Polycrisis refers to the simultaneous occurrence of multiple, interconnected economic, social, and environmental crises that exacerbate overall instability. Economic shock typically denotes a sudden and significant disruption in economic activity, such as a financial crash or supply chain collapse. Explore the differences and impacts of polycrisis versus economic shocks to better understand global economic resilience.

Why it is important

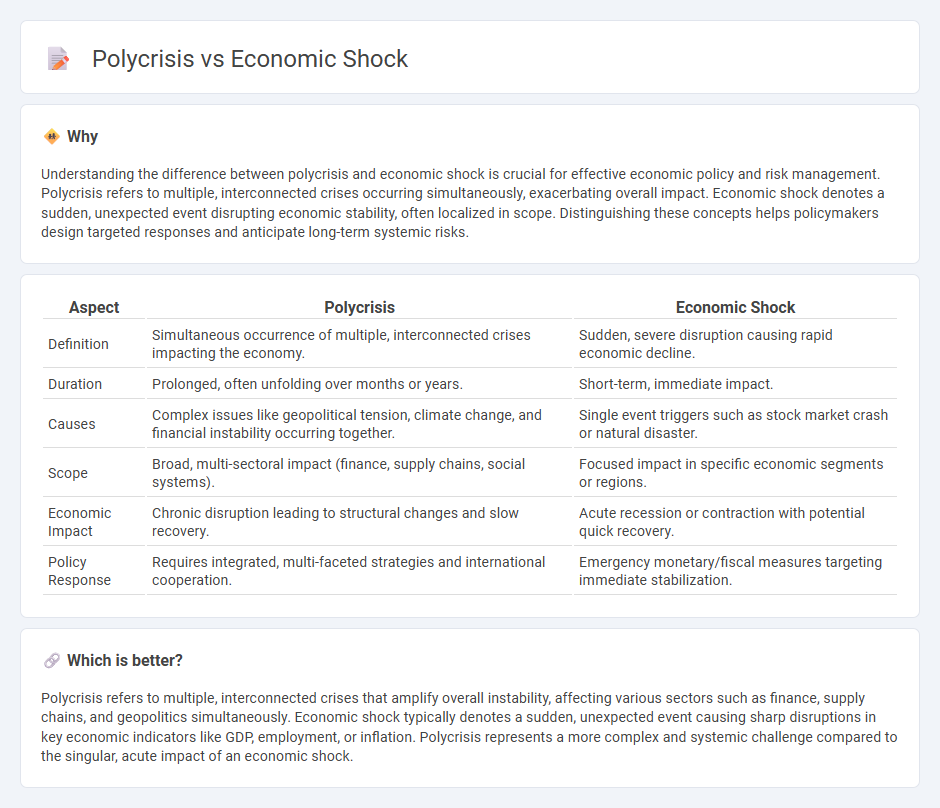

Understanding the difference between polycrisis and economic shock is crucial for effective economic policy and risk management. Polycrisis refers to multiple, interconnected crises occurring simultaneously, exacerbating overall impact. Economic shock denotes a sudden, unexpected event disrupting economic stability, often localized in scope. Distinguishing these concepts helps policymakers design targeted responses and anticipate long-term systemic risks.

Comparison Table

| Aspect | Polycrisis | Economic Shock |

|---|---|---|

| Definition | Simultaneous occurrence of multiple, interconnected crises impacting the economy. | Sudden, severe disruption causing rapid economic decline. |

| Duration | Prolonged, often unfolding over months or years. | Short-term, immediate impact. |

| Causes | Complex issues like geopolitical tension, climate change, and financial instability occurring together. | Single event triggers such as stock market crash or natural disaster. |

| Scope | Broad, multi-sectoral impact (finance, supply chains, social systems). | Focused impact in specific economic segments or regions. |

| Economic Impact | Chronic disruption leading to structural changes and slow recovery. | Acute recession or contraction with potential quick recovery. |

| Policy Response | Requires integrated, multi-faceted strategies and international cooperation. | Emergency monetary/fiscal measures targeting immediate stabilization. |

Which is better?

Polycrisis refers to multiple, interconnected crises that amplify overall instability, affecting various sectors such as finance, supply chains, and geopolitics simultaneously. Economic shock typically denotes a sudden, unexpected event causing sharp disruptions in key economic indicators like GDP, employment, or inflation. Polycrisis represents a more complex and systemic challenge compared to the singular, acute impact of an economic shock.

Connection

Polycrisis refers to multiple, interconnected crises occurring simultaneously, amplifying their adverse effects on the economy. Economic shocks, such as sudden market crashes or supply chain disruptions, often act as catalysts within a polycrisis, triggering widespread financial instability and reduced consumer confidence. The interplay between polycrisis and economic shocks creates compounded vulnerabilities that hinder economic recovery and growth.

Key Terms

**Economic shock:**

An economic shock refers to a sudden and unexpected event that significantly disrupts the economy, such as financial crises, natural disasters, or geopolitical conflicts, leading to rapid declines in GDP, employment, and consumer confidence. These shocks can cause long-lasting damage to supply chains, investment flows, and market stability, requiring immediate policy interventions to mitigate adverse effects. Explore the intricate dynamics and coping strategies related to economic shocks to understand their profound impact on global economies.

Demand-supply imbalance

Economic shocks refer to sudden, unexpected events that disrupt the balance between demand and supply, causing rapid fluctuations in prices and output. A polycrisis involves simultaneous, interconnected crises that amplify demand-supply imbalances across multiple sectors, magnifying systemic risks and economic instability. Explore the dynamics of demand-supply imbalances to understand how economic shocks escalate into complex polycrises.

Sudden disruption

An economic shock refers to a sudden, unexpected event that disrupts financial markets, such as a sharp decline in stock prices or a significant drop in commodity supplies, causing immediate economic instability. A polycrisis, however, involves the simultaneous occurrence of multiple interconnected crises--economic, social, environmental, or political--that compound each other's effects and create prolonged systemic disruption. Explore how these sudden disruptions differ in scope and impact across global systems for deeper insights.

Source and External Links

Economic Shocks - (Principles of Microeconomics) - Fiveable - An economic shock is a sudden, unexpected event that disrupts normal economic patterns like supply, demand, and market equilibrium, with wide-ranging effects on GDP, employment, inflation, and consumer confidence.

Economic Shocks: Definition and Examples - SmartAsset - An economic shock is a singular, short-term, and large-scale event that unexpectedly disrupts the entire economy rather than being part of long-term trends, and is typically exogenous (originating outside the economy).

Economic Shock - NOLA Ready - Economic shocks can emerge from natural or man-made disasters or from broader national or global events, and the severity depends on the scale of the event and the vulnerability of affected sectors.

dowidth.com

dowidth.com