Payment for order flow involves brokers receiving compensation for routing client orders to specific market makers, enhancing execution speed but potentially raising conflicts of interest. Liquidity rebates reward traders who add liquidity to the market, incentivizing tighter spreads and improved market depth. Explore how these mechanisms impact trading costs and market efficiency to understand their roles in modern finance.

Why it is important

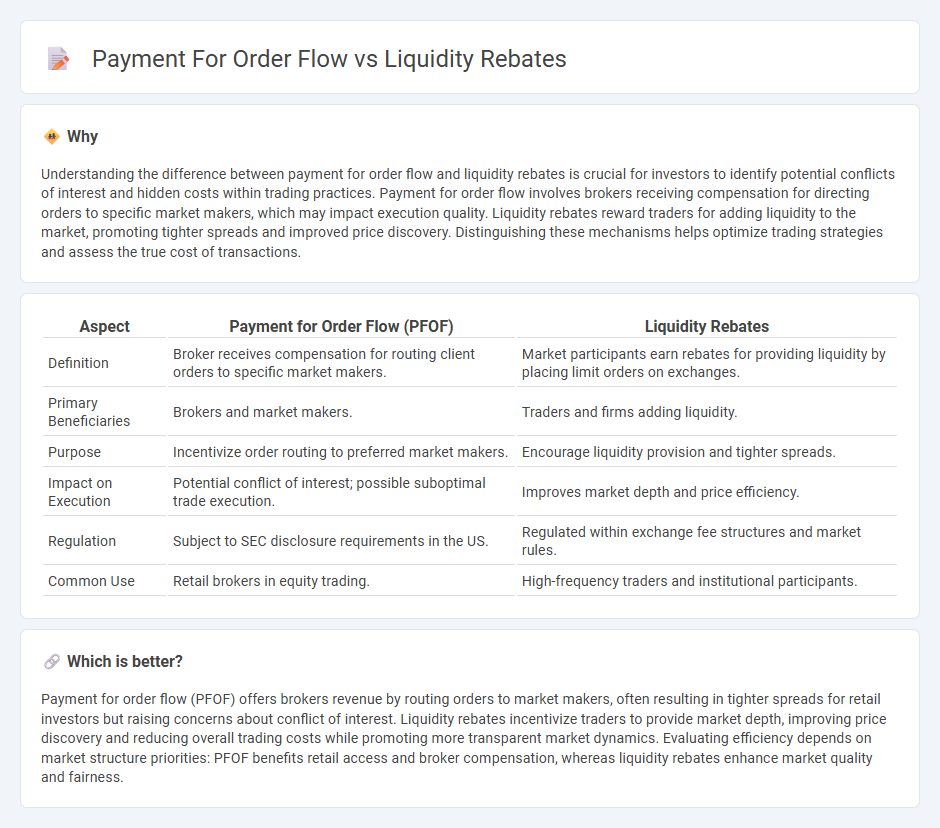

Understanding the difference between payment for order flow and liquidity rebates is crucial for investors to identify potential conflicts of interest and hidden costs within trading practices. Payment for order flow involves brokers receiving compensation for directing orders to specific market makers, which may impact execution quality. Liquidity rebates reward traders for adding liquidity to the market, promoting tighter spreads and improved price discovery. Distinguishing these mechanisms helps optimize trading strategies and assess the true cost of transactions.

Comparison Table

| Aspect | Payment for Order Flow (PFOF) | Liquidity Rebates |

|---|---|---|

| Definition | Broker receives compensation for routing client orders to specific market makers. | Market participants earn rebates for providing liquidity by placing limit orders on exchanges. |

| Primary Beneficiaries | Brokers and market makers. | Traders and firms adding liquidity. |

| Purpose | Incentivize order routing to preferred market makers. | Encourage liquidity provision and tighter spreads. |

| Impact on Execution | Potential conflict of interest; possible suboptimal trade execution. | Improves market depth and price efficiency. |

| Regulation | Subject to SEC disclosure requirements in the US. | Regulated within exchange fee structures and market rules. |

| Common Use | Retail brokers in equity trading. | High-frequency traders and institutional participants. |

Which is better?

Payment for order flow (PFOF) offers brokers revenue by routing orders to market makers, often resulting in tighter spreads for retail investors but raising concerns about conflict of interest. Liquidity rebates incentivize traders to provide market depth, improving price discovery and reducing overall trading costs while promoting more transparent market dynamics. Evaluating efficiency depends on market structure priorities: PFOF benefits retail access and broker compensation, whereas liquidity rebates enhance market quality and fairness.

Connection

Payment for order flow incentivizes brokers to route orders to specific market makers, enhancing their order flow volume and enabling them to offer liquidity rebates. These liquidity rebates improve market liquidity by rewarding market participants for adding depth to order books, creating a symbiotic relationship that lowers trading costs and optimizes market efficiency. Consequently, the combined effect of payment for order flow and liquidity rebates fosters a more competitive trading environment with tighter bid-ask spreads.

Key Terms

Market Makers

Market makers benefit from liquidity rebates as they earn incentives for adding liquidity to exchanges, which lowers their trading costs and enhances market efficiency. Payment for order flow (PFOF) involves market makers paying brokers to route retail orders to them, gaining access to order flow and profiting from the bid-ask spread. Explore the detailed impacts of liquidity rebates and PFOF on market maker strategies and market quality to understand their roles fully.

Bid-Ask Spread

Liquidity rebates reward market makers for providing tighter bid-ask spreads, enhancing market liquidity and reducing trading costs for investors. Payment for order flow involves brokers receiving compensation for routing trades to specific venues, which can widen bid-ask spreads and increase costs for retail traders. Explore how these mechanisms impact market efficiency and trading expenses in greater detail.

Order Routing

Liquidity rebates incentivize market makers and brokers to route orders to venues where they add liquidity, often resulting in narrower spreads and improved price discovery. Payment for order flow compensates brokers for directing orders to specific market makers or trading firms, which can create conflicts of interest and impact execution quality. Explore the differences in order routing strategies to better understand their impact on trade execution efficiency and costs.

Source and External Links

Subsidizing Liquidity: The Impact of Make/Take Fees on Market Quality - Liquidity rebates are payments made to liquidity providers (makers) that trade via limit order books, compensating them for offering liquidity and influencing market spreads and provider revenues.

Rebate Trading Strategy: What Is It and How to Maximize ECN Rebates - Liquidity rebates work by paying traders who offer liquidity on ECNs a fee per share traded, incentivizing them to place limit orders while those who remove liquidity pay a cost.

Why Exchange Rebate Tiers are Anti-Competitive | IEX - Exchange liquidity rebates often depend on volume tiers that can create anti-competitive effects by favoring large liquidity providers and limiting competition among market makers.

dowidth.com

dowidth.com