Trader funding programs provide capital to skilled traders, enabling them to access larger positions without risking their own money, while exchange-traded funds (ETFs) allow investors to buy shares representing diversified portfolios managed by professionals. These programs focus on leveraging trader expertise for profit, whereas ETFs emphasize broad market exposure and liquidity for long-term investment strategies. Explore the differences further to determine which financial tool aligns best with your trading or investment goals.

Why it is important

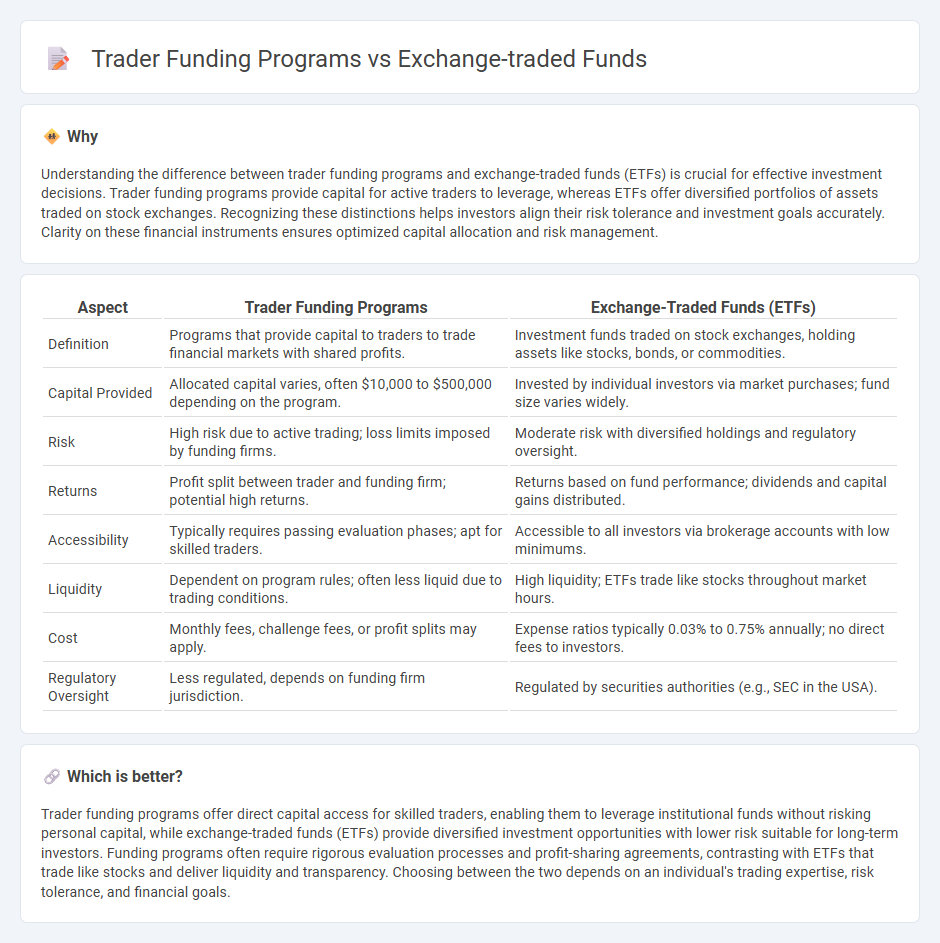

Understanding the difference between trader funding programs and exchange-traded funds (ETFs) is crucial for effective investment decisions. Trader funding programs provide capital for active traders to leverage, whereas ETFs offer diversified portfolios of assets traded on stock exchanges. Recognizing these distinctions helps investors align their risk tolerance and investment goals accurately. Clarity on these financial instruments ensures optimized capital allocation and risk management.

Comparison Table

| Aspect | Trader Funding Programs | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Programs that provide capital to traders to trade financial markets with shared profits. | Investment funds traded on stock exchanges, holding assets like stocks, bonds, or commodities. |

| Capital Provided | Allocated capital varies, often $10,000 to $500,000 depending on the program. | Invested by individual investors via market purchases; fund size varies widely. |

| Risk | High risk due to active trading; loss limits imposed by funding firms. | Moderate risk with diversified holdings and regulatory oversight. |

| Returns | Profit split between trader and funding firm; potential high returns. | Returns based on fund performance; dividends and capital gains distributed. |

| Accessibility | Typically requires passing evaluation phases; apt for skilled traders. | Accessible to all investors via brokerage accounts with low minimums. |

| Liquidity | Dependent on program rules; often less liquid due to trading conditions. | High liquidity; ETFs trade like stocks throughout market hours. |

| Cost | Monthly fees, challenge fees, or profit splits may apply. | Expense ratios typically 0.03% to 0.75% annually; no direct fees to investors. |

| Regulatory Oversight | Less regulated, depends on funding firm jurisdiction. | Regulated by securities authorities (e.g., SEC in the USA). |

Which is better?

Trader funding programs offer direct capital access for skilled traders, enabling them to leverage institutional funds without risking personal capital, while exchange-traded funds (ETFs) provide diversified investment opportunities with lower risk suitable for long-term investors. Funding programs often require rigorous evaluation processes and profit-sharing agreements, contrasting with ETFs that trade like stocks and deliver liquidity and transparency. Choosing between the two depends on an individual's trading expertise, risk tolerance, and financial goals.

Connection

Trader funding programs provide capital to skilled traders, enabling them to execute larger trades without risking personal funds, which can enhance performance in markets where exchange-traded funds (ETFs) are actively traded. ETFs facilitate liquidity and diverse asset exposure, creating opportunities for funded traders to exploit price movements across multiple sectors with reduced risk. The synergy between these programs and ETFs supports scalable trading strategies, increasing potential profits while distributing risk efficiently.

Key Terms

Liquidity

Exchange-traded funds (ETFs) provide high liquidity by allowing investors to buy and sell shares on public exchanges throughout the trading day, enabling quick access to capital. Trader funding programs usually have different liquidity constraints, often requiring traders to meet performance metrics before accessing profits or adding funds. Explore more about how liquidity impacts your trading strategy and funding options.

Leverage

Exchange-traded funds (ETFs) offer investors diversified exposure to various asset classes without the direct use of leverage, typically maintaining a 1:1 asset-to-share ratio, while trader funding programs often provide leveraged capital, sometimes exceeding 10:1, enabling traders to control larger positions with less initial capital. Leveraged ETFs exist, but their leverage is embedded within the fund structure and designed for short-term strategies, contrasting with trader funding programs that actively use leverage to amplify returns based on performance. Explore the advantages and risks of leverage in both ETFs and trader funding programs to optimize your investment strategy.

Expense Ratio

Exchange-traded funds (ETFs) typically have lower expense ratios compared to trader funding programs, making ETFs more cost-effective for long-term investors. Trader funding programs may involve higher fees due to performance splits and administrative costs, impacting overall profitability. Explore detailed comparisons to understand cost implications and optimize your investment strategy.

Source and External Links

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs are funds traded on stock exchanges that combine the flexibility of stocks with the diversification of mutual funds, allowing investors to buy and sell a bundle of stocks, bonds, or other assets throughout the trading day with lower costs and tax efficiencies.

Exchange-Traded Funds and Products | FINRA.org - ETFs are a type of exchange-traded product (ETP) that provide investors exposure to baskets of securities or benchmarks and can be traded like stocks during market hours with regulatory oversight under the Securities Act and Exchange Act.

Exchange-traded fund - Wikipedia - ETFs differ from mutual funds in that they trade on stock exchanges throughout the day, generally have lower fees, greater transparency, and provide tax advantages while allowing features like short selling and margin purchases.

dowidth.com

dowidth.com