Revenue-based financing offers flexible capital repayment tied to a company's monthly revenue, minimizing dilution of ownership compared to angel investment, which involves equity stakes and active investor involvement. Startups seeking growth capital must weigh the predictable cash flow obligations of revenue-based financing against the strategic guidance and larger capital injections provided by angel investors. Explore how each funding option can align with your business goals and growth strategy.

Why it is important

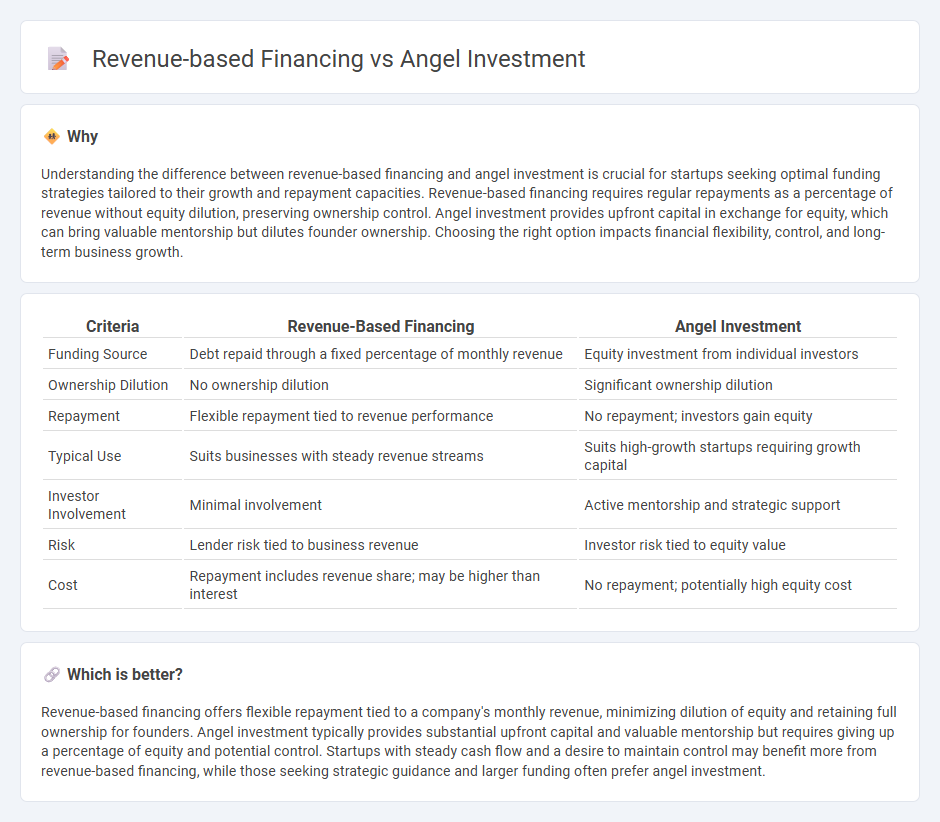

Understanding the difference between revenue-based financing and angel investment is crucial for startups seeking optimal funding strategies tailored to their growth and repayment capacities. Revenue-based financing requires regular repayments as a percentage of revenue without equity dilution, preserving ownership control. Angel investment provides upfront capital in exchange for equity, which can bring valuable mentorship but dilutes founder ownership. Choosing the right option impacts financial flexibility, control, and long-term business growth.

Comparison Table

| Criteria | Revenue-Based Financing | Angel Investment |

|---|---|---|

| Funding Source | Debt repaid through a fixed percentage of monthly revenue | Equity investment from individual investors |

| Ownership Dilution | No ownership dilution | Significant ownership dilution |

| Repayment | Flexible repayment tied to revenue performance | No repayment; investors gain equity |

| Typical Use | Suits businesses with steady revenue streams | Suits high-growth startups requiring growth capital |

| Investor Involvement | Minimal involvement | Active mentorship and strategic support |

| Risk | Lender risk tied to business revenue | Investor risk tied to equity value |

| Cost | Repayment includes revenue share; may be higher than interest | No repayment; potentially high equity cost |

Which is better?

Revenue-based financing offers flexible repayment tied to a company's monthly revenue, minimizing dilution of equity and retaining full ownership for founders. Angel investment typically provides substantial upfront capital and valuable mentorship but requires giving up a percentage of equity and potential control. Startups with steady cash flow and a desire to maintain control may benefit more from revenue-based financing, while those seeking strategic guidance and larger funding often prefer angel investment.

Connection

Revenue-based financing and angel investment both serve as alternative funding sources for startups seeking capital without giving up significant equity. Revenue-based financing offers repayment tied to a percentage of future revenue, aligning investor returns with business performance, while angel investors provide early-stage capital often coupled with mentorship and strategic guidance. These funding mechanisms can complement each other, enabling startups to balance growth funding with manageable repayment structures and access to valuable investor expertise.

Key Terms

Equity

Angel investment provides startups with equity funding, granting investors ownership stakes and potential influence over company decisions, which aligns their success with the business growth. Revenue-based financing, in contrast, avoids equity dilution by offering capital repaid through a percentage of ongoing revenues, preserving full ownership for founders. Explore the detailed differences to determine the best funding strategy for your startup's equity goals.

Repayment Structure

Angel investment involves a one-time capital injection in exchange for equity, with no fixed repayment schedule, allowing startups to focus on growth rather than immediate repayments. Revenue-based financing requires periodic payments based on a fixed percentage of the company's revenue, aligning repayment amounts with business performance and cash flow. Explore these repayment structures in detail to determine the best fit for your funding strategy.

Ownership Dilution

Angel investment typically involves equity financing where investors receive ownership shares, leading to ownership dilution for the founders. Revenue-based financing allows companies to raise capital without giving up equity, as repayments are made as a percentage of revenue, thus avoiding ownership dilution. Explore the detailed implications of ownership dilution in funding choices to make informed investment decisions.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investors provide early capital to startups in exchange for equity or convertible debt, often helping founders develop prototypes, conduct market research, and navigate early challenges while offering mentorship and valuable networks.

Angel Investors - The Hartford Insurance - Angel investors are wealthy private individuals who invest their own money into small businesses for equity, usually offering patient funding smaller than venture capitalists and expecting eventual profits through exits like acquisitions or public offerings.

Angel investor - Wikipedia - Angel investors often provide seed capital and can realize significant returns, with active markets such as in the UK seeing average investments of around PS42,000 and returns averaging 2.2 times the investment over about 3.6 years.

dowidth.com

dowidth.com