Structured credit products aggregate various debt instruments to create diversified portfolios that offer tailored risk and return profiles, often including tranches with varying credit qualities. Corporate bonds represent straightforward debt securities issued by companies, providing investors with fixed income based on the issuer's creditworthiness. Explore the detailed nuances of structured credit and corporate bonds to optimize your investment strategy.

Why it is important

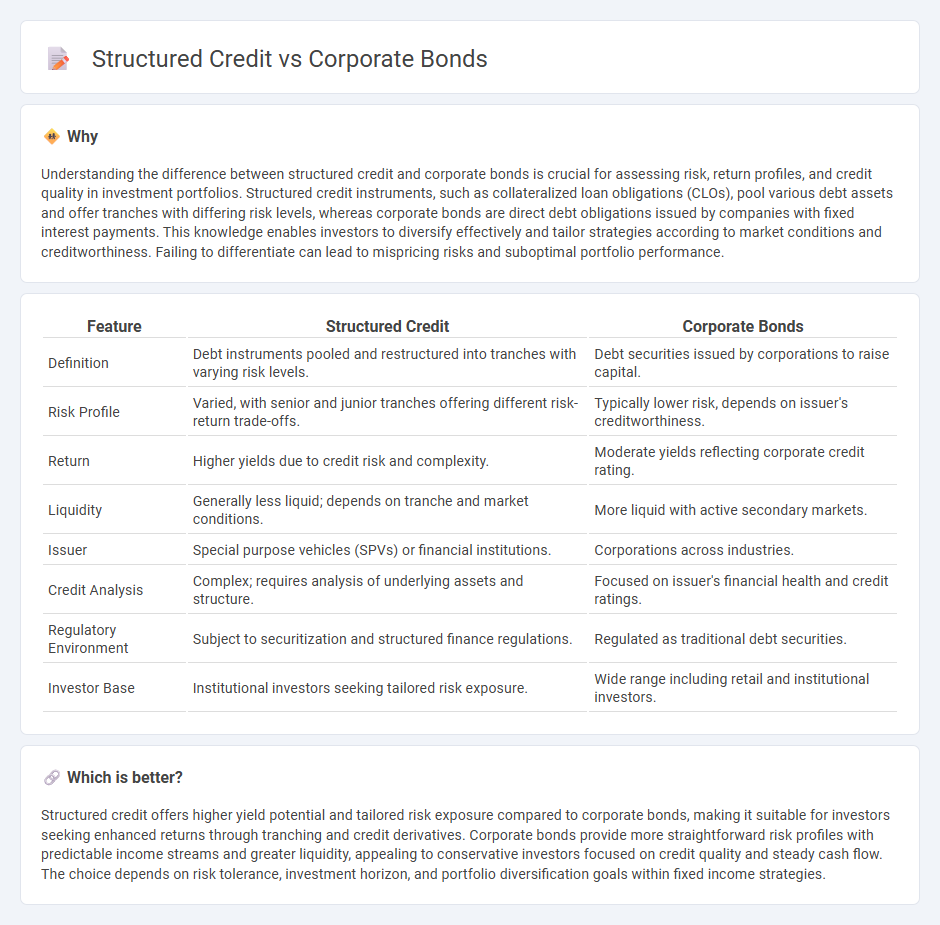

Understanding the difference between structured credit and corporate bonds is crucial for assessing risk, return profiles, and credit quality in investment portfolios. Structured credit instruments, such as collateralized loan obligations (CLOs), pool various debt assets and offer tranches with differing risk levels, whereas corporate bonds are direct debt obligations issued by companies with fixed interest payments. This knowledge enables investors to diversify effectively and tailor strategies according to market conditions and creditworthiness. Failing to differentiate can lead to mispricing risks and suboptimal portfolio performance.

Comparison Table

| Feature | Structured Credit | Corporate Bonds |

|---|---|---|

| Definition | Debt instruments pooled and restructured into tranches with varying risk levels. | Debt securities issued by corporations to raise capital. |

| Risk Profile | Varied, with senior and junior tranches offering different risk-return trade-offs. | Typically lower risk, depends on issuer's creditworthiness. |

| Return | Higher yields due to credit risk and complexity. | Moderate yields reflecting corporate credit rating. |

| Liquidity | Generally less liquid; depends on tranche and market conditions. | More liquid with active secondary markets. |

| Issuer | Special purpose vehicles (SPVs) or financial institutions. | Corporations across industries. |

| Credit Analysis | Complex; requires analysis of underlying assets and structure. | Focused on issuer's financial health and credit ratings. |

| Regulatory Environment | Subject to securitization and structured finance regulations. | Regulated as traditional debt securities. |

| Investor Base | Institutional investors seeking tailored risk exposure. | Wide range including retail and institutional investors. |

Which is better?

Structured credit offers higher yield potential and tailored risk exposure compared to corporate bonds, making it suitable for investors seeking enhanced returns through tranching and credit derivatives. Corporate bonds provide more straightforward risk profiles with predictable income streams and greater liquidity, appealing to conservative investors focused on credit quality and steady cash flow. The choice depends on risk tolerance, investment horizon, and portfolio diversification goals within fixed income strategies.

Connection

Structured credit instruments often incorporate corporate bonds as underlying assets, pooling these bonds into collateralized debt obligations (CDOs) or collateralized loan obligations (CLOs) to distribute credit risk among investors. Corporate bonds provide the cash flow streams that structured credit products repackage, enabling risk diversification and tailored investment strategies. The performance of structured credit depends largely on the credit quality and default rates of the underlying corporate bonds.

Key Terms

Credit risk

Corporate bonds primarily expose investors to credit risk stemming from the issuer's financial health and default probability. Structured credit products, such as collateralized loan obligations (CLOs), distribute credit risk across various tranches, offering different risk-return profiles based on underlying asset quality and tranche seniority. Explore deeper insights into credit risk management strategies and comparative performance metrics.

Tranching

Corporate bonds represent debt securities issued by corporations with fixed interest payments and seniority levels, typically straightforward in structure. Structured credit involves pooling various debt obligations, which are subsequently divided into tranches with varying risk and return profiles, allowing investors to select exposure based on credit risk tolerance. Explore the nuances of tranching in structured credit to understand how risk allocation impacts investment decisions.

Coupon rate

Corporate bonds typically offer fixed coupon rates based on the issuer's credit quality and market conditions, providing predictable income streams for investors. Structured credit products, such as collateralized loan obligations (CLOs), often feature variable or tiered coupon rates influenced by the performance of underlying assets, adding complexity and risk. Explore more about how coupon rates impact investment strategies in corporate bonds and structured credit portfolios.

Source and External Links

Understanding Corporate Bonds | PIMCO - Corporate bonds are debt instruments issued by companies to borrow money for expansion or new ventures, with investors lending money in return for interest payments and principal repayment, classified by maturity and credit quality into investment-grade and speculative-grade categories.

Corporate Bonds - Fidelity Investments - Corporate bonds are debt obligations issued by companies to fund various needs, offering fixed-rate coupons with semiannual payments and classified as investment grade or high yield based on credit ratings that affect risk and yield.

Bonds, Corporate | Investor.gov - Corporate bonds represent loans to companies, promising repayment of principal at maturity and usually paying interest semiannually, without granting ownership rights, unlike stocks.

dowidth.com

dowidth.com