Locavesting focuses on investing directly in local businesses or projects to boost community economic growth, emphasizing regional development and sustainable impact. Peer-to-peer lending connects individual borrowers with private lenders online, creating decentralized financial opportunities and higher returns compared to traditional banks. Explore the benefits and risks of locavesting and peer-to-peer lending to make informed investment decisions.

Why it is important

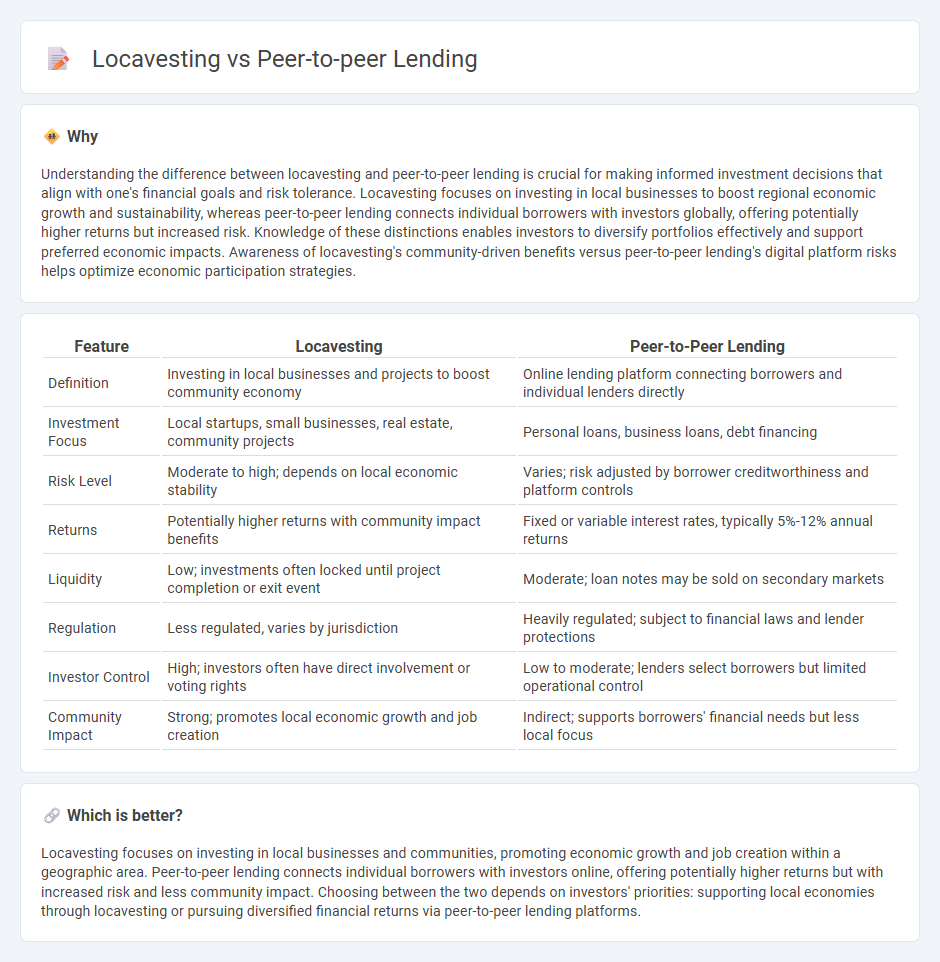

Understanding the difference between locavesting and peer-to-peer lending is crucial for making informed investment decisions that align with one's financial goals and risk tolerance. Locavesting focuses on investing in local businesses to boost regional economic growth and sustainability, whereas peer-to-peer lending connects individual borrowers with investors globally, offering potentially higher returns but increased risk. Knowledge of these distinctions enables investors to diversify portfolios effectively and support preferred economic impacts. Awareness of locavesting's community-driven benefits versus peer-to-peer lending's digital platform risks helps optimize economic participation strategies.

Comparison Table

| Feature | Locavesting | Peer-to-Peer Lending |

|---|---|---|

| Definition | Investing in local businesses and projects to boost community economy | Online lending platform connecting borrowers and individual lenders directly |

| Investment Focus | Local startups, small businesses, real estate, community projects | Personal loans, business loans, debt financing |

| Risk Level | Moderate to high; depends on local economic stability | Varies; risk adjusted by borrower creditworthiness and platform controls |

| Returns | Potentially higher returns with community impact benefits | Fixed or variable interest rates, typically 5%-12% annual returns |

| Liquidity | Low; investments often locked until project completion or exit event | Moderate; loan notes may be sold on secondary markets |

| Regulation | Less regulated, varies by jurisdiction | Heavily regulated; subject to financial laws and lender protections |

| Investor Control | High; investors often have direct involvement or voting rights | Low to moderate; lenders select borrowers but limited operational control |

| Community Impact | Strong; promotes local economic growth and job creation | Indirect; supports borrowers' financial needs but less local focus |

Which is better?

Locavesting focuses on investing in local businesses and communities, promoting economic growth and job creation within a geographic area. Peer-to-peer lending connects individual borrowers with investors online, offering potentially higher returns but with increased risk and less community impact. Choosing between the two depends on investors' priorities: supporting local economies through locavesting or pursuing diversified financial returns via peer-to-peer lending platforms.

Connection

Locavesting and peer-to-peer lending are interconnected through their focus on grassroots economic empowerment and community-based investment. Both strategies prioritize local capital circulation by enabling individuals to fund projects or businesses within their geographic region, reducing reliance on traditional financial institutions. This synergy fosters economic resilience and supports sustainable growth by directly linking investors with borrowers who have shared community interests.

Key Terms

Disintermediation

Peer-to-peer lending and locavesting both emphasize disintermediation by eliminating traditional financial institutions, allowing direct transactions between investors and borrowers or local projects. Peer-to-peer lending platforms connect individual lenders with borrowers globally, reducing reliance on banks, while locavesting channels investments directly into local businesses or communities, fostering regional economic growth. Explore how these models reshape finance by enhancing transparency and reducing costs.

Crowdfunding

Peer-to-peer lending platforms connect individual borrowers with investors, facilitating direct loans that often offer higher returns and lower risks compared to traditional banking. Locavesting emphasizes local crowdfunding, enabling community members to invest in nearby businesses and projects, fostering economic growth within specific regions. Explore the distinct advantages of peer-to-peer lending and locavesting to understand which crowdfunding approach aligns best with your financial goals.

Local investment

Local investment via locavesting targets community-focused projects and small businesses, fostering regional economic growth and personal impact. Peer-to-peer lending connects individual lenders directly with borrowers, offering diversified portfolios but often wider geographical reach. Explore how locavesting enhances local economies and personal financial influence by discovering more about its unique advantages.

Source and External Links

Peer-to-peer lending - Peer-to-peer lending is an alternative financial service allowing individuals or businesses to borrow money from other individuals online, facilitated by intermediaries that manage the lending process.

PEER-TO-PEER LENDING - Peer-to-peer lending is an emerging online financial service where individuals and small businesses can obtain unsecured loans from other persons via the Internet.

Peer to peer lending: what you need to know - Peer-to-peer lending is a marketplace where people lend money to individuals or businesses, receiving interest and getting their money back upon loan repayment, but it carries higher risks compared to savings accounts.

dowidth.com

dowidth.com