Synthetic risk transfer techniques involve the use of financial instruments to shift credit risk without transferring the underlying assets, whereas credit default swaps (CDS) are contracts that provide protection against the default of a reference entity. CDS enable investors to hedge or speculate on credit risk by paying a premium in exchange for compensation if a credit event occurs, while synthetic risk transfers often entail bespoke structures combining derivatives and tranching. Explore the complexities and applications of these risk management tools to deepen your understanding of modern finance.

Why it is important

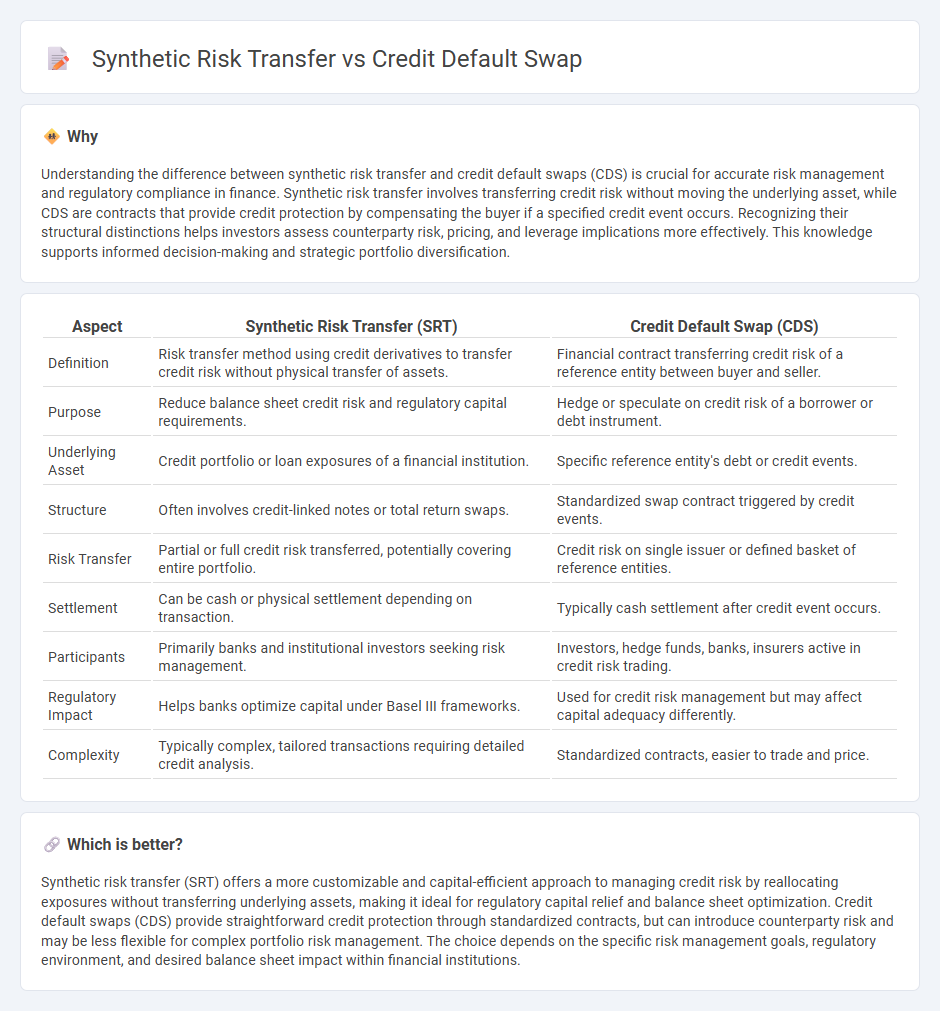

Understanding the difference between synthetic risk transfer and credit default swaps (CDS) is crucial for accurate risk management and regulatory compliance in finance. Synthetic risk transfer involves transferring credit risk without moving the underlying asset, while CDS are contracts that provide credit protection by compensating the buyer if a specified credit event occurs. Recognizing their structural distinctions helps investors assess counterparty risk, pricing, and leverage implications more effectively. This knowledge supports informed decision-making and strategic portfolio diversification.

Comparison Table

| Aspect | Synthetic Risk Transfer (SRT) | Credit Default Swap (CDS) |

|---|---|---|

| Definition | Risk transfer method using credit derivatives to transfer credit risk without physical transfer of assets. | Financial contract transferring credit risk of a reference entity between buyer and seller. |

| Purpose | Reduce balance sheet credit risk and regulatory capital requirements. | Hedge or speculate on credit risk of a borrower or debt instrument. |

| Underlying Asset | Credit portfolio or loan exposures of a financial institution. | Specific reference entity's debt or credit events. |

| Structure | Often involves credit-linked notes or total return swaps. | Standardized swap contract triggered by credit events. |

| Risk Transfer | Partial or full credit risk transferred, potentially covering entire portfolio. | Credit risk on single issuer or defined basket of reference entities. |

| Settlement | Can be cash or physical settlement depending on transaction. | Typically cash settlement after credit event occurs. |

| Participants | Primarily banks and institutional investors seeking risk management. | Investors, hedge funds, banks, insurers active in credit risk trading. |

| Regulatory Impact | Helps banks optimize capital under Basel III frameworks. | Used for credit risk management but may affect capital adequacy differently. |

| Complexity | Typically complex, tailored transactions requiring detailed credit analysis. | Standardized contracts, easier to trade and price. |

Which is better?

Synthetic risk transfer (SRT) offers a more customizable and capital-efficient approach to managing credit risk by reallocating exposures without transferring underlying assets, making it ideal for regulatory capital relief and balance sheet optimization. Credit default swaps (CDS) provide straightforward credit protection through standardized contracts, but can introduce counterparty risk and may be less flexible for complex portfolio risk management. The choice depends on the specific risk management goals, regulatory environment, and desired balance sheet impact within financial institutions.

Connection

Synthetic risk transfer involves using credit derivatives to transfer credit risk without moving the underlying assets, often using credit default swaps (CDS) as the primary instrument. Credit default swaps provide protection buyers with a financial guarantee against borrower default, effectively enabling risk transfer between financial institutions. This connection allows banks to manage portfolio risk and capital requirements efficiently by synthetically transferring exposure to third parties.

Key Terms

Counterparty risk

Credit default swaps (CDS) transfer credit risk by creating a derivative contract where the protection buyer receives compensation if a reference entity defaults, exposing both parties to counterparty risk based on the likelihood of the protection seller's default. Synthetic risk transfer (SRT) involves off-balance-sheet transactions using CDS or similar instruments to transfer credit risk while mitigating counterparty risk through structured vehicles and collateral arrangements. Explore how advanced risk management techniques in SRT effectively reduce counterparty risk compared to traditional CDS setups.

Reference entity

Credit default swaps (CDS) directly reference a specific entity, transferring the risk of default through contractually bound credit protection. Synthetic risk transfer (SRT) structures use CDS or similar derivatives to isolate and transfer credit risk without transferring the underlying assets, often involving multiple reference entities or portfolios. Explore further to understand how varying reference entity scopes impact risk management strategies.

Derivative

Credit default swaps (CDS) are derivative contracts that transfer the credit risk of a reference entity from one party to another, providing protection against default events. Synthetic risk transfer involves using derivatives like CDS to offload credit risk without the actual sale of underlying assets, enhancing capital relief for financial institutions. Explore further to understand how these derivatives uniquely manage credit risk and optimize balance sheets.

Source and External Links

credit default swap (CDS) - IRMI - A credit default swap is a contract where the buyer makes payments to the seller in exchange for a promise that the seller will pay if a specific credit instrument defaults, functioning like a financial guarantee or insurance for bonds or loans.

Credit Default Swaps | CFA Institute - A CDS is a contract in which one party buys protection from another against losses from a borrower's default for a defined period, paying off upon credit events such as bankruptcy or failure to pay.

Credit default swap - Wikipedia - A CDS is a financial swap where the seller compensates the buyer if a debt defaults, with buyers paying fees to the seller and potentially receiving payouts if the referenced debt instrument suffers a credit event.

dowidth.com

dowidth.com