Decentralized exchanges (DEXs) operate on blockchain technology, enabling peer-to-peer trading without intermediaries, offering enhanced security and transparency compared to traditional stock exchanges. Traditional stock exchanges rely on centralized entities for trade execution, regulation, and oversight, ensuring market stability but often limiting accessibility and increasing costs. Explore the key differences and implications of these trading models to understand their impact on modern finance.

Why it is important

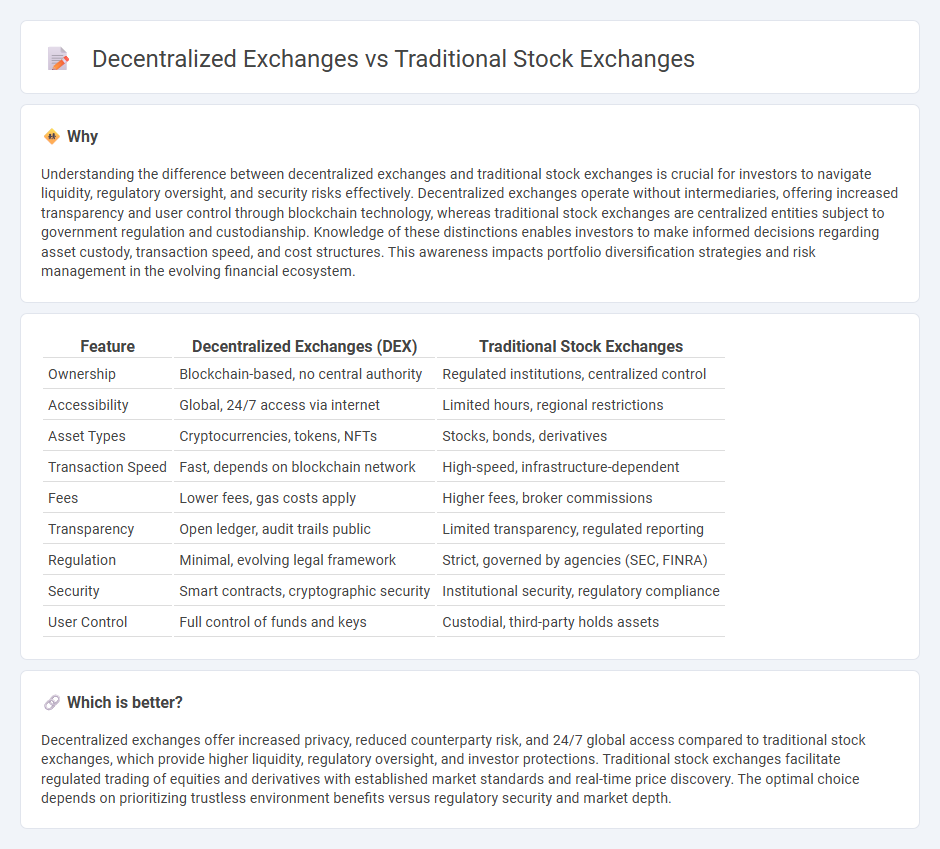

Understanding the difference between decentralized exchanges and traditional stock exchanges is crucial for investors to navigate liquidity, regulatory oversight, and security risks effectively. Decentralized exchanges operate without intermediaries, offering increased transparency and user control through blockchain technology, whereas traditional stock exchanges are centralized entities subject to government regulation and custodianship. Knowledge of these distinctions enables investors to make informed decisions regarding asset custody, transaction speed, and cost structures. This awareness impacts portfolio diversification strategies and risk management in the evolving financial ecosystem.

Comparison Table

| Feature | Decentralized Exchanges (DEX) | Traditional Stock Exchanges |

|---|---|---|

| Ownership | Blockchain-based, no central authority | Regulated institutions, centralized control |

| Accessibility | Global, 24/7 access via internet | Limited hours, regional restrictions |

| Asset Types | Cryptocurrencies, tokens, NFTs | Stocks, bonds, derivatives |

| Transaction Speed | Fast, depends on blockchain network | High-speed, infrastructure-dependent |

| Fees | Lower fees, gas costs apply | Higher fees, broker commissions |

| Transparency | Open ledger, audit trails public | Limited transparency, regulated reporting |

| Regulation | Minimal, evolving legal framework | Strict, governed by agencies (SEC, FINRA) |

| Security | Smart contracts, cryptographic security | Institutional security, regulatory compliance |

| User Control | Full control of funds and keys | Custodial, third-party holds assets |

Which is better?

Decentralized exchanges offer increased privacy, reduced counterparty risk, and 24/7 global access compared to traditional stock exchanges, which provide higher liquidity, regulatory oversight, and investor protections. Traditional stock exchanges facilitate regulated trading of equities and derivatives with established market standards and real-time price discovery. The optimal choice depends on prioritizing trustless environment benefits versus regulatory security and market depth.

Connection

Decentralized exchanges (DEXs) and traditional stock exchanges both facilitate the trading of assets but operate on fundamentally different infrastructures, with DEXs using blockchain technology to enable peer-to-peer transactions without intermediaries. They are connected through the growing integration of tokenized stocks and digital assets, which allow traditional securities to be represented and traded on decentralized platforms. This convergence is driving innovation in liquidity provision, regulatory frameworks, and cross-market arbitrage opportunities within the evolving financial ecosystem.

Key Terms

Traditional Stock Exchanges:

Traditional stock exchanges like the New York Stock Exchange and NASDAQ operate as centralized platforms where securities are traded through authorized brokers under strict regulatory oversight, ensuring transparency and investor protection. These exchanges offer high liquidity, well-established market infrastructure, and real-time price discovery, which fosters confidence among institutional and retail investors. Explore key advantages and operational details of traditional stock exchanges to understand their role in global financial markets.

Centralized Clearinghouse

Traditional stock exchanges rely on a centralized clearinghouse to facilitate trade settlement, ensuring transaction accuracy, risk management, and regulatory compliance. This centralized entity acts as an intermediary, mitigating counterparty risk by guaranteeing the fulfillment of trade obligations, which enhances market stability. Explore the differences in clearing mechanisms between traditional centralized exchanges and decentralized platforms to understand their impact on liquidity and security.

Broker

Traditional stock exchanges rely heavily on brokers to facilitate trades, acting as intermediaries who manage order execution, compliance, and client relationships. Decentralized exchanges (DEXs) eliminate the need for brokers by enabling peer-to-peer trading through smart contracts on blockchain networks, increasing transparency and reducing fees. Explore the key differences in broker roles and operational benefits between traditional and decentralized exchanges to understand their impact on market accessibility.

Source and External Links

A Breakdown of the Eight U.S. Stock Exchanges - Traders Magazine - Traditional stock exchanges like the New York Stock Exchange (NYSE) and the American Stock Exchange (AMEX) historically listed large national companies, while regional exchanges supported smaller local firms; regional exchanges have consolidated due to competition and declining profitability, with some like the Midwest Stock Exchange and Cincinnati Stock Exchange continuing with modified operations.

Understanding the Different Stock Exchanges | SoFi - Traditional U.S. exchanges include the NYSE and NYSE American (formerly AMEX), which historically attracted smaller and specialized listings, as well as regional historic exchanges like the Philadelphia Stock Exchange (now Nasdaq PHLX) and Boston Stock Exchange (now Nasdaq BX).

Stock exchange - Wikipedia - Traditional stock exchanges remain central to global finance, with the largest by market capitalization including the NYSE, Nasdaq, Shanghai, and Tokyo Stock Exchanges; these exchanges started as physical trading floors but have largely shifted to electronic systems while still handling equities, bonds, and futures contracts.

dowidth.com

dowidth.com