Carbon trading enables businesses to buy and sell emission allowances, creating financial incentives to reduce greenhouse gas emissions while promoting sustainable practices. Climate risk insurance offers protection against losses caused by extreme weather events and climate-related damage, helping companies manage financial uncertainty and enhance resilience. Explore the key differences and benefits of carbon trading versus climate risk insurance to make informed decisions in your sustainability strategy.

Why it is important

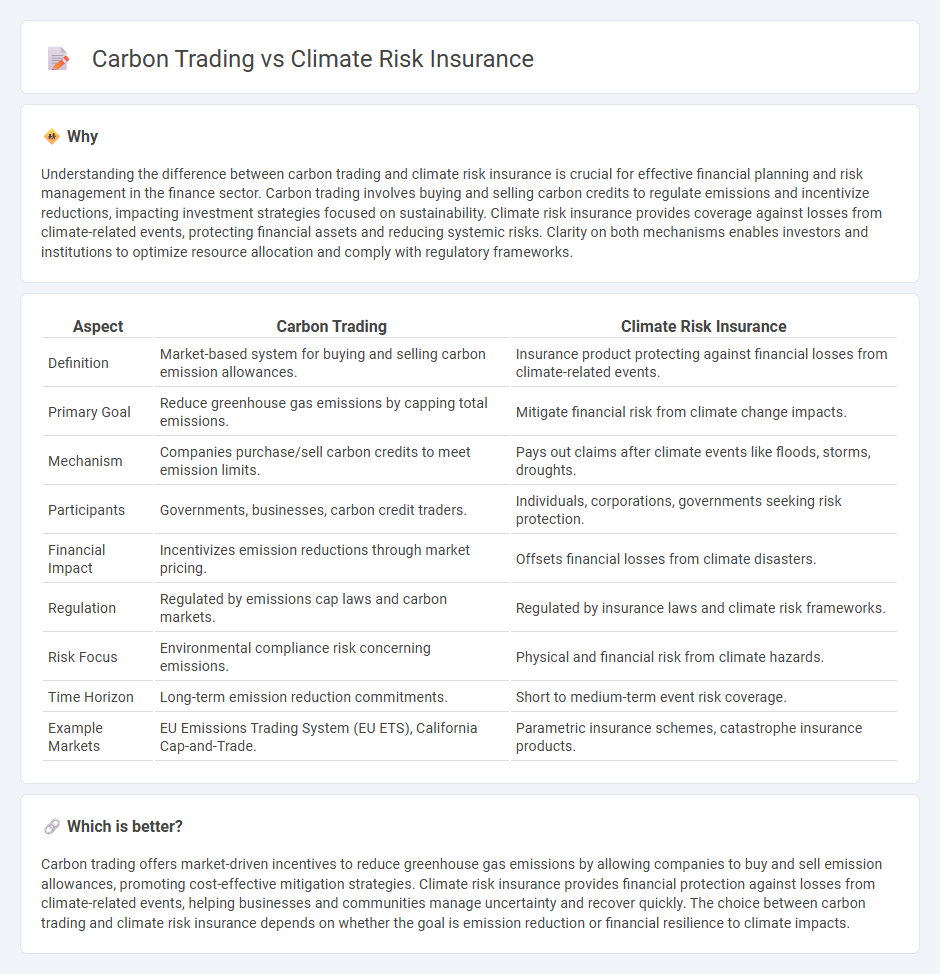

Understanding the difference between carbon trading and climate risk insurance is crucial for effective financial planning and risk management in the finance sector. Carbon trading involves buying and selling carbon credits to regulate emissions and incentivize reductions, impacting investment strategies focused on sustainability. Climate risk insurance provides coverage against losses from climate-related events, protecting financial assets and reducing systemic risks. Clarity on both mechanisms enables investors and institutions to optimize resource allocation and comply with regulatory frameworks.

Comparison Table

| Aspect | Carbon Trading | Climate Risk Insurance |

|---|---|---|

| Definition | Market-based system for buying and selling carbon emission allowances. | Insurance product protecting against financial losses from climate-related events. |

| Primary Goal | Reduce greenhouse gas emissions by capping total emissions. | Mitigate financial risk from climate change impacts. |

| Mechanism | Companies purchase/sell carbon credits to meet emission limits. | Pays out claims after climate events like floods, storms, droughts. |

| Participants | Governments, businesses, carbon credit traders. | Individuals, corporations, governments seeking risk protection. |

| Financial Impact | Incentivizes emission reductions through market pricing. | Offsets financial losses from climate disasters. |

| Regulation | Regulated by emissions cap laws and carbon markets. | Regulated by insurance laws and climate risk frameworks. |

| Risk Focus | Environmental compliance risk concerning emissions. | Physical and financial risk from climate hazards. |

| Time Horizon | Long-term emission reduction commitments. | Short to medium-term event risk coverage. |

| Example Markets | EU Emissions Trading System (EU ETS), California Cap-and-Trade. | Parametric insurance schemes, catastrophe insurance products. |

Which is better?

Carbon trading offers market-driven incentives to reduce greenhouse gas emissions by allowing companies to buy and sell emission allowances, promoting cost-effective mitigation strategies. Climate risk insurance provides financial protection against losses from climate-related events, helping businesses and communities manage uncertainty and recover quickly. The choice between carbon trading and climate risk insurance depends on whether the goal is emission reduction or financial resilience to climate impacts.

Connection

Carbon trading markets create financial incentives for reducing greenhouse gas emissions, significantly impacting corporate risk profiles by quantifying climate-related liabilities. Climate risk insurance offers financial protection against losses from climate-induced events, whose pricing increasingly factors in emissions data and regulatory compliance driven by carbon markets. Together, these mechanisms integrate environmental accountability into financial risk management, promoting sustainable investment and resilience in the face of climate change.

Key Terms

**Climate Risk Insurance:**

Climate risk insurance provides financial protection against losses caused by extreme weather events and climate-related disasters, addressing the immediate economic impacts on vulnerable communities. It helps to promote resilience by offering timely compensation, reducing recovery time, and supporting humanitarian aid efforts in the aftermath of climate shocks. Learn more about how climate risk insurance strengthens adaptation strategies and fosters sustainable development.

Premium

Climate risk insurance premiums vary based on geographic location, risk exposure, and policy coverage, often resulting in higher costs for regions prone to extreme weather events. Carbon trading premiums depend on market demand, regulatory policies, and the scarcity of carbon credits, influencing the price per ton of CO2 emissions traded. Explore more to understand how premium structures impact these climate finance tools' effectiveness.

Payout

Climate risk insurance offers direct financial payouts to policyholders affected by climate-related events like floods or droughts, providing immediate relief and recovery funds. In contrast, carbon trading involves the exchange of emission allowances or credits, which indirectly incentivizes emission reductions but does not result in direct monetary payouts to individuals. Explore the mechanisms and benefits of both approaches to understand their distinct roles in climate risk management.

Source and External Links

Climate risk insurance - Wikipedia - Climate risk insurance is designed to mitigate financial and other risks from climate change-related extreme weather, providing post-disaster liquidity and improving resilience, especially for vulnerable communities; however, it faces challenges like high costs for low-income countries and simultaneous large claims in disasters.

Understanding climate risk insurance - Climate risk insurance encompasses financial instruments that protect governments, institutions, and individuals from losses due to extreme weather events intensified by climate change, helping especially poor and vulnerable populations recover quickly.

Mitigating climate risk | Swiss Re - Climate risk insurance helps close the protection gap for natural catastrophe losses by offering financial solutions that enable recovery and adaptation; it complements efforts to achieve net-zero emissions and requires public-private partnerships to address the challenge effectively.

dowidth.com

dowidth.com