Living wage represents the income required to cover basic necessities such as housing, food, and healthcare, reflecting the actual cost of living in a specific area. Nominal wage is the amount of money earned by an individual before taxes and inflation adjustments, often not accounting for living expenses. Explore more to understand how these wage concepts impact economic well-being and policy decisions.

Why it is important

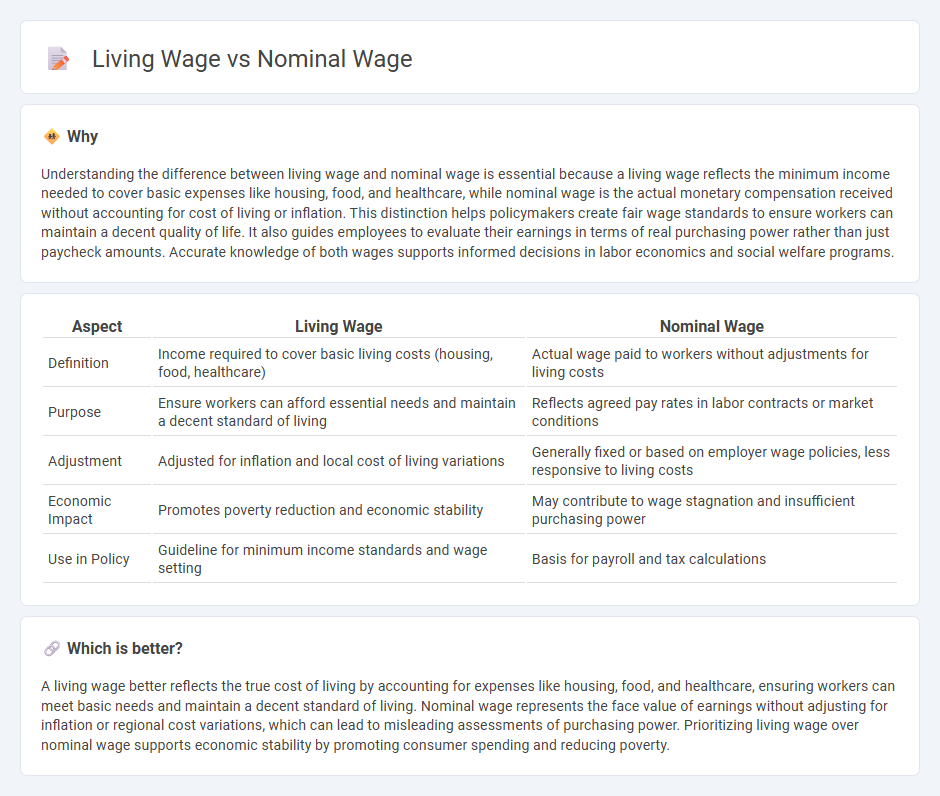

Understanding the difference between living wage and nominal wage is essential because a living wage reflects the minimum income needed to cover basic expenses like housing, food, and healthcare, while nominal wage is the actual monetary compensation received without accounting for cost of living or inflation. This distinction helps policymakers create fair wage standards to ensure workers can maintain a decent quality of life. It also guides employees to evaluate their earnings in terms of real purchasing power rather than just paycheck amounts. Accurate knowledge of both wages supports informed decisions in labor economics and social welfare programs.

Comparison Table

| Aspect | Living Wage | Nominal Wage |

|---|---|---|

| Definition | Income required to cover basic living costs (housing, food, healthcare) | Actual wage paid to workers without adjustments for living costs |

| Purpose | Ensure workers can afford essential needs and maintain a decent standard of living | Reflects agreed pay rates in labor contracts or market conditions |

| Adjustment | Adjusted for inflation and local cost of living variations | Generally fixed or based on employer wage policies, less responsive to living costs |

| Economic Impact | Promotes poverty reduction and economic stability | May contribute to wage stagnation and insufficient purchasing power |

| Use in Policy | Guideline for minimum income standards and wage setting | Basis for payroll and tax calculations |

Which is better?

A living wage better reflects the true cost of living by accounting for expenses like housing, food, and healthcare, ensuring workers can meet basic needs and maintain a decent standard of living. Nominal wage represents the face value of earnings without adjusting for inflation or regional cost variations, which can lead to misleading assessments of purchasing power. Prioritizing living wage over nominal wage supports economic stability by promoting consumer spending and reducing poverty.

Connection

Living wage represents the minimum income necessary for workers to meet basic needs, while nominal wage is the actual monetary compensation paid by employers without adjusting for inflation or cost of living. The connection between living wage and nominal wage lies in evaluating whether nominal wages are sufficient to cover living costs, influencing workers' purchasing power and economic well-being. Economists analyze the gap between nominal wages and living wages to assess labor market conditions and inform wage policy decisions.

Key Terms

Purchasing Power

Nominal wage refers to the amount of money earned by an employee before taxes and deductions, while living wage represents the income necessary to cover basic expenses such as housing, food, healthcare, and transportation. Purchasing power plays a crucial role in distinguishing these wages, as it measures the real value of income based on the cost of living and inflation rates. Explore how purchasing power affects your earning potential and quality of life by learning more about the relationship between nominal and living wages.

Cost of Living

Nominal wage refers to the monetary compensation received by employees without adjustments for inflation or living expenses, while a living wage accounts for the actual cost of living, including housing, food, healthcare, and transportation. The cost of living varies significantly by region, making a living wage essential for ensuring workers can meet basic needs and maintain a decent quality of life. Explore detailed analyses and regional cost comparisons to understand how living wages impact economic stability and worker well-being.

Inflation

Nominal wage refers to the amount of money earned by an employee without adjusting for inflation, while living wage represents the income necessary to meet basic needs such as housing, food, and healthcare in a specific location. Inflation reduces the purchasing power of nominal wages, making it essential for wages to grow in line with or above the inflation rate to maintain a living wage. Explore how inflation impacts wage policies and cost of living adjustments to better understand economic well-being.

Source and External Links

Nominal Wage vs. Real Wage: What's the Difference? | Indeed.com - Nominal wage is the literal amount of money paid per hour or salary without adjusting for inflation, representing current dollar earnings rather than purchasing power.

Nominal Wage Definition, Formula & Examples - Lesson - Study.com - Nominal wage, also called money wage, is the pay rate before inflation adjustment, influenced by supply and demand for labor, and differs from real wage which accounts for inflation.

10.1 Nominal Wages and Real Wages - Nominal wage is the wage measured in money units without adjusting for changes in price level, making it a less useful measure for workers' actual purchasing power compared to real wage.

dowidth.com

dowidth.com