Nonfungible tokens fractionalization divides a unique digital asset into smaller, tradable shares, enabling broader ownership and liquidity in blockchain markets. Crowdfunding pools financial contributions from multiple investors to support projects or startups, typically offering rewards or equity stakes in return. Explore the nuances and benefits of these innovative financing methods to determine which suits your investment strategy best.

Why it is important

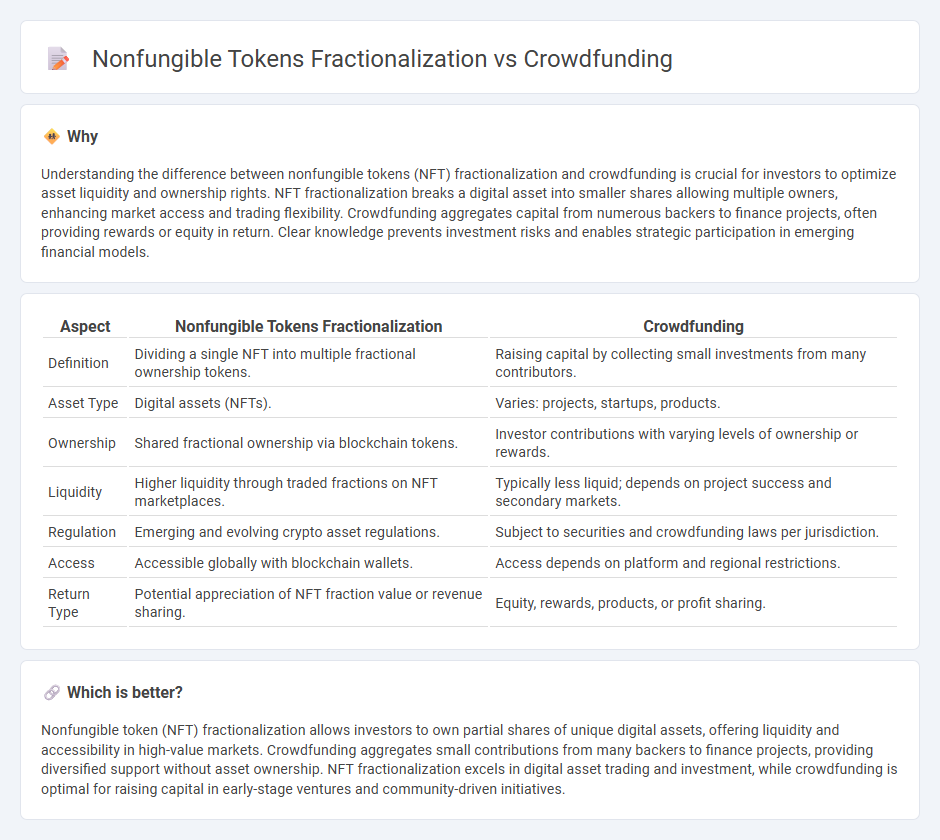

Understanding the difference between nonfungible tokens (NFT) fractionalization and crowdfunding is crucial for investors to optimize asset liquidity and ownership rights. NFT fractionalization breaks a digital asset into smaller shares allowing multiple owners, enhancing market access and trading flexibility. Crowdfunding aggregates capital from numerous backers to finance projects, often providing rewards or equity in return. Clear knowledge prevents investment risks and enables strategic participation in emerging financial models.

Comparison Table

| Aspect | Nonfungible Tokens Fractionalization | Crowdfunding |

|---|---|---|

| Definition | Dividing a single NFT into multiple fractional ownership tokens. | Raising capital by collecting small investments from many contributors. |

| Asset Type | Digital assets (NFTs). | Varies: projects, startups, products. |

| Ownership | Shared fractional ownership via blockchain tokens. | Investor contributions with varying levels of ownership or rewards. |

| Liquidity | Higher liquidity through traded fractions on NFT marketplaces. | Typically less liquid; depends on project success and secondary markets. |

| Regulation | Emerging and evolving crypto asset regulations. | Subject to securities and crowdfunding laws per jurisdiction. |

| Access | Accessible globally with blockchain wallets. | Access depends on platform and regional restrictions. |

| Return Type | Potential appreciation of NFT fraction value or revenue sharing. | Equity, rewards, products, or profit sharing. |

Which is better?

Nonfungible token (NFT) fractionalization allows investors to own partial shares of unique digital assets, offering liquidity and accessibility in high-value markets. Crowdfunding aggregates small contributions from many backers to finance projects, providing diversified support without asset ownership. NFT fractionalization excels in digital asset trading and investment, while crowdfunding is optimal for raising capital in early-stage ventures and community-driven initiatives.

Connection

Nonfungible tokens (NFTs) fractionalization enables the division of a single digital asset into multiple shares, allowing investors to collectively own and trade portions of high-value NFTs. This process mirrors crowdfunding principles by pooling resources from numerous participants to finance expensive digital assets or projects. Consequently, NFT fractionalization democratizes access to investment opportunities and enhances liquidity in the digital asset market.

Key Terms

Tokenization

Tokenization transforms ownership rights into digital tokens, enabling fractional access in both crowdfunding and nonfungible token (NFT) markets. Crowdfunding leverages tokenization to democratize investment opportunities, allowing multiple backers to own a share in projects, whereas NFT fractionalization breaks down unique digital assets into smaller, tradable fractions to increase liquidity. Explore the nuances of tokenization to better understand how it revolutionizes asset accessibility and investment models.

Ownership

Crowdfunding enables multiple investors to collectively fund a project, sharing ownership based on their contribution percentages, while nonfungible token (NFT) fractionalization divides a unique digital asset into smaller, tradable fractions, allowing multiple owners to hold partial stakes. NFT fractionalization offers enhanced liquidity and transferability compared to traditional crowdfunding equity shares, enabling easier market participation and asset management. Explore the nuances of ownership models in crowdfunding and NFT fractionalization to understand their implications for investors.

Liquidity

Crowdfunding provides liquidity by pooling small investments from multiple contributors to finance projects, while nonfungible tokens (NFTs) fractionalization enhances liquidity by enabling ownership of high-value digital assets to be divided into tradable fractions. NFT fractionalization leverages blockchain technology to facilitate transparent and instantaneous trading on decentralized marketplaces, surpassing traditional crowdfunding's liquidity limitations. Explore how fractionalized NFTs redefine asset liquidity and investment opportunities in digital economies.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding projects or ventures by raising money from many people, typically online, without traditional financial intermediaries, and was coined in 2006 to describe this Internet-based funding method.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding is a way to raise money through collective effort mainly online, involving individual investors ranging from friends to strangers, used often to finance startups and projects.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding uses online platforms to collect small amounts of money from many individuals and can be donation-based, rewards-based, or equity-based, with equity crowdfunding allowing investors part ownership in a company.

dowidth.com

dowidth.com