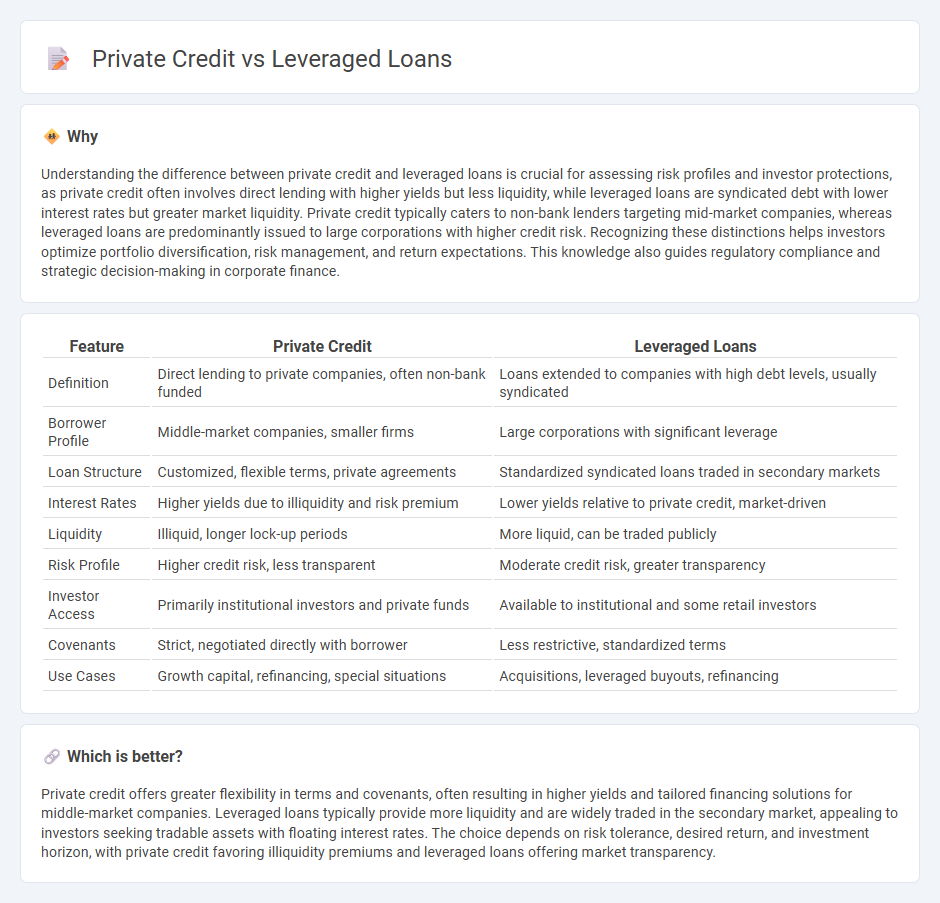

Understanding the difference between private credit and leveraged loans is crucial for assessing risk profiles and investor protections, as private credit often involves direct lending with higher yields but less liquidity, while leveraged loans are syndicated debt with lower interest rates but greater market liquidity. Private credit typically caters to non-bank lenders targeting mid-market companies, whereas leveraged loans are predominantly issued to large corporations with higher credit risk. Recognizing these distinctions helps investors optimize portfolio diversification, risk management, and return expectations. This knowledge also guides regulatory compliance and strategic decision-making in corporate finance.

Comparison Table

| Feature | Private Credit | Leveraged Loans |

|---|---|---|

| Definition | Direct lending to private companies, often non-bank funded | Loans extended to companies with high debt levels, usually syndicated |

| Borrower Profile | Middle-market companies, smaller firms | Large corporations with significant leverage |

| Loan Structure | Customized, flexible terms, private agreements | Standardized syndicated loans traded in secondary markets |

| Interest Rates | Higher yields due to illiquidity and risk premium | Lower yields relative to private credit, market-driven |

| Liquidity | Illiquid, longer lock-up periods | More liquid, can be traded publicly |

| Risk Profile | Higher credit risk, less transparent | Moderate credit risk, greater transparency |

| Investor Access | Primarily institutional investors and private funds | Available to institutional and some retail investors |

| Covenants | Strict, negotiated directly with borrower | Less restrictive, standardized terms |

| Use Cases | Growth capital, refinancing, special situations | Acquisitions, leveraged buyouts, refinancing |

Which is better?

Private credit offers greater flexibility in terms and covenants, often resulting in higher yields and tailored financing solutions for middle-market companies. Leveraged loans typically provide more liquidity and are widely traded in the secondary market, appealing to investors seeking tradable assets with floating interest rates. The choice depends on risk tolerance, desired return, and investment horizon, with private credit favoring illiquidity premiums and leveraged loans offering market transparency.

Connection

Private credit and leveraged loans intersect as both involve non-bank lenders providing capital to companies with higher risk profiles, often those with substantial debt levels or below investment-grade credit ratings. Leveraged loans are frequently syndicated by institutional investors, including private credit funds, which seek higher returns through direct lending in the private credit market. This relationship underscores how private credit funds play a key role in financing leveraged buyouts, acquisitions, and refinancing for middle-market and large corporations.

Key Terms

Senior Secured Debt

Senior secured debt in leveraged loans typically involves borrowing by companies with high debt levels, secured against specific assets to reduce lender risk and often used for acquisitions or refinancing. In private credit, senior secured debt offers direct lending opportunities with tailored terms, higher interest rates, and less regulatory oversight compared to syndicated loans. Explore in-depth comparisons of senior secured debt within leveraged loans and private credit to understand risk profiles and investment strategies.

Covenant-Lite

Covenant-lite loans, a hallmark of leveraged loans, feature fewer borrower restrictions, offering greater flexibility but increased risk for lenders compared to traditional private credit agreements. Private credit often entails stricter covenant packages, providing enhanced protections and monitoring to safeguard investor interests. Explore the nuanced differences in covenant structures to optimize credit strategy and risk assessment.

Direct Lending

Leveraged loans are senior secured loans typically issued to companies with higher debt levels, traded in syndicated markets, and often backed by collateral, while private credit, including direct lending, involves non-bank lenders providing customized, illiquid loans directly to mid-market companies without public trading. Direct lending focuses on building strong borrower relationships, offering flexible terms and greater control over loan covenants, making it a preferred choice for companies seeking tailored financing solutions outside traditional banking channels. Explore the nuances between leveraged loans and private credit in direct lending to understand their impact on corporate financing strategies and investor portfolios.

Source and External Links

Use of Leveraged Loans - Leveraged loans are loans to companies with high debt or poor credit, typically used for large transactions like buyouts, featuring a quoted margin to compensate for credit risk and priced based on principal without accrued interest.

Leveraged Loan Funds | Investor.gov - Leveraged loans are given to borrowers with high debt or low credit ratings, carry higher risk and interest rates, and investment funds may hold these loans for higher, variable-rate returns.

Leveraged Bank Loans Primer - NAIC - Leveraged bank loans are senior secured commercial loans to high-yield companies, often floating rate, typically with maturities of 7-8 years, and include covenants that govern borrower compliance with loan terms.

dowidth.com

dowidth.com