Revenge spending describes the surge in consumer purchases following periods of restricted economic activity, driven by pent-up demand and increased disposable income. The wealth effect occurs when rising asset values, such as real estate or stock market gains, boost consumer confidence and spending capacity. Explore how these phenomena influence economic recovery and consumer behavior.

Why it is important

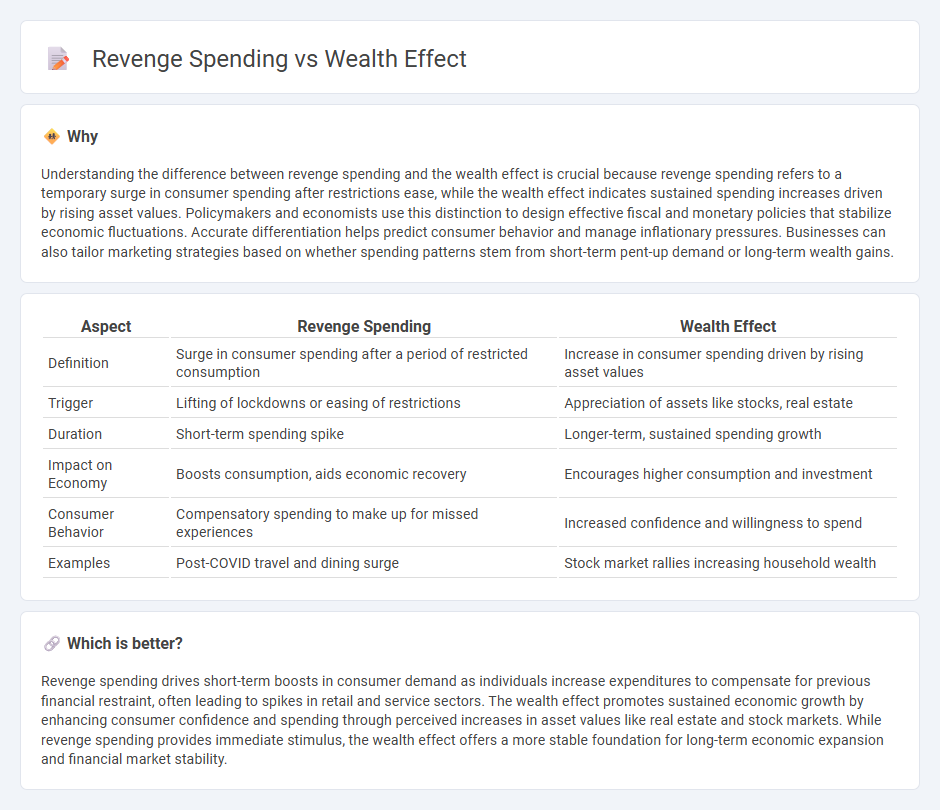

Understanding the difference between revenge spending and the wealth effect is crucial because revenge spending refers to a temporary surge in consumer spending after restrictions ease, while the wealth effect indicates sustained spending increases driven by rising asset values. Policymakers and economists use this distinction to design effective fiscal and monetary policies that stabilize economic fluctuations. Accurate differentiation helps predict consumer behavior and manage inflationary pressures. Businesses can also tailor marketing strategies based on whether spending patterns stem from short-term pent-up demand or long-term wealth gains.

Comparison Table

| Aspect | Revenge Spending | Wealth Effect |

|---|---|---|

| Definition | Surge in consumer spending after a period of restricted consumption | Increase in consumer spending driven by rising asset values |

| Trigger | Lifting of lockdowns or easing of restrictions | Appreciation of assets like stocks, real estate |

| Duration | Short-term spending spike | Longer-term, sustained spending growth |

| Impact on Economy | Boosts consumption, aids economic recovery | Encourages higher consumption and investment |

| Consumer Behavior | Compensatory spending to make up for missed experiences | Increased confidence and willingness to spend |

| Examples | Post-COVID travel and dining surge | Stock market rallies increasing household wealth |

Which is better?

Revenge spending drives short-term boosts in consumer demand as individuals increase expenditures to compensate for previous financial restraint, often leading to spikes in retail and service sectors. The wealth effect promotes sustained economic growth by enhancing consumer confidence and spending through perceived increases in asset values like real estate and stock markets. While revenge spending provides immediate stimulus, the wealth effect offers a more stable foundation for long-term economic expansion and financial market stability.

Connection

Revenge spending occurs when consumers increase their expenditures to compensate for previous periods of restraint, directly amplifying the wealth effect by boosting perceived financial security and confidence. This surge in discretionary spending fuels economic growth as higher consumption drives demand across various sectors. Consequently, the interplay between revenge spending and the wealth effect accelerates GDP expansion and fosters robust market activity.

Key Terms

Consumer Spending

Consumer spending rises with the wealth effect as increased asset values boost consumer confidence and purchasing power, prompting higher expenditures on both discretionary and essential goods. Revenge spending, driven by pent-up demand following periods of restricted consumption, leads to sudden spikes in spending, particularly in sectors like travel, dining, and entertainment. Explore detailed insights on how these phenomena shape economic recovery and market trends.

Disposable Income

Wealth effect describes how increases in household wealth, such as rising property values or stock market gains, boost disposable income and consumer spending by enhancing confidence and perceived financial security. Revenge spending refers to consumers increasing their spending--often on luxury or non-essential items--after a period of restricted consumption, fueled by pent-up disposable income and a desire to reclaim lost experiences. Explore how shifts in disposable income drive these contrasting consumer behaviors and their impacts on the economy.

Behavioral Economics

Wealth effect refers to the psychological impact of increased asset values, prompting higher consumer spending due to perceived financial well-being. Revenge spending, observed post-restriction periods, involves consumers indulging in purchases as a compensatory behavior to regain lost experiences. Explore the intricate links between these behavioral economics concepts to understand consumer motivation dynamics better.

Source and External Links

The sudden increase in the wealth effect and its impact on spending - Visa - The wealth effect describes how consumer spending increases when households feel richer due to rising asset values like housing or stocks; for example, housing wealth once contributed up to 2% of consumer spending growth before the pandemic, while stock market wealth effects vary with market performance, significantly influencing spending patterns.

New Estimates of the Stock Market Wealth Effect - NBER - Research finds that increases in stock market wealth lead to higher consumer spending, with a quantified effect of about 2.8 cents in spending for every additional dollar of stock wealth, underscoring how wealth changes stimulate the broader economy.

Wealth Effects and Macroeconomic Dynamics - Harvard Scholar - Studies show the wealth effect varies between housing and financial assets, often larger for housing wealth, and can change over time due to factors like demographics and borrowing constraints, impacting consumption dynamics differently across countries and periods.

dowidth.com

dowidth.com