Zombie companies are firms that generate just enough revenue to continue operating but lack the financial vigor to invest or grow, often relying heavily on debt. Distressed assets refer to properties or investments that are underperforming or facing foreclosure, typically sold below market value due to financial instability. Explore the intricate relationship between zombie companies and distressed assets to understand their impact on economic recovery and investment opportunities.

Why it is important

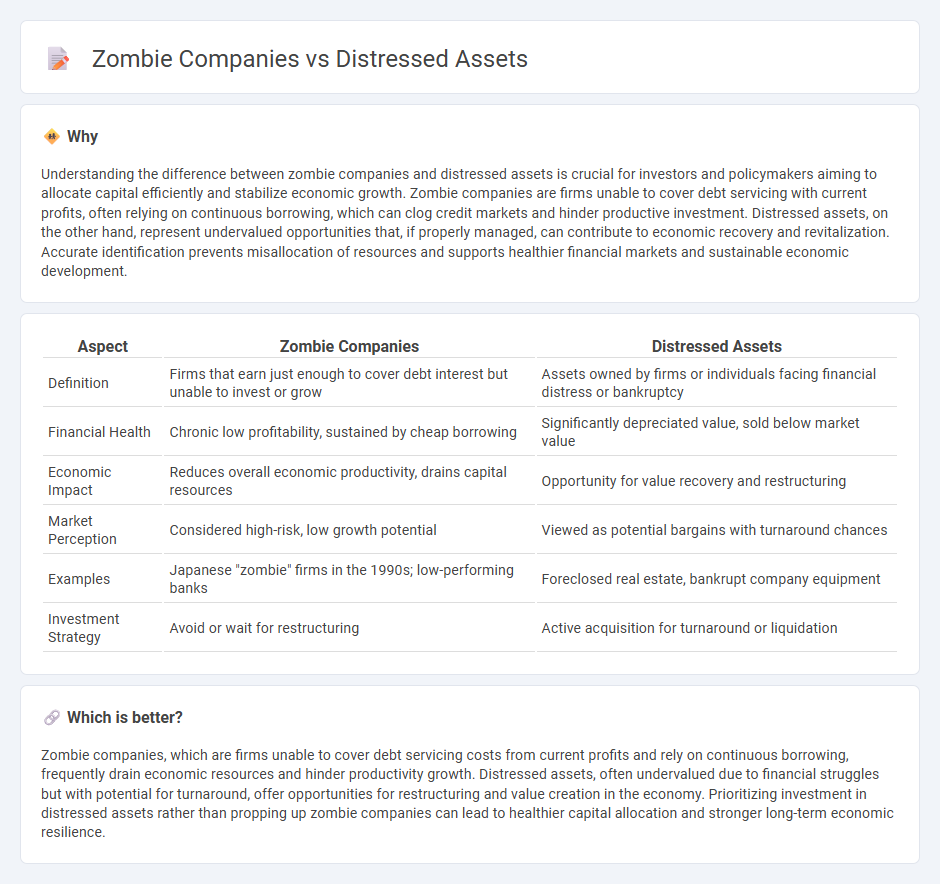

Understanding the difference between zombie companies and distressed assets is crucial for investors and policymakers aiming to allocate capital efficiently and stabilize economic growth. Zombie companies are firms unable to cover debt servicing with current profits, often relying on continuous borrowing, which can clog credit markets and hinder productive investment. Distressed assets, on the other hand, represent undervalued opportunities that, if properly managed, can contribute to economic recovery and revitalization. Accurate identification prevents misallocation of resources and supports healthier financial markets and sustainable economic development.

Comparison Table

| Aspect | Zombie Companies | Distressed Assets |

|---|---|---|

| Definition | Firms that earn just enough to cover debt interest but unable to invest or grow | Assets owned by firms or individuals facing financial distress or bankruptcy |

| Financial Health | Chronic low profitability, sustained by cheap borrowing | Significantly depreciated value, sold below market value |

| Economic Impact | Reduces overall economic productivity, drains capital resources | Opportunity for value recovery and restructuring |

| Market Perception | Considered high-risk, low growth potential | Viewed as potential bargains with turnaround chances |

| Examples | Japanese "zombie" firms in the 1990s; low-performing banks | Foreclosed real estate, bankrupt company equipment |

| Investment Strategy | Avoid or wait for restructuring | Active acquisition for turnaround or liquidation |

Which is better?

Zombie companies, which are firms unable to cover debt servicing costs from current profits and rely on continuous borrowing, frequently drain economic resources and hinder productivity growth. Distressed assets, often undervalued due to financial struggles but with potential for turnaround, offer opportunities for restructuring and value creation in the economy. Prioritizing investment in distressed assets rather than propping up zombie companies can lead to healthier capital allocation and stronger long-term economic resilience.

Connection

Zombie companies, typically unprofitable and heavily indebted firms, persist in the market due to continuous financial support, often from banks or governments, leading to a misallocation of resources and suppressed economic productivity. Distressed assets emerge when these companies' liabilities exceed asset values, creating opportunities for investors specializing in turnaround strategies. The connection lies in how zombie companies' ongoing financial struggles inflate the volume of distressed assets, impacting credit markets and economic recovery prospects.

Key Terms

Insolvency

Distressed assets refer to properties or investments under financial strain but still holding potential value, whereas zombie companies are insolvent firms that continue operating by borrowing without viable prospects for recovery. Insolvency highlights a critical threshold where zombie companies fail to generate sufficient revenue to cover debts, contrasting with distressed assets that may be restructured or sold to mitigate losses. Explore in-depth analyses of insolvency's impact on both distressed assets and zombie companies for strategic insights.

Debt restructuring

Distressed assets typically involve debt restructuring to improve cash flow and solvency by renegotiating loan terms or converting debt to equity. Zombie companies, often suffering prolonged losses, rely heavily on continuous debt restructuring to avoid bankruptcy but may remain unprofitable and heavily leveraged. Explore further to understand strategies and outcomes of debt restructuring for both entities.

Non-performing loans

Distressed assets primarily refer to financial instruments or properties suffering from a significant decline in value, often linked to non-performing loans (NPLs) that burden lenders with high default risks. Zombie companies, meanwhile, are firms that rely on continual debt refinancing to survive despite poor financial health, commonly contributing to the growth of NPLs in the banking sector. Explore further to understand how non-performing loans influence the dynamics between distressed assets and zombie companies.

Source and External Links

What Are Distressed Assets? - Hartenstein Poor & Foster - A distressed asset is property sold at a significantly reduced price because the owner faces financial pressure such as bankruptcy or foreclosure, and these can be personal, real property, or business equity.

US Distressed Investing: A Guide - Chapman and Cutler LLP - Distressed assets have depressed intrinsic value due to operational or financial distress, offering investors opportunities to buy cheaply with potential upside as assets recover value, but require risk tolerance.

Distressed securities - Wikipedia - Distressed securities are debt or equity of companies or governments in financial distress, often bought at deep discounts by institutional investors aiming for high returns through restructuring or turnaround strategies.

dowidth.com

dowidth.com