Quantamental investing combines quantitative data analysis with fundamental research to optimize portfolio performance, leveraging algorithms to identify undervalued securities more efficiently than traditional active investing methods. Active investing relies heavily on human judgment and in-depth company analysis, often leading to higher costs and potential biases. Discover how integrating quantamental strategies can enhance your investment approach.

Why it is important

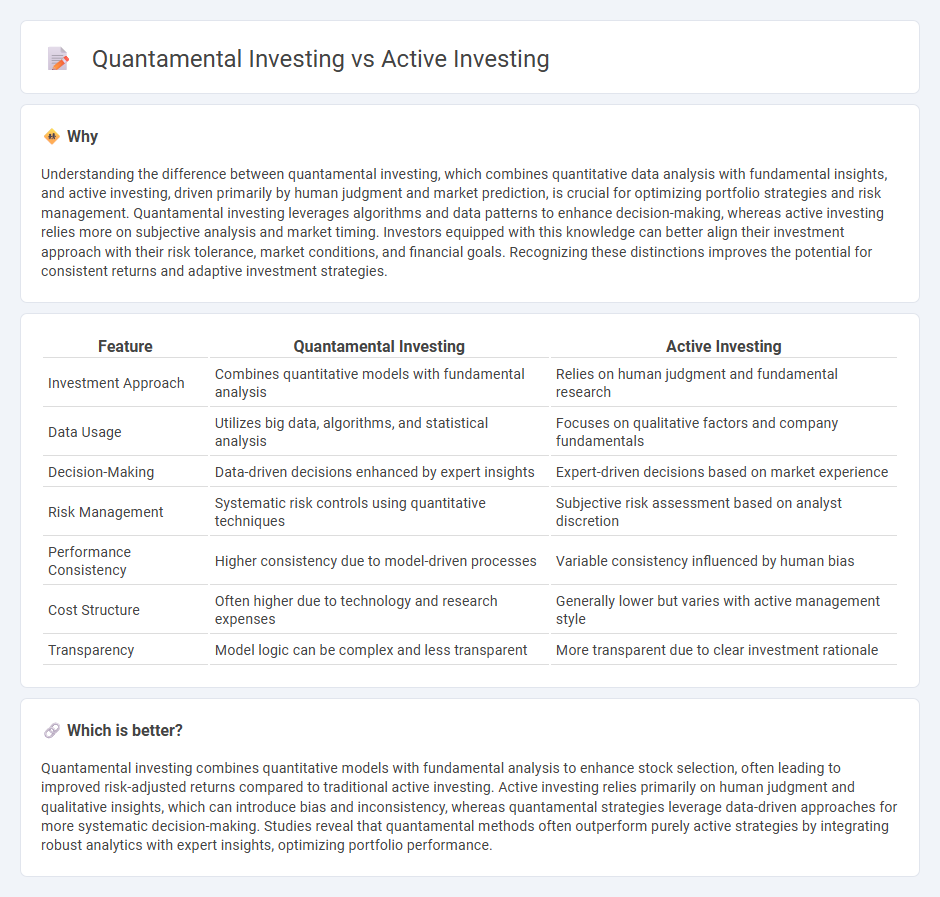

Understanding the difference between quantamental investing, which combines quantitative data analysis with fundamental insights, and active investing, driven primarily by human judgment and market prediction, is crucial for optimizing portfolio strategies and risk management. Quantamental investing leverages algorithms and data patterns to enhance decision-making, whereas active investing relies more on subjective analysis and market timing. Investors equipped with this knowledge can better align their investment approach with their risk tolerance, market conditions, and financial goals. Recognizing these distinctions improves the potential for consistent returns and adaptive investment strategies.

Comparison Table

| Feature | Quantamental Investing | Active Investing |

|---|---|---|

| Investment Approach | Combines quantitative models with fundamental analysis | Relies on human judgment and fundamental research |

| Data Usage | Utilizes big data, algorithms, and statistical analysis | Focuses on qualitative factors and company fundamentals |

| Decision-Making | Data-driven decisions enhanced by expert insights | Expert-driven decisions based on market experience |

| Risk Management | Systematic risk controls using quantitative techniques | Subjective risk assessment based on analyst discretion |

| Performance Consistency | Higher consistency due to model-driven processes | Variable consistency influenced by human bias |

| Cost Structure | Often higher due to technology and research expenses | Generally lower but varies with active management style |

| Transparency | Model logic can be complex and less transparent | More transparent due to clear investment rationale |

Which is better?

Quantamental investing combines quantitative models with fundamental analysis to enhance stock selection, often leading to improved risk-adjusted returns compared to traditional active investing. Active investing relies primarily on human judgment and qualitative insights, which can introduce bias and inconsistency, whereas quantamental strategies leverage data-driven approaches for more systematic decision-making. Studies reveal that quantamental methods often outperform purely active strategies by integrating robust analytics with expert insights, optimizing portfolio performance.

Connection

Quantamental investing combines quantitative models with fundamental analysis to enhance stock selection and portfolio management. Active investing leverages these insights by actively adjusting holdings based on data-driven signals and intrinsic company valuations. This hybrid approach aims to optimize returns while managing risk through comprehensive analysis.

Key Terms

Fundamental Analysis

Active investing emphasizes in-depth fundamental analysis to identify undervalued stocks through qualitative and quantitative assessment of financial statements, management quality, and industry positioning. Quantamental investing integrates advanced quantitative models with fundamental analysis to enhance stock selection by leveraging large datasets, machine learning algorithms, and traditional financial metrics. Explore how combining rigorous fundamental research with quantitative techniques can optimize investment strategies in dynamic markets.

Quantitative Models

Quantamental investing combines active investing strategies with advanced quantitative models to enhance stock selection and risk management by integrating fundamental analysis with data-driven algorithms. This approach leverages vast datasets, machine learning, and statistical techniques to identify market inefficiencies while maintaining a fundamental understanding of company financials and macroeconomic factors. Discover how integrating quantitative models into active investing can optimize portfolio performance and reduce biases.

Alpha Generation

Active investing relies heavily on fundamental analysis and market intuition to identify mispriced assets and generate alpha, while quantamental investing combines quantitative models with traditional fundamental research to enhance decision-making and improve alpha generation consistency. Quantamental approaches utilize vast datasets, machine learning algorithms, and factor analysis to uncover alpha sources that are often missed by purely active methods. Discover how integrating quantitative insights with fundamental research can elevate your alpha generation strategy.

Source and External Links

Active management - Active investing involves buying and selling investments strategically to attempt to generate returns above the market, offering flexibility to tailor risk, income focus, and tax planning but generally incurs higher fees and may underperform compared to passive strategies.

Active vs. Passive Investing Strategies | KAR - Active investing relies on expert analysis to select undervalued stocks and adjust portfolios quickly to market changes, potentially delivering higher rewards and tax management benefits, especially in volatile markets where quality stock selection stands out.

Active vs. Passive Investing - Active investing requires frequent trading and portfolio intervention to capitalize on short-term opportunities, contrasting with passive investing's buy-and-hold approach that aims to replicate market performance over the long term.

dowidth.com

dowidth.com