Degen boxes offer high-risk, high-reward opportunities by aggregating volatile crypto assets into simplified investment packages, appealing to aggressive traders seeking rapid gains. Structured products provide tailored financial instruments combining derivatives and traditional assets to balance risk and return, ideal for investors seeking customized exposure and capital protection. Explore the differences between degen boxes and structured products to determine which fits your investment strategy best.

Why it is important

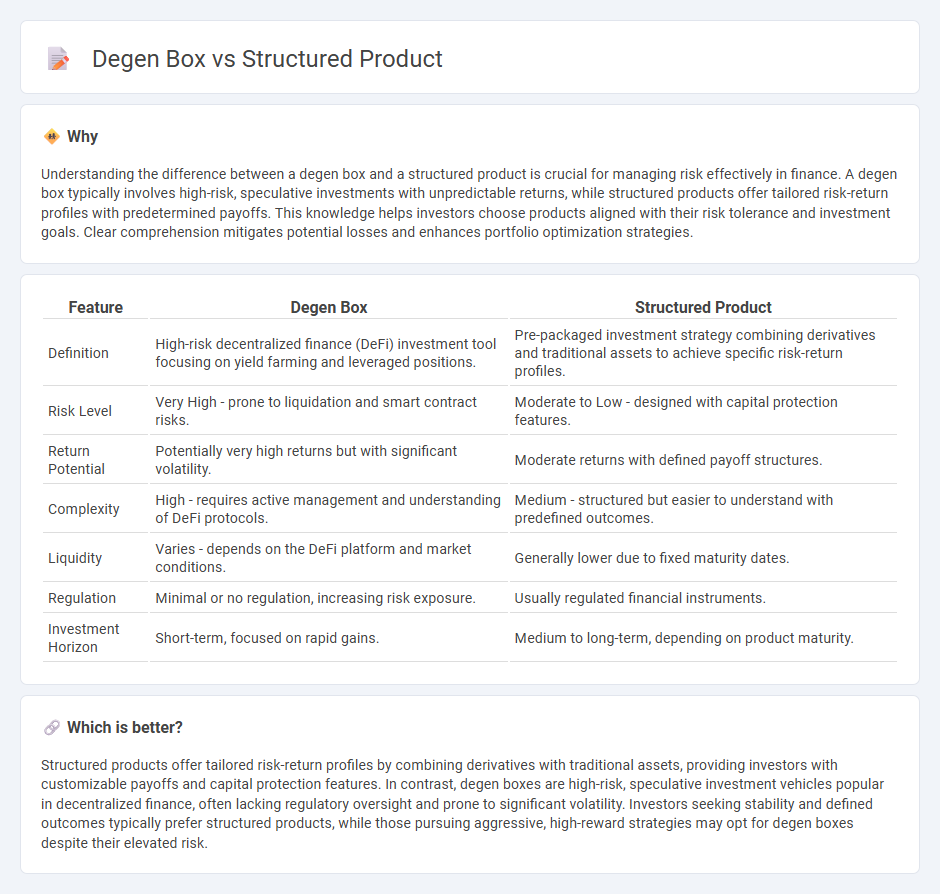

Understanding the difference between a degen box and a structured product is crucial for managing risk effectively in finance. A degen box typically involves high-risk, speculative investments with unpredictable returns, while structured products offer tailored risk-return profiles with predetermined payoffs. This knowledge helps investors choose products aligned with their risk tolerance and investment goals. Clear comprehension mitigates potential losses and enhances portfolio optimization strategies.

Comparison Table

| Feature | Degen Box | Structured Product |

|---|---|---|

| Definition | High-risk decentralized finance (DeFi) investment tool focusing on yield farming and leveraged positions. | Pre-packaged investment strategy combining derivatives and traditional assets to achieve specific risk-return profiles. |

| Risk Level | Very High - prone to liquidation and smart contract risks. | Moderate to Low - designed with capital protection features. |

| Return Potential | Potentially very high returns but with significant volatility. | Moderate returns with defined payoff structures. |

| Complexity | High - requires active management and understanding of DeFi protocols. | Medium - structured but easier to understand with predefined outcomes. |

| Liquidity | Varies - depends on the DeFi platform and market conditions. | Generally lower due to fixed maturity dates. |

| Regulation | Minimal or no regulation, increasing risk exposure. | Usually regulated financial instruments. |

| Investment Horizon | Short-term, focused on rapid gains. | Medium to long-term, depending on product maturity. |

Which is better?

Structured products offer tailored risk-return profiles by combining derivatives with traditional assets, providing investors with customizable payoffs and capital protection features. In contrast, degen boxes are high-risk, speculative investment vehicles popular in decentralized finance, often lacking regulatory oversight and prone to significant volatility. Investors seeking stability and defined outcomes typically prefer structured products, while those pursuing aggressive, high-reward strategies may opt for degen boxes despite their elevated risk.

Connection

Degen boxes and structured products are connected through their roles in high-risk investment strategies aiming for enhanced returns. Degen boxes often involve speculative, high-leverage trades, while structured products combine traditional assets with derivatives to tailor risk and return profiles. Investors use both tools to exploit market volatility and create customized exposure within the finance sector.

Key Terms

Risk-return profile

Structured products offer tailored risk-return profiles with predefined payoffs, often providing capital protection paired with market-linked returns, making them suitable for conservative to moderate investors. Degen boxes, by contrast, typically exhibit high-risk, high-reward dynamics due to their speculative nature and lack of guarantee on principal, appealing to traders seeking significant profit potential with elevated volatility. Explore detailed comparisons to understand which aligns best with your investment strategy and risk tolerance.

Leverage

Structured products offer controlled leverage with defined risk parameters, allowing investors to tailor exposure to market movements while managing potential losses. In contrast, degen boxes typically provide high leverage with minimal risk controls, leading to amplified gains or losses and increased volatility. Explore detailed comparisons to understand which leverage strategy aligns with your investment goals.

Yield

Structured products deliver predictable yield by combining fixed-income securities with derivatives to optimize risk-adjusted returns, typically favored by conservative investors seeking capital protection. In contrast, degen boxes offer high-risk, high-reward yield opportunities through exposure to volatile tokens and leveraged positions, attracting speculative traders aiming for aggressive gains. Explore more to discover which yield strategy aligns with your investment goals.

Source and External Links

What is a Structured Product? - Societe Generale Private Banking - A structured product is a financial instrument composed of at least two financial assets (shares, bonds, options) designed by banks to provide returns based on predetermined market scenarios, often used for portfolio diversification and tailored risk/return profiles.

Understanding Structured Products - Structured products are investment products whose return depends on an underlying asset with features like maturity and capital protection, combining components such as bonds and underlying assets to provide customized solutions in various market conditions.

Structured product - Wikipedia - A structured product, or market-linked investment, is a pre-packaged investment strategy based on securities or derivatives with cash flows contingent on indices or underlying assets, available in various categories such as equity-linked notes or credit-linked notes.

dowidth.com

dowidth.com