A soft landing occurs when an economy slows down just enough to curb inflation without triggering a recession, maintaining steady growth and employment levels. In contrast, a recession involves a significant decline in economic activity, marked by falling GDP, rising unemployment, and reduced consumer spending. Explore the key indicators and strategies that differentiate soft landings from recessions to better understand economic cycles.

Why it is important

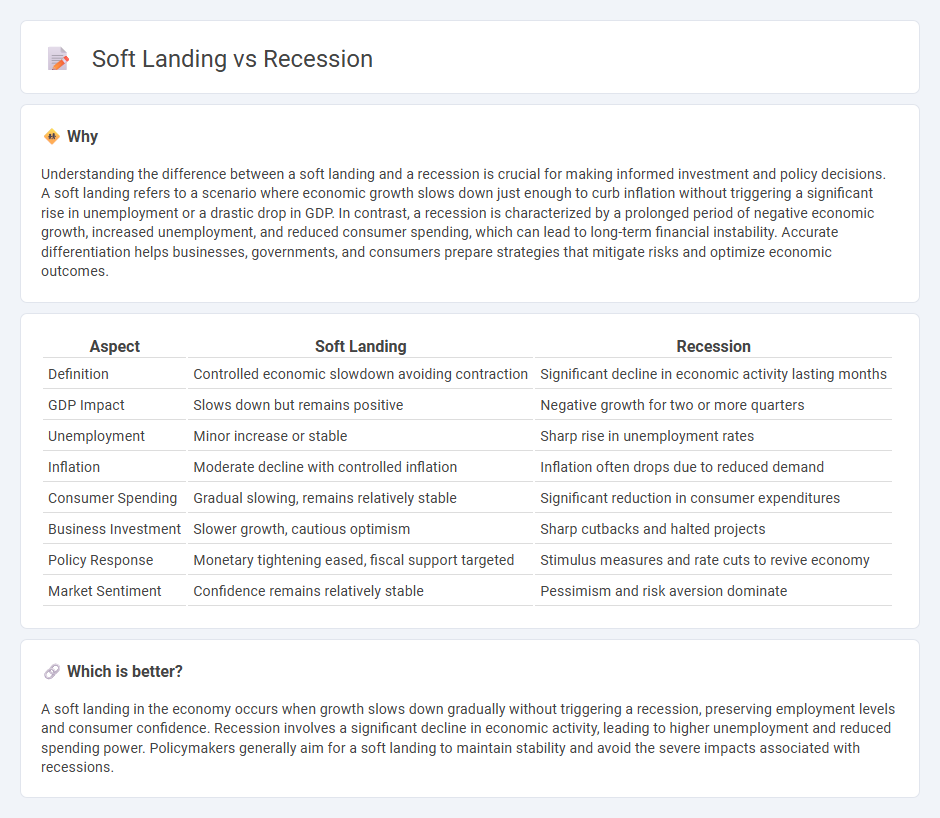

Understanding the difference between a soft landing and a recession is crucial for making informed investment and policy decisions. A soft landing refers to a scenario where economic growth slows down just enough to curb inflation without triggering a significant rise in unemployment or a drastic drop in GDP. In contrast, a recession is characterized by a prolonged period of negative economic growth, increased unemployment, and reduced consumer spending, which can lead to long-term financial instability. Accurate differentiation helps businesses, governments, and consumers prepare strategies that mitigate risks and optimize economic outcomes.

Comparison Table

| Aspect | Soft Landing | Recession |

|---|---|---|

| Definition | Controlled economic slowdown avoiding contraction | Significant decline in economic activity lasting months |

| GDP Impact | Slows down but remains positive | Negative growth for two or more quarters |

| Unemployment | Minor increase or stable | Sharp rise in unemployment rates |

| Inflation | Moderate decline with controlled inflation | Inflation often drops due to reduced demand |

| Consumer Spending | Gradual slowing, remains relatively stable | Significant reduction in consumer expenditures |

| Business Investment | Slower growth, cautious optimism | Sharp cutbacks and halted projects |

| Policy Response | Monetary tightening eased, fiscal support targeted | Stimulus measures and rate cuts to revive economy |

| Market Sentiment | Confidence remains relatively stable | Pessimism and risk aversion dominate |

Which is better?

A soft landing in the economy occurs when growth slows down gradually without triggering a recession, preserving employment levels and consumer confidence. Recession involves a significant decline in economic activity, leading to higher unemployment and reduced spending power. Policymakers generally aim for a soft landing to maintain stability and avoid the severe impacts associated with recessions.

Connection

A soft landing in the economy refers to a scenario where growth slows down just enough to avoid a recession, maintaining stable inflation and employment levels. Recession occurs when economic activity contracts significantly, often due to sharp declines in consumer demand, investment, or external shocks. Central banks aim for a soft landing by adjusting monetary policies to prevent the economy from tipping into recession.

Key Terms

GDP (Gross Domestic Product)

Recession is characterized by a significant decline in GDP over consecutive quarters, indicating a contracting economy and reduced economic activity. A soft landing occurs when GDP growth slows down but remains positive, avoiding a pronounced downturn and maintaining economic stability. Explore further to understand how these GDP trends impact fiscal policies and market expectations.

Unemployment Rate

The unemployment rate plays a critical role in distinguishing a recession from a soft landing, with recessions typically marked by significant increases in joblessness as businesses reduce operations and cut staff. In contrast, a soft landing scenario aims to stabilize the economy without sharp rises in unemployment, maintaining labor market resilience even amid slowing growth. Explore how shifts in the unemployment rate signal economic trajectories and impact policy decisions.

Inflation

Inflation plays a critical role in distinguishing a recession from a soft landing, as persistent high inflation often forces central banks to implement aggressive interest rate hikes that can trigger a recession by stifling economic growth. In a soft landing scenario, inflation is gradually controlled through measured monetary policy adjustments, allowing the economy to slow down without entering a recessionary phase. Explore the nuanced impacts of inflation dynamics on economic cycles to understand how policymakers aim to balance growth and price stability.

Source and External Links

What is a recession and what does it mean for you? | Fidelity - A recession is a prolonged period of negative economic growth, often marked by rising unemployment, falling corporate profits, and lower consumer spending, which can trigger a cycle of further economic decline.

Recession - Wikipedia - In economics, a recession is a business cycle contraction involving a broad decline in economic activity, commonly defined in some countries as two consecutive quarters of falling GDP, and often triggered by events like financial crises or external shocks.

What is a recession? - McKinsey - A recession is generally recognized as two consecutive quarters of economic contraction, caused by market imbalances and considered an inevitable part of the business cycle in modern capitalist economies.

dowidth.com

dowidth.com