Digital asset custody involves securing cryptocurrencies and blockchain-based tokens through specialized services that safeguard private keys and enable safe transactions. Multi-signature custody enhances security by requiring multiple approvals from designated parties before assets can be accessed or transferred, reducing the risk of unauthorized use. Explore the differences between digital asset custody and multi-signature custody to determine the best security solution for your crypto portfolio.

Why it is important

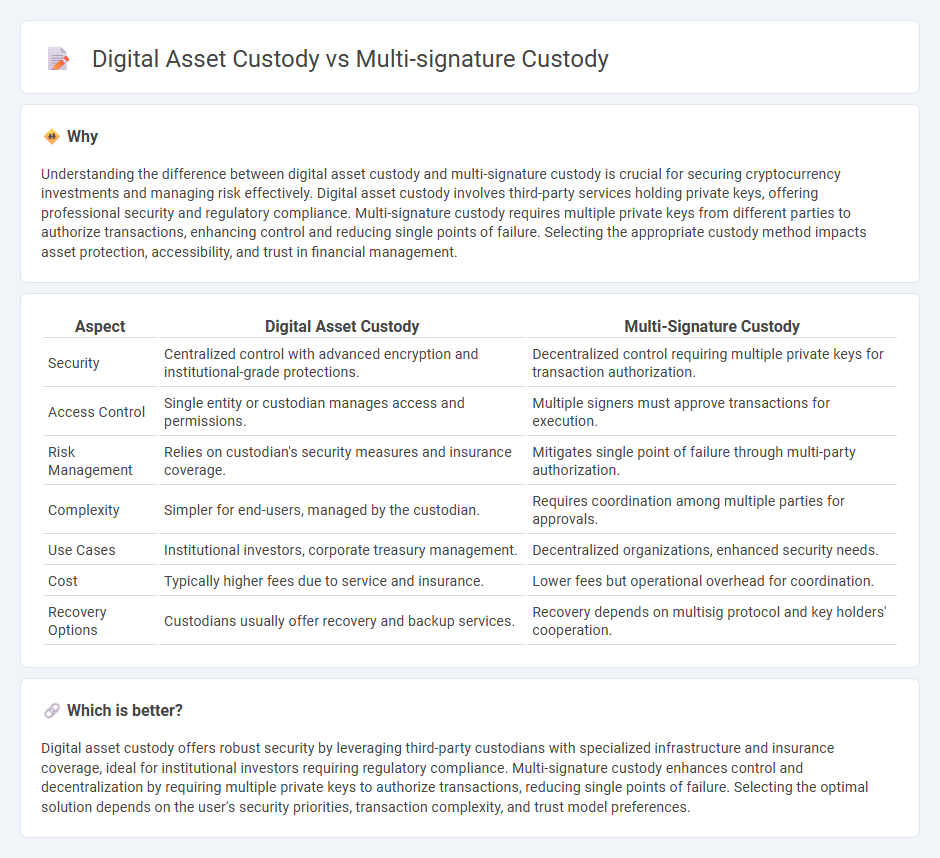

Understanding the difference between digital asset custody and multi-signature custody is crucial for securing cryptocurrency investments and managing risk effectively. Digital asset custody involves third-party services holding private keys, offering professional security and regulatory compliance. Multi-signature custody requires multiple private keys from different parties to authorize transactions, enhancing control and reducing single points of failure. Selecting the appropriate custody method impacts asset protection, accessibility, and trust in financial management.

Comparison Table

| Aspect | Digital Asset Custody | Multi-Signature Custody |

|---|---|---|

| Security | Centralized control with advanced encryption and institutional-grade protections. | Decentralized control requiring multiple private keys for transaction authorization. |

| Access Control | Single entity or custodian manages access and permissions. | Multiple signers must approve transactions for execution. |

| Risk Management | Relies on custodian's security measures and insurance coverage. | Mitigates single point of failure through multi-party authorization. |

| Complexity | Simpler for end-users, managed by the custodian. | Requires coordination among multiple parties for approvals. |

| Use Cases | Institutional investors, corporate treasury management. | Decentralized organizations, enhanced security needs. |

| Cost | Typically higher fees due to service and insurance. | Lower fees but operational overhead for coordination. |

| Recovery Options | Custodians usually offer recovery and backup services. | Recovery depends on multisig protocol and key holders' cooperation. |

Which is better?

Digital asset custody offers robust security by leveraging third-party custodians with specialized infrastructure and insurance coverage, ideal for institutional investors requiring regulatory compliance. Multi-signature custody enhances control and decentralization by requiring multiple private keys to authorize transactions, reducing single points of failure. Selecting the optimal solution depends on the user's security priorities, transaction complexity, and trust model preferences.

Connection

Digital asset custody ensures secure storage and management of cryptocurrencies by leveraging advanced encryption and blockchain technology. Multi-signature custody enhances this security by requiring multiple private keys for transaction approval, reducing risks of unauthorized access and theft. Combining these methods strengthens asset protection and compliance in the evolving digital finance landscape.

Key Terms

Multi-signature wallet

Multi-signature custody enhances digital asset security by requiring multiple private keys for transaction approval, reducing the risk of unauthorized access compared to single-key wallets. This approach is ideal for businesses and organizations needing collaborative control over funds, minimizing the potential for fraud or loss. Discover how multi-signature wallets can elevate your digital asset protection strategy today.

Private key management

Multi-signature custody enhances private key management by requiring multiple approvals before authorizing transactions, significantly reducing the risk of unauthorized access compared to traditional digital asset custody. This approach distributes control over private keys among several parties, thereby increasing security and mitigating single points of failure. Explore advanced private key management strategies to safeguard your digital assets effectively.

Third-party custodian

Third-party custodians play a critical role in digital asset custody by securely managing private keys and safeguarding assets through regulated frameworks and insurance coverage, reducing risks associated with self-custody. Multi-signature custody amplifies security by requiring multiple private keys for transaction approval, which third-party custodians can facilitate to prevent unauthorized access and mitigate single points of failure. Explore further to understand how combining multi-signature protocols with third-party custody enhances asset protection and regulatory compliance.

Source and External Links

Multi-Sig Custody and Inheritance - Swan Bitcoin - Multi-signature custody involves using multiple signature devices for Bitcoin security, enabling inheritance planning by ensuring heirs cannot access funds without necessary keys, improving security and control over assets.

DIY multisig vs. collaborative custody multisig - Unchained Capital - Collaborative custody multisig allows Bitcoin holders to share control with trusted partners or companies in setups like 2-of-3 keys, balancing self-custody control with available assistance without losing unilateral spending power.

Multi-Signature Wallets: History, benefits and progress - Block&Capital - Multi-signature wallets improve digital asset security by distributing control among multiple key holders, eliminating single points of failure, and providing redundancy with configurable m-of-n key requirements.

dowidth.com

dowidth.com