Liquidity crunch occurs when businesses or individuals struggle to meet short-term financial obligations due to insufficient cash flow, while solvency crisis indicates a deeper problem where liabilities exceed assets, threatening the entity's long-term viability. Understanding the distinction is crucial for policymakers and investors focused on financial stability and risk management. Explore further to grasp how these economic challenges impact markets and recovery strategies.

Why it is important

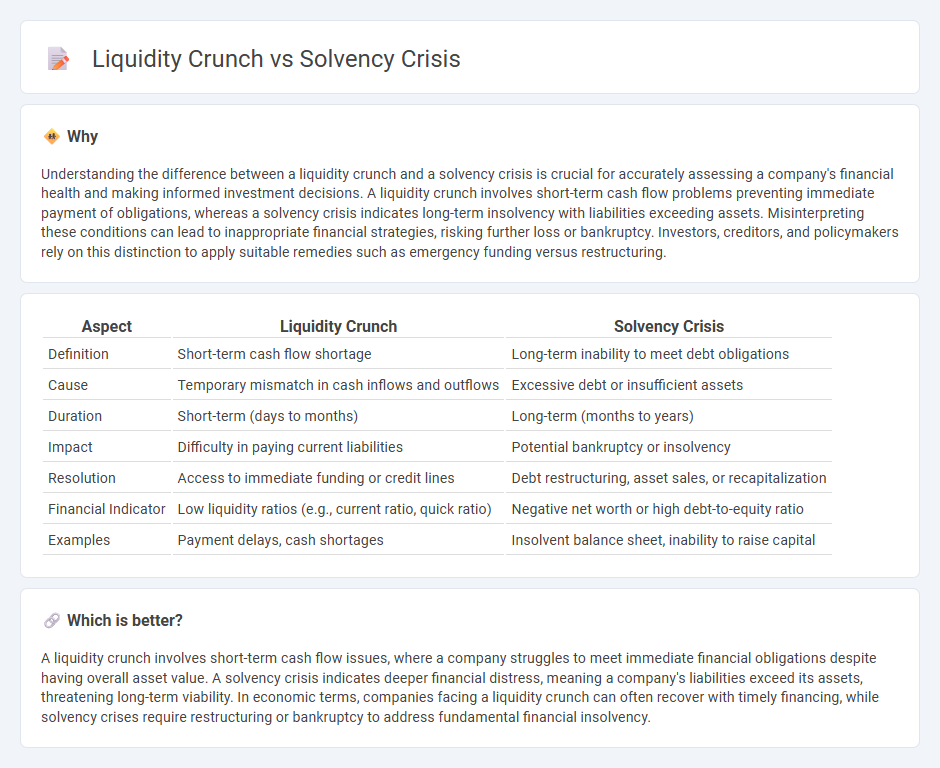

Understanding the difference between a liquidity crunch and a solvency crisis is crucial for accurately assessing a company's financial health and making informed investment decisions. A liquidity crunch involves short-term cash flow problems preventing immediate payment of obligations, whereas a solvency crisis indicates long-term insolvency with liabilities exceeding assets. Misinterpreting these conditions can lead to inappropriate financial strategies, risking further loss or bankruptcy. Investors, creditors, and policymakers rely on this distinction to apply suitable remedies such as emergency funding versus restructuring.

Comparison Table

| Aspect | Liquidity Crunch | Solvency Crisis |

|---|---|---|

| Definition | Short-term cash flow shortage | Long-term inability to meet debt obligations |

| Cause | Temporary mismatch in cash inflows and outflows | Excessive debt or insufficient assets |

| Duration | Short-term (days to months) | Long-term (months to years) |

| Impact | Difficulty in paying current liabilities | Potential bankruptcy or insolvency |

| Resolution | Access to immediate funding or credit lines | Debt restructuring, asset sales, or recapitalization |

| Financial Indicator | Low liquidity ratios (e.g., current ratio, quick ratio) | Negative net worth or high debt-to-equity ratio |

| Examples | Payment delays, cash shortages | Insolvent balance sheet, inability to raise capital |

Which is better?

A liquidity crunch involves short-term cash flow issues, where a company struggles to meet immediate financial obligations despite having overall asset value. A solvency crisis indicates deeper financial distress, meaning a company's liabilities exceed its assets, threatening long-term viability. In economic terms, companies facing a liquidity crunch can often recover with timely financing, while solvency crises require restructuring or bankruptcy to address fundamental financial insolvency.

Connection

A liquidity crunch restricts a company's ability to meet short-term obligations, often triggering a solvency crisis when prolonged cash flow shortages erode its overall financial stability. Insufficient liquidity can force asset sales at depressed prices, worsening debt burdens and compromising long-term solvency. The intertwined nature of liquidity and solvency risks makes effective cash flow management critical for maintaining economic resilience and preventing financial collapse.

Key Terms

**Solvency Crisis:**

A solvency crisis occurs when a company or institution's liabilities exceed its assets, making it unable to meet long-term financial obligations, unlike a liquidity crunch which involves short-term cash flow shortages. Key indicators of a solvency crisis include negative net worth, persistent losses, and insolvency filings such as bankruptcy. Explore deeper insights into how solvency crises impact business sustainability and economic stability.

Insolvency

Solvency crisis occurs when a company's total liabilities surpass its assets, indicating an inability to meet long-term financial obligations, while a liquidity crunch refers to short-term cash flow problems despite overall solvency. Insolvency specifically highlights a firm's financial state where debts exceed assets, leading to potential bankruptcy or restructuring. Explore more about insolvency to understand its impact on business continuity and legal ramifications.

Balance Sheet

A solvency crisis arises when a company's total liabilities exceed its assets, indicating long-term financial instability on the balance sheet. In contrast, a liquidity crunch occurs when a firm has sufficient assets but lacks quick access to cash or liquid assets to meet immediate obligations, highlighting short-term cash flow issues. Explore detailed strategies to manage and differentiate these critical financial conditions effectively.

Source and External Links

Senior Fellow Amit Seru: Recent Bank Failures Point To Solvency Crisis in Financial System - The solvency crisis occurs when the market value of assets in many banks falls below their liabilities, making the banks effectively insolvent, as seen in recent failures such as Silicon Valley Bank, due to valuation declines following interest rate hikes.

Difference between Liquidity Crisis and Solvency Crisis - A solvency crisis happens when debts exceed assets such that even selling all assets cannot cover liabilities, differentiating it from a liquidity crisis which is a temporary cash flow problem despite having positive net assets.

Bank solvency, liquidity and financial crisis - Solvency and liquidity risks are interlinked in banks, and in times of financial crisis solvency problems can significantly impact liquidity, contributing to systemic financial instability.

dowidth.com

dowidth.com