Degen Box offers high-risk, high-reward opportunities by enabling users to participate in leveraged trading and volatile asset speculation, attracting those seeking aggressive growth in decentralized finance. Dual Investment provides a more balanced approach, allowing investors to earn stable returns by committing assets to buy or sell at predetermined prices, reducing exposure to market fluctuations. Explore the detailed comparison to determine which strategy aligns best with your financial goals and risk tolerance.

Why it is important

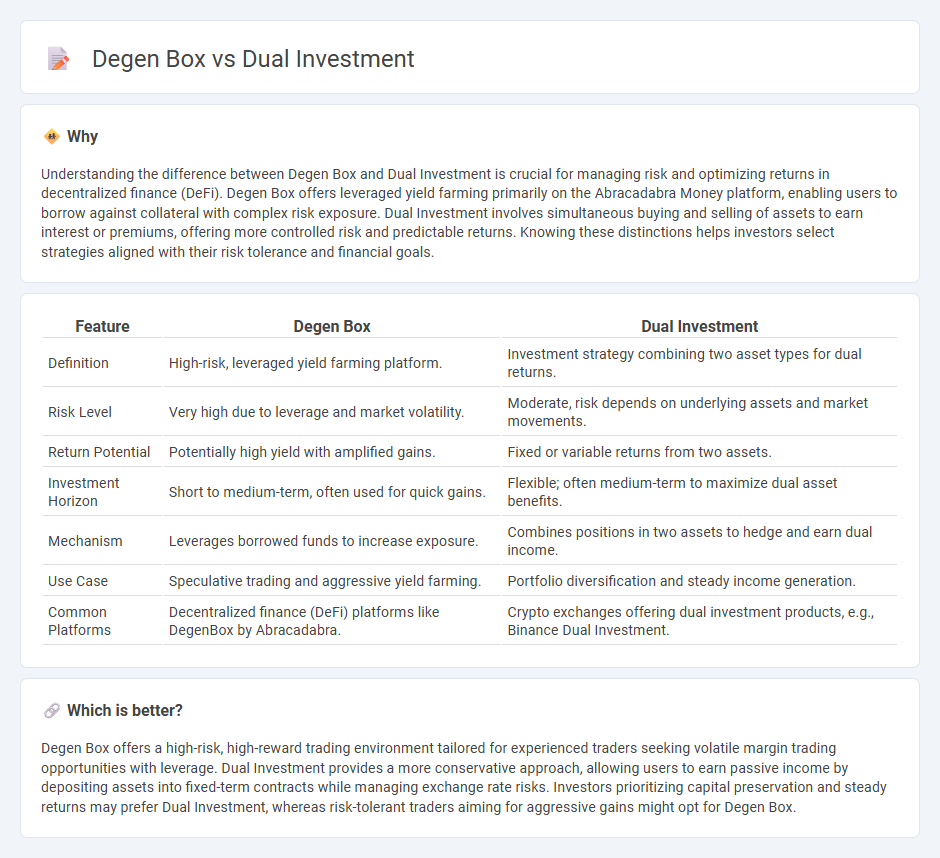

Understanding the difference between Degen Box and Dual Investment is crucial for managing risk and optimizing returns in decentralized finance (DeFi). Degen Box offers leveraged yield farming primarily on the Abracadabra Money platform, enabling users to borrow against collateral with complex risk exposure. Dual Investment involves simultaneous buying and selling of assets to earn interest or premiums, offering more controlled risk and predictable returns. Knowing these distinctions helps investors select strategies aligned with their risk tolerance and financial goals.

Comparison Table

| Feature | Degen Box | Dual Investment |

|---|---|---|

| Definition | High-risk, leveraged yield farming platform. | Investment strategy combining two asset types for dual returns. |

| Risk Level | Very high due to leverage and market volatility. | Moderate, risk depends on underlying assets and market movements. |

| Return Potential | Potentially high yield with amplified gains. | Fixed or variable returns from two assets. |

| Investment Horizon | Short to medium-term, often used for quick gains. | Flexible; often medium-term to maximize dual asset benefits. |

| Mechanism | Leverages borrowed funds to increase exposure. | Combines positions in two assets to hedge and earn dual income. |

| Use Case | Speculative trading and aggressive yield farming. | Portfolio diversification and steady income generation. |

| Common Platforms | Decentralized finance (DeFi) platforms like DegenBox by Abracadabra. | Crypto exchanges offering dual investment products, e.g., Binance Dual Investment. |

Which is better?

Degen Box offers a high-risk, high-reward trading environment tailored for experienced traders seeking volatile margin trading opportunities with leverage. Dual Investment provides a more conservative approach, allowing users to earn passive income by depositing assets into fixed-term contracts while managing exchange rate risks. Investors prioritizing capital preservation and steady returns may prefer Dual Investment, whereas risk-tolerant traders aiming for aggressive gains might opt for Degen Box.

Connection

Degen Box and Dual Investment are interconnected financial strategies leveraging high-risk, high-reward opportunities in decentralized finance (DeFi) platforms. Degen Box enables leveraged yield farming by allowing users to borrow assets and amplify exposure, while Dual Investment offers a way to earn returns by locking assets into two different cryptocurrencies, often with predetermined conditions. Both methods optimize capital efficiency and risk-reward management through smart contract protocols on blockchain networks.

Key Terms

Yield

Dual investment offers a structured yield strategy by allowing users to lock in profits in multiple assets with predefined conditions, optimizing returns based on market movements. In contrast, Degen Box typically involves higher-risk, high-reward yield farming in decentralized finance (DeFi), relying on volatile liquidity pools and leverage to maximize gains. Explore more about how these yield mechanisms can fit your investment portfolio and risk appetite.

Risk

Dual investment offers a structured risk profile by allowing investors to earn returns based on predefined conditions, minimizing exposure to volatile market swings. In contrast, degen boxes involve high risk due to their speculative nature and significant price volatility, often resulting in unpredictable outcomes. Explore the detailed risk factors of dual investment and degen box strategies to make informed decisions.

Structured Product

Dual investment offers a strategic approach to earning yield by locking assets into a structured product that balances risk and return, often involving stablecoins or crypto pairs. The Degen Box, while a form of structured product, typically emphasizes higher risk and leverage, catering to aggressive traders seeking amplified exposure. Explore the nuances and risk profiles of these structured products to enhance your investment strategy.

Source and External Links

Decoding Dual Investment: A New Approach in Crypto Trading - Dual Investment is a crypto product blending investment and trading strategies that allows users to buy or sell assets like BTC or ETH at a predetermined price and date, earning higher interest rates regardless of market volatility, without fees, and employing 'Buy Low' or 'Sell High' strategies for potential enhanced returns.

Binance Dual Investment Update: Earn Interest & Trade Smarter - Binance Dual Investment enables investors to set target prices for buying or selling cryptocurrency on a future settlement date, earning interest regardless of whether the target price is reached, with no trading fees on executed orders, making it an effective way to earn passive income by combining trading and interest generation.

Nexo Dual Investment | Generate Strong Returns - Nexo offers a Dual Investment product where users can subscribe to buy or sell major crypto pairs at a future date and price, earning interest on their assets until settlement, with flexible maturities, and the option to choose between buying low or selling high strategies, supported by dedicated advisory services and educational tools.

dowidth.com

dowidth.com