Private credit offers direct lending opportunities with potentially higher yields and more flexible terms than traditional corporate bonds, which are debt securities issued by companies to raise capital. While corporate bonds provide liquidity and standardized risk profiles through public markets, private credit involves negotiated agreements often suited for mid-market companies seeking tailored financing solutions. Discover more about the differences between private credit and corporate bonds to optimize your investment strategy.

Why it is important

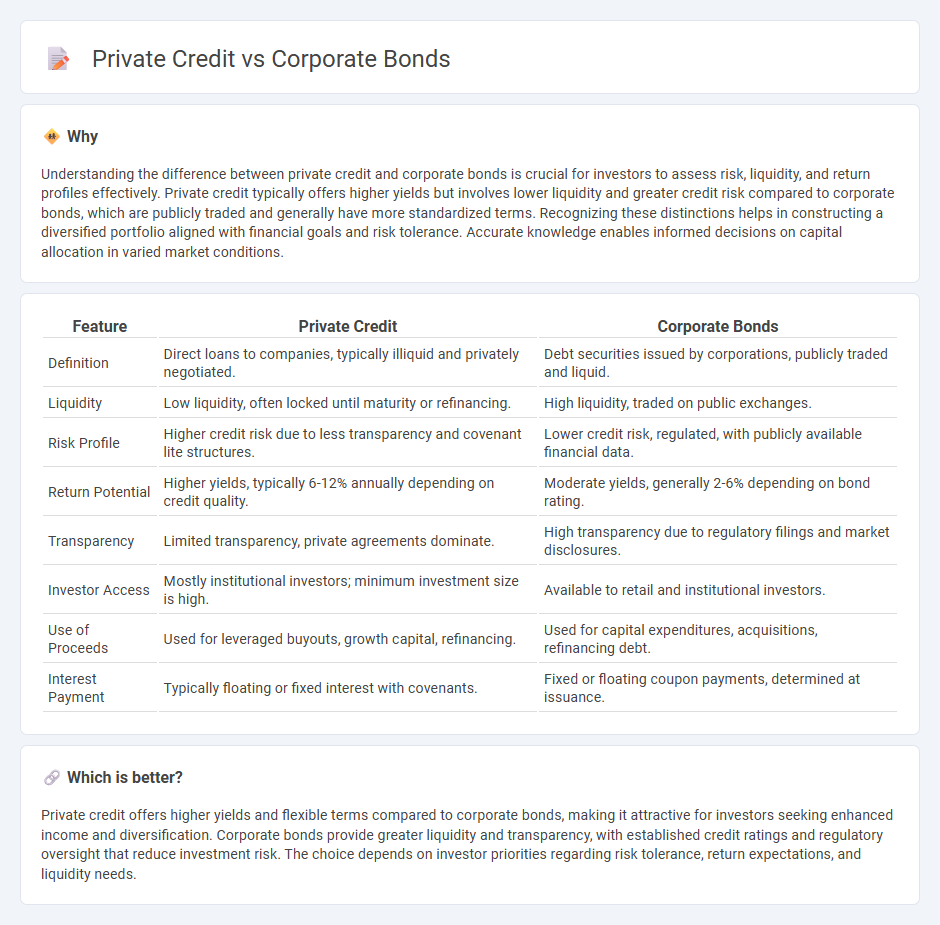

Understanding the difference between private credit and corporate bonds is crucial for investors to assess risk, liquidity, and return profiles effectively. Private credit typically offers higher yields but involves lower liquidity and greater credit risk compared to corporate bonds, which are publicly traded and generally have more standardized terms. Recognizing these distinctions helps in constructing a diversified portfolio aligned with financial goals and risk tolerance. Accurate knowledge enables informed decisions on capital allocation in varied market conditions.

Comparison Table

| Feature | Private Credit | Corporate Bonds |

|---|---|---|

| Definition | Direct loans to companies, typically illiquid and privately negotiated. | Debt securities issued by corporations, publicly traded and liquid. |

| Liquidity | Low liquidity, often locked until maturity or refinancing. | High liquidity, traded on public exchanges. |

| Risk Profile | Higher credit risk due to less transparency and covenant lite structures. | Lower credit risk, regulated, with publicly available financial data. |

| Return Potential | Higher yields, typically 6-12% annually depending on credit quality. | Moderate yields, generally 2-6% depending on bond rating. |

| Transparency | Limited transparency, private agreements dominate. | High transparency due to regulatory filings and market disclosures. |

| Investor Access | Mostly institutional investors; minimum investment size is high. | Available to retail and institutional investors. |

| Use of Proceeds | Used for leveraged buyouts, growth capital, refinancing. | Used for capital expenditures, acquisitions, refinancing debt. |

| Interest Payment | Typically floating or fixed interest with covenants. | Fixed or floating coupon payments, determined at issuance. |

Which is better?

Private credit offers higher yields and flexible terms compared to corporate bonds, making it attractive for investors seeking enhanced income and diversification. Corporate bonds provide greater liquidity and transparency, with established credit ratings and regulatory oversight that reduce investment risk. The choice depends on investor priorities regarding risk tolerance, return expectations, and liquidity needs.

Connection

Private credit and corporate bonds are connected as complementary sources of debt financing for businesses, with private credit typically involving direct loans from non-bank lenders and corporate bonds representing tradable debt securities issued in public markets. Both instruments serve to meet varied capital structure needs depending on factors like company size, credit rating, and investor preferences. The interplay between these financing options influences corporate leverage, liquidity management, and overall credit market dynamics.

Key Terms

Issuance Market (Public vs. Private)

Corporate bonds are issued through public markets, allowing companies to raise capital by selling debt securities to a broad range of investors with transparent pricing and regulatory oversight. Private credit involves direct lending arrangements between borrowers and institutional lenders or private funds in a private market, offering more flexible terms but less liquidity and disclosure. Explore further to understand how issuance structures impact risk and investment strategies.

Credit Risk Evaluation

Corporate bonds offer transparent credit risk evaluation due to regulatory disclosures and public financial data, allowing investors to assess issuer default risk with standardized metrics like credit ratings and yield spreads. Private credit involves direct lending to companies with less regulatory oversight, requiring more rigorous due diligence and bespoke credit risk assessment models to evaluate borrower-specific financial health and covenant structures. Explore detailed methodologies and risk factors in credit risk evaluation for corporate bonds and private credit to optimize your investment strategy.

Liquidity

Corporate bonds offer higher liquidity with active secondary markets enabling quick buy or sell transactions. Private credit typically involves less liquidity due to limited secondary trading and longer lock-up periods for investors. Explore detailed comparisons on liquidity profiles to determine the best fit for your investment strategy.

Source and External Links

Corporate Bonds - Fidelity - Corporate bonds are debt obligations issued by corporations to fund capital improvements, expansions, or acquisitions; they typically pay fixed-rate coupons and are classified as investment grade or high yield based on credit risk assessments by rating agencies.

Corporate Bonds - Investor.gov - Corporate bonds are debt obligations where investors lend money to companies and receive periodic interest payments plus principal repayment at maturity, with bondholders having priority over shareholders in financial distress.

Corporate Bond - Wikipedia - Corporate bonds are issued by corporations to raise financing for operations or expansions, traded mainly over-the-counter, and divided into High Grade (investment grade) and High Yield (speculative) categories depending on credit ratings.

dowidth.com

dowidth.com