Rentvesting allows individuals to rent a home while investing in property ownership elsewhere, offering flexibility and potential wealth accumulation. Fractional ownership involves multiple investors sharing equity in a single property, reducing entry costs and spreading financial risk. Explore these strategies to understand which suits your economic goals and investment style.

Why it is important

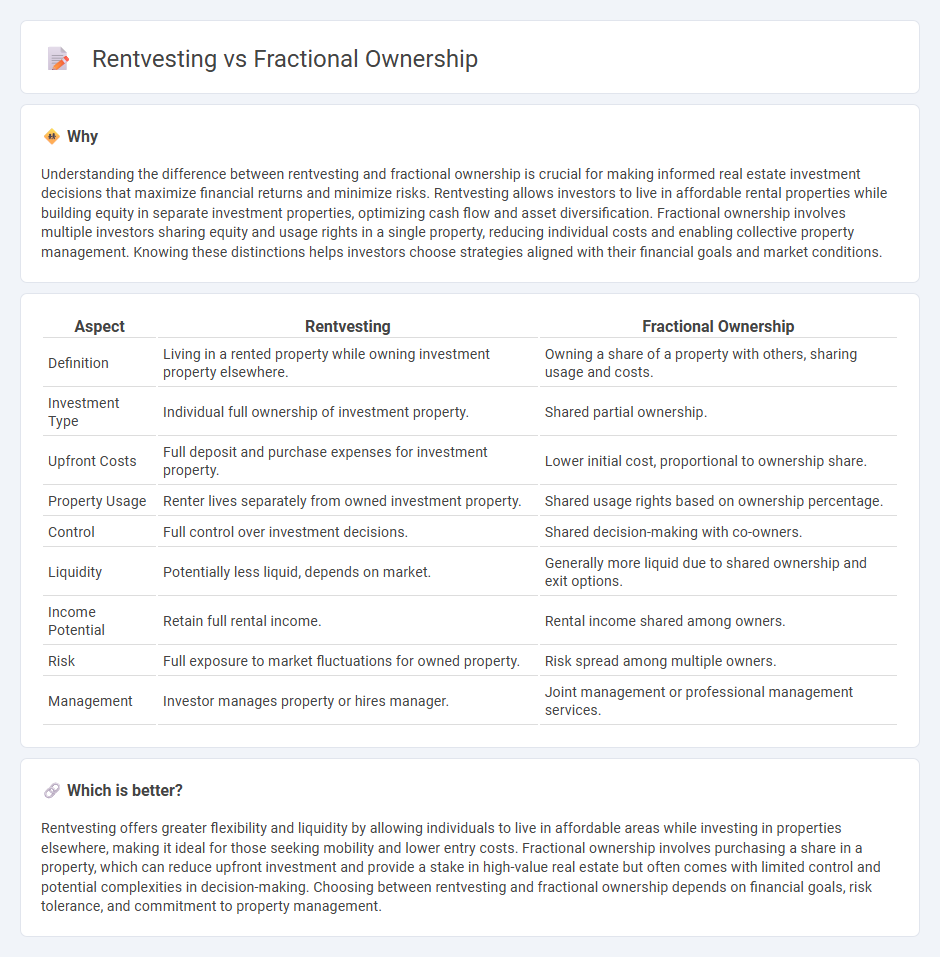

Understanding the difference between rentvesting and fractional ownership is crucial for making informed real estate investment decisions that maximize financial returns and minimize risks. Rentvesting allows investors to live in affordable rental properties while building equity in separate investment properties, optimizing cash flow and asset diversification. Fractional ownership involves multiple investors sharing equity and usage rights in a single property, reducing individual costs and enabling collective property management. Knowing these distinctions helps investors choose strategies aligned with their financial goals and market conditions.

Comparison Table

| Aspect | Rentvesting | Fractional Ownership |

|---|---|---|

| Definition | Living in a rented property while owning investment property elsewhere. | Owning a share of a property with others, sharing usage and costs. |

| Investment Type | Individual full ownership of investment property. | Shared partial ownership. |

| Upfront Costs | Full deposit and purchase expenses for investment property. | Lower initial cost, proportional to ownership share. |

| Property Usage | Renter lives separately from owned investment property. | Shared usage rights based on ownership percentage. |

| Control | Full control over investment decisions. | Shared decision-making with co-owners. |

| Liquidity | Potentially less liquid, depends on market. | Generally more liquid due to shared ownership and exit options. |

| Income Potential | Retain full rental income. | Rental income shared among owners. |

| Risk | Full exposure to market fluctuations for owned property. | Risk spread among multiple owners. |

| Management | Investor manages property or hires manager. | Joint management or professional management services. |

Which is better?

Rentvesting offers greater flexibility and liquidity by allowing individuals to live in affordable areas while investing in properties elsewhere, making it ideal for those seeking mobility and lower entry costs. Fractional ownership involves purchasing a share in a property, which can reduce upfront investment and provide a stake in high-value real estate but often comes with limited control and potential complexities in decision-making. Choosing between rentvesting and fractional ownership depends on financial goals, risk tolerance, and commitment to property management.

Connection

Rentvesting and fractional ownership both provide innovative pathways for property investment, enabling individuals to participate in real estate markets without full property ownership. Rentvesting involves renting a home while investing in another property for rental income, maximizing financial flexibility and building equity. Fractional ownership divides property costs and benefits among multiple investors, lowering entry barriers and facilitating collective wealth growth in real estate.

Key Terms

Asset Appreciation

Fractional ownership allows investors to directly own a share of a property, benefiting from asset appreciation as the property's value increases over time. Rentvesting involves renting where one lives while investing in property in more affordable markets to capitalize on growth potential and accumulation of equity. Explore the advantages of each strategy to optimize your asset growth and investment goals.

Equity

Fractional ownership allows investors to hold a direct share of a high-value property, securing equity proportional to their stake, unlike rentvesting where tenants rent while owning separate investment properties to build equity elsewhere. Rentvesting diversifies equity accumulation by balancing living flexibility with targeted property investments, whereas fractional ownership consolidates equity in a single asset. Explore how each strategy impacts your long-term wealth and property portfolio.

Cash Flow

Fractional ownership allows investors to share property costs and benefits, resulting in potential positive cash flow through rental income and equity appreciation. Rentvesting enables individuals to rent where they live while investing in more affordable properties elsewhere, optimizing cash flow by minimizing living expenses and maximizing rental returns. Discover more strategies to enhance your cash flow in property investment.

Source and External Links

Fractional ownership - Wikipedia - Fractional ownership allows multiple unrelated parties to jointly own and share the costs and risks of a high-value asset, such as a jet, yacht, or resort property, with each owner receiving guaranteed access and sharing in maintenance and management expenses.

The Definitive Guide to Fractional Ownership - In fractional ownership, two or more individuals co-own a property (often through an LLC), each holding a deeded, sellable share that dictates their usage time and obligates them to split annual running costs.

Fractional Interest Ownership - National Association of REALTORS(r) - Fractional ownership divides investment and usage rights in expensive assets among shareholders, who jointly benefit from income sharing, reduced rates, and shared access, commonly for vacation homes, luxury cars, and aircraft.

dowidth.com

dowidth.com