Tokenization in finance involves converting real-world assets into digital tokens on a blockchain, enhancing liquidity and enabling fractional ownership. Mutual funds pool investor money to diversify across a portfolio of securities managed by professionals, offering accessibility and risk mitigation. Explore the benefits and differences between tokenization and mutual funds to optimize your investment strategy.

Why it is important

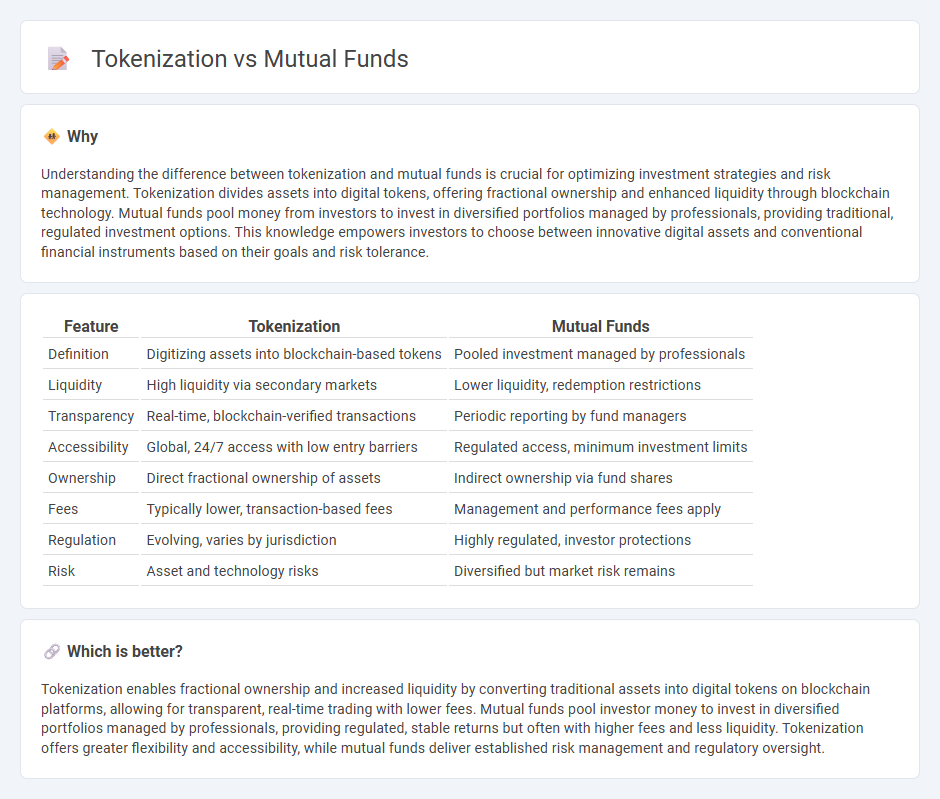

Understanding the difference between tokenization and mutual funds is crucial for optimizing investment strategies and risk management. Tokenization divides assets into digital tokens, offering fractional ownership and enhanced liquidity through blockchain technology. Mutual funds pool money from investors to invest in diversified portfolios managed by professionals, providing traditional, regulated investment options. This knowledge empowers investors to choose between innovative digital assets and conventional financial instruments based on their goals and risk tolerance.

Comparison Table

| Feature | Tokenization | Mutual Funds |

|---|---|---|

| Definition | Digitizing assets into blockchain-based tokens | Pooled investment managed by professionals |

| Liquidity | High liquidity via secondary markets | Lower liquidity, redemption restrictions |

| Transparency | Real-time, blockchain-verified transactions | Periodic reporting by fund managers |

| Accessibility | Global, 24/7 access with low entry barriers | Regulated access, minimum investment limits |

| Ownership | Direct fractional ownership of assets | Indirect ownership via fund shares |

| Fees | Typically lower, transaction-based fees | Management and performance fees apply |

| Regulation | Evolving, varies by jurisdiction | Highly regulated, investor protections |

| Risk | Asset and technology risks | Diversified but market risk remains |

Which is better?

Tokenization enables fractional ownership and increased liquidity by converting traditional assets into digital tokens on blockchain platforms, allowing for transparent, real-time trading with lower fees. Mutual funds pool investor money to invest in diversified portfolios managed by professionals, providing regulated, stable returns but often with higher fees and less liquidity. Tokenization offers greater flexibility and accessibility, while mutual funds deliver established risk management and regulatory oversight.

Connection

Tokenization transforms traditional mutual fund assets into digital tokens on blockchain platforms, enhancing liquidity and enabling fractional ownership for investors. Mutual funds benefit from tokenization by increasing transparency, reducing settlement times, and lowering transaction costs through automated smart contracts. This integration facilitates broader market access and streamlines regulatory compliance in the finance sector.

Key Terms

Liquidity

Mutual funds typically offer liquidity through daily redemption at the net asset value, allowing investors to buy or sell shares with relative ease during market hours. Tokenization leverages blockchain technology to enable 24/7 trading and fractional ownership, potentially increasing liquidity by opening access to a broader range of investors. Discover more about how liquidity dynamics differ between these investment methods and the implications for your portfolio.

Ownership

Mutual funds provide fractional ownership of a diversified portfolio managed by professionals, with shares representing investors' proportional stakes. Tokenization enables digital representation of assets, offering transparent, fractional ownership on blockchain, enhancing liquidity and transferability compared to traditional mutual fund shares. Explore how tokenization is reshaping ownership models and investment accessibility.

Regulation

Mutual funds operate under stringent regulatory frameworks such as the Investment Company Act of 1940, ensuring investor protection and transparency through oversight by entities like the SEC. Tokenization leverages blockchain technology, introducing new regulatory challenges and evolving frameworks focused on digital asset compliance, anti-money laundering (AML), and securities laws enforcement. Explore the regulatory differences and implications to understand how each investment approach aligns with your risk and compliance preferences.

Source and External Links

Mutual Funds | Investor.gov - Mutual funds are SEC-registered investment companies pooling money from many investors to invest in stocks, bonds, or other assets, managed by professionals, offering diversification, liquidity, and low minimum investments.

Mutual fund - Wikipedia - Mutual funds pool money from investors to buy securities and are classified by investment types; they offer professional management, diversification, and liquidity, with open-end funds redeemable at net asset value (NAV).

Understanding mutual funds - Charles Schwab - Mutual funds let investors pool money to buy stocks and bonds managed by professionals, providing diversification, low costs due to large transactions, and convenient access to many fund types.

dowidth.com

dowidth.com