Decentralized finance (DeFi) leverages blockchain technology to enable peer-to-peer financial transactions without intermediaries, offering transparency and accessibility. Traditional asset management relies on centralized institutions to manage investments and portfolios on behalf of clients, emphasizing regulatory compliance and risk management. Explore the benefits and challenges of both systems to understand their impact on the future of finance.

Why it is important

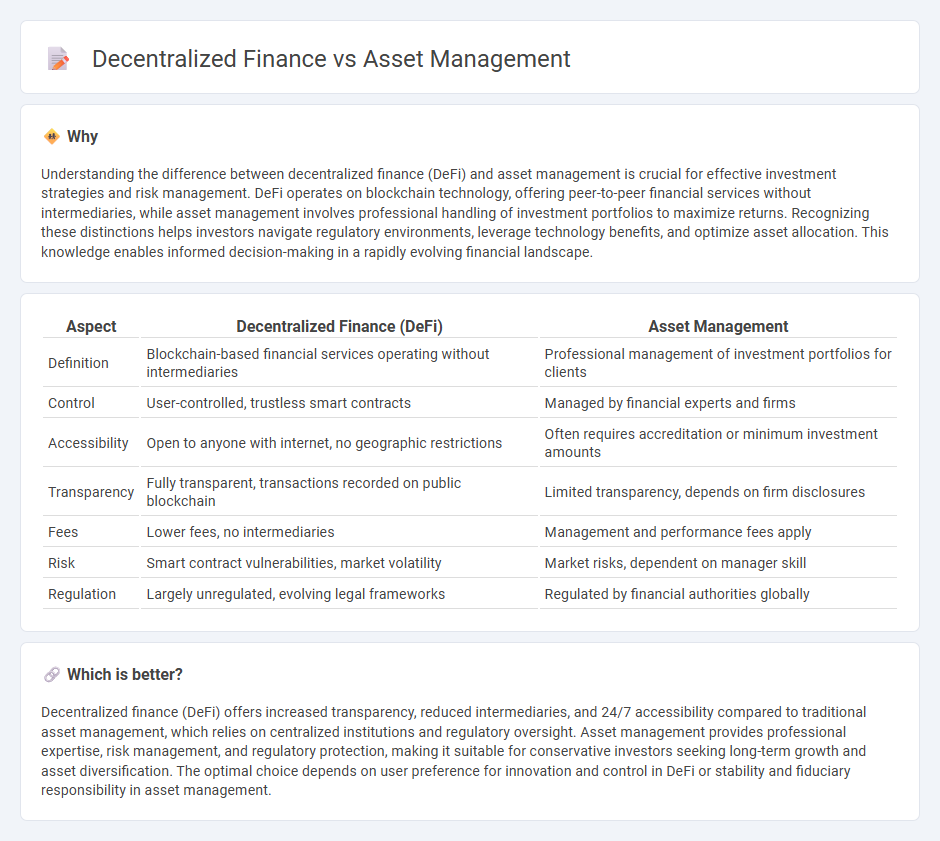

Understanding the difference between decentralized finance (DeFi) and asset management is crucial for effective investment strategies and risk management. DeFi operates on blockchain technology, offering peer-to-peer financial services without intermediaries, while asset management involves professional handling of investment portfolios to maximize returns. Recognizing these distinctions helps investors navigate regulatory environments, leverage technology benefits, and optimize asset allocation. This knowledge enables informed decision-making in a rapidly evolving financial landscape.

Comparison Table

| Aspect | Decentralized Finance (DeFi) | Asset Management |

|---|---|---|

| Definition | Blockchain-based financial services operating without intermediaries | Professional management of investment portfolios for clients |

| Control | User-controlled, trustless smart contracts | Managed by financial experts and firms |

| Accessibility | Open to anyone with internet, no geographic restrictions | Often requires accreditation or minimum investment amounts |

| Transparency | Fully transparent, transactions recorded on public blockchain | Limited transparency, depends on firm disclosures |

| Fees | Lower fees, no intermediaries | Management and performance fees apply |

| Risk | Smart contract vulnerabilities, market volatility | Market risks, dependent on manager skill |

| Regulation | Largely unregulated, evolving legal frameworks | Regulated by financial authorities globally |

Which is better?

Decentralized finance (DeFi) offers increased transparency, reduced intermediaries, and 24/7 accessibility compared to traditional asset management, which relies on centralized institutions and regulatory oversight. Asset management provides professional expertise, risk management, and regulatory protection, making it suitable for conservative investors seeking long-term growth and asset diversification. The optimal choice depends on user preference for innovation and control in DeFi or stability and fiduciary responsibility in asset management.

Connection

Decentralized finance (DeFi) revolutionizes asset management by enabling direct peer-to-peer transactions and reducing reliance on traditional intermediaries, enhancing transparency and liquidity. Smart contracts automate portfolio rebalancing, asset allocation, and risk management, providing real-time updates and customizable strategies. The integration of blockchain technology ensures secure, immutable records, fostering trust and efficiency in managing digital and traditional assets.

Key Terms

Portfolio Diversification

Asset management traditionally emphasizes portfolio diversification through a variety of asset classes such as stocks, bonds, and real estate to minimize risk and optimize returns. Decentralized finance (DeFi) introduces innovative diversification options using digital assets, including cryptocurrencies, tokenized assets, and yield farming, offering increased access and liquidity. Explore how integrating both approaches can enhance portfolio diversification strategies for modern investors.

Smart Contracts

Asset management traditionally relies on centralized institutions to oversee portfolios, whereas decentralized finance (DeFi) utilizes blockchain-based smart contracts to automate and trustlessly execute asset transactions. Smart contracts eliminate intermediaries by enforcing pre-defined rules transparently and securely, enhancing efficiency and reducing counterparty risk. Explore how smart contracts revolutionize asset management within DeFi for innovative financial solutions.

Source and External Links

Asset Management Explained: Key Roles and Benefits - Asset management involves financial institutions managing money on behalf of clients such as institutions and pension funds, developing investment strategies, and acting as fiduciaries to create value through stocks, bonds, and other assets.

Asset management - Asset management is a systematic process of developing, operating, maintaining, and disposing of both tangible and intangible assets in a cost-effective manner, used in finance, engineering, and public sectors, with international standards like ISO 55000 guiding its practices.

Homepage | Brookfield Asset Management (BAM) - Brookfield Asset Management is a global alternative asset manager with over $1 trillion in assets under management across sectors like renewable power, infrastructure, private equity, and real estate, focused on long-term risk-adjusted returns for clients.

dowidth.com

dowidth.com