Risk parity portfolios allocate risk evenly across asset classes to achieve balanced diversification, reducing dependency on any single asset's performance. The Capital Market Line (CML) portfolio combines the risk-free asset with the market portfolio to optimize returns for a given level of risk through efficient frontier theory. Explore how these strategies differ in risk management and return optimization to enhance portfolio performance.

Why it is important

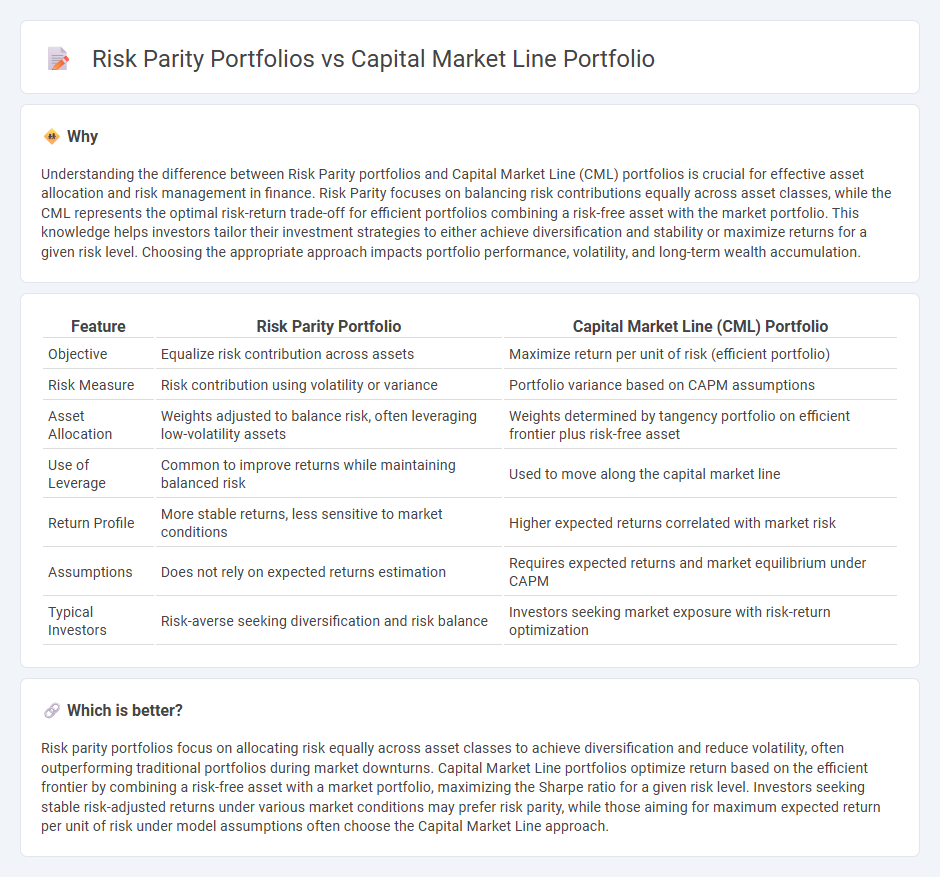

Understanding the difference between Risk Parity portfolios and Capital Market Line (CML) portfolios is crucial for effective asset allocation and risk management in finance. Risk Parity focuses on balancing risk contributions equally across asset classes, while the CML represents the optimal risk-return trade-off for efficient portfolios combining a risk-free asset with the market portfolio. This knowledge helps investors tailor their investment strategies to either achieve diversification and stability or maximize returns for a given risk level. Choosing the appropriate approach impacts portfolio performance, volatility, and long-term wealth accumulation.

Comparison Table

| Feature | Risk Parity Portfolio | Capital Market Line (CML) Portfolio |

|---|---|---|

| Objective | Equalize risk contribution across assets | Maximize return per unit of risk (efficient portfolio) |

| Risk Measure | Risk contribution using volatility or variance | Portfolio variance based on CAPM assumptions |

| Asset Allocation | Weights adjusted to balance risk, often leveraging low-volatility assets | Weights determined by tangency portfolio on efficient frontier plus risk-free asset |

| Use of Leverage | Common to improve returns while maintaining balanced risk | Used to move along the capital market line |

| Return Profile | More stable returns, less sensitive to market conditions | Higher expected returns correlated with market risk |

| Assumptions | Does not rely on expected returns estimation | Requires expected returns and market equilibrium under CAPM |

| Typical Investors | Risk-averse seeking diversification and risk balance | Investors seeking market exposure with risk-return optimization |

Which is better?

Risk parity portfolios focus on allocating risk equally across asset classes to achieve diversification and reduce volatility, often outperforming traditional portfolios during market downturns. Capital Market Line portfolios optimize return based on the efficient frontier by combining a risk-free asset with a market portfolio, maximizing the Sharpe ratio for a given risk level. Investors seeking stable risk-adjusted returns under various market conditions may prefer risk parity, while those aiming for maximum expected return per unit of risk under model assumptions often choose the Capital Market Line approach.

Connection

Risk parity portfolios and Capital Market Line (CML) portfolios both aim to optimize risk-adjusted returns by balancing asset allocations, but they differ in approach. While the CML portfolio represents the optimal combination of the risk-free asset and the market portfolio on the efficient frontier, risk parity portfolios allocate capital to achieve equal risk contributions across assets regardless of expected returns. These methodologies connect through their focus on diversification and efficient risk distribution to maximize portfolio Sharpe ratios under varying market conditions.

Key Terms

Expected Return

The Capital Market Line (CML) portfolio optimizes expected return by combining the risk-free asset with the market portfolio, maximizing the Sharpe ratio through efficient diversification. Risk parity portfolios allocate capital based on risk contribution from each asset, aiming for balanced risk exposure rather than maximizing expected return alone. Explore the differences in expected return strategies and risk management to deepen your investment approach understanding.

Risk (Standard Deviation / Volatility)

Capital Market Line (CML) portfolios optimize returns per unit of risk, typically measured by standard deviation, focusing on the efficient frontier with a mix of the risk-free asset and the market portfolio. Risk parity portfolios distribute risk equally across asset classes to achieve balanced volatility contributions, often resulting in lower overall portfolio volatility compared to traditional CML approaches. Explore detailed comparisons and risk management strategies to understand the advantages of each portfolio construction method.

Asset Allocation

Capital market line portfolios optimize asset allocation by balancing risk and return along the efficient frontier, typically emphasizing a mix of risky assets and a risk-free asset to maximize the Sharpe ratio. Risk parity portfolios prioritize equal risk contribution from each asset class, diversifying exposure to reduce portfolio volatility regardless of the asset's expected return. Explore detailed asset allocation strategies to understand the trade-offs and benefits of each approach.

Source and External Links

Capital Allocation Line (CAL) and Optimal Portfolio - Financial Edge - The Capital Market Line (CML) is a specific Capital Allocation Line representing the risk-return trade-off using the market portfolio plus a risk-free asset, where its slope is the Sharpe ratio of the market portfolio, showing optimal risk-return combinations for investors.

Capital Market & Allocation Lines | CFA Level 1 - AnalystPrep - The Capital Market Line (CML) is the tangent line from the risk-free asset to the market portfolio on the efficient frontier, representing optimal portfolios formed by combining the risk-free asset and the market portfolio along efficient risk-return trade-offs.

Capital market line - Wikipedia - The CML is the tangent line from the risk-free asset to the market portfolio on the feasible set of risky assets, representing combinations of the risk-free asset and the market portfolio that offer superior risk-return profiles, with the formula \(R_f + \sigma_p \times \frac{E(R_M) - R_f}{\sigma_M}\).

dowidth.com

dowidth.com