Zero-day work contracts offer employees no guaranteed working hours, creating financial unpredictability and limited job security compared to piece-rate employment, where pay is directly tied to output or units produced. Piece-rate systems incentivize productivity but can also pressure workers to prioritize quantity over quality, impacting overall labor market dynamics. Explore the economic implications and worker experiences of these employment types to understand their roles in modern labor markets.

Why it is important

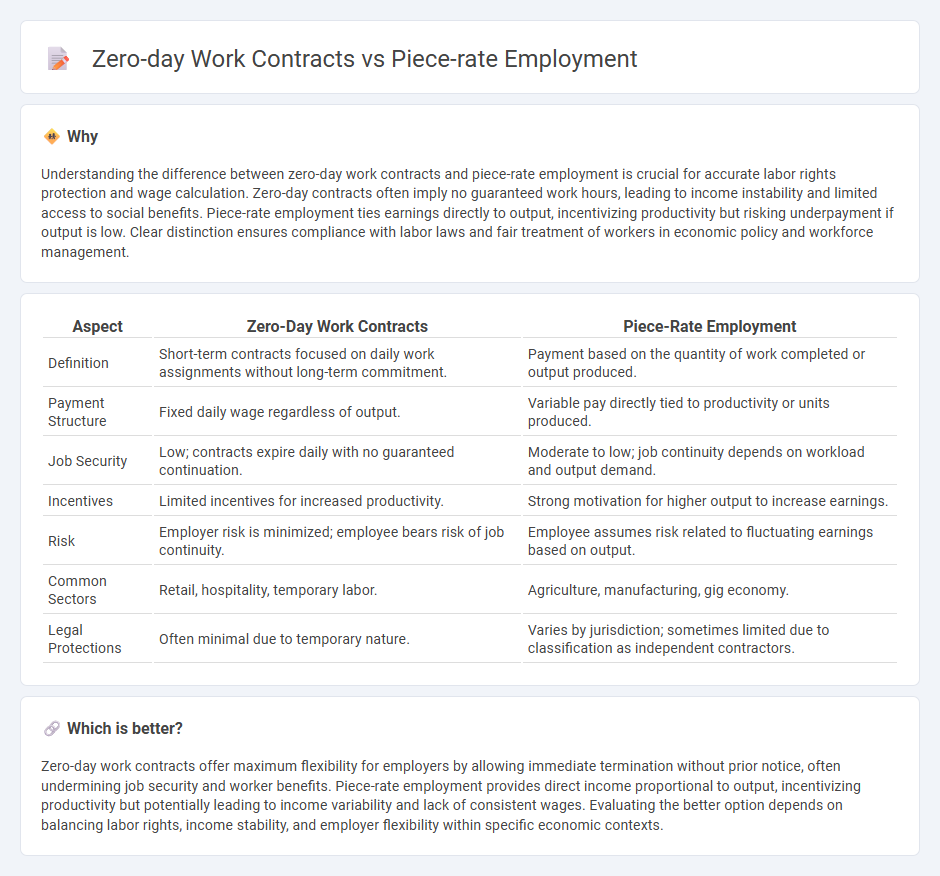

Understanding the difference between zero-day work contracts and piece-rate employment is crucial for accurate labor rights protection and wage calculation. Zero-day contracts often imply no guaranteed work hours, leading to income instability and limited access to social benefits. Piece-rate employment ties earnings directly to output, incentivizing productivity but risking underpayment if output is low. Clear distinction ensures compliance with labor laws and fair treatment of workers in economic policy and workforce management.

Comparison Table

| Aspect | Zero-Day Work Contracts | Piece-Rate Employment |

|---|---|---|

| Definition | Short-term contracts focused on daily work assignments without long-term commitment. | Payment based on the quantity of work completed or output produced. |

| Payment Structure | Fixed daily wage regardless of output. | Variable pay directly tied to productivity or units produced. |

| Job Security | Low; contracts expire daily with no guaranteed continuation. | Moderate to low; job continuity depends on workload and output demand. |

| Incentives | Limited incentives for increased productivity. | Strong motivation for higher output to increase earnings. |

| Risk | Employer risk is minimized; employee bears risk of job continuity. | Employee assumes risk related to fluctuating earnings based on output. |

| Common Sectors | Retail, hospitality, temporary labor. | Agriculture, manufacturing, gig economy. |

| Legal Protections | Often minimal due to temporary nature. | Varies by jurisdiction; sometimes limited due to classification as independent contractors. |

Which is better?

Zero-day work contracts offer maximum flexibility for employers by allowing immediate termination without prior notice, often undermining job security and worker benefits. Piece-rate employment provides direct income proportional to output, incentivizing productivity but potentially leading to income variability and lack of consistent wages. Evaluating the better option depends on balancing labor rights, income stability, and employer flexibility within specific economic contexts.

Connection

Zero-day work contracts and piece-rate employment both undermine job security by offering irregular or performance-based pay structures that prioritize labor flexibility over stability. These employment types often lead to income volatility and limited worker protections, contributing to a precarious labor market and challenging traditional economic models of stable employment. Their proliferation reflects broader trends in the gig economy and labor market deregulation, affecting wage dynamics and worker rights globally.

Key Terms

Wage structure

Piece-rate employment compensates workers based on the quantity of output produced, creating a direct link between productivity and wage, which can incentivize efficiency but may result in income variability. Zero-day work contracts, commonly used for on-demand or casual labor, lack guaranteed working hours and secure wages, often leading to income instability and limited labor protections. Explore further to understand how these wage structures impact worker rights and economic security.

Job security

Piece-rate employment offers workers payment based on output, often resulting in variable income but some continuity of work, while zero-day work contracts provide no guaranteed working days, leading to minimal job security and unpredictable earnings. Workers under zero-day contracts face higher risks of unemployment and lack access to benefits like health insurance or paid leave, unlike many piece-rate arrangements that may offer limited protections depending on local labor laws. Explore the differences in labor protections and financial stability between these contract types to better understand employment security.

Flexibility

Piece-rate employment offers workers payment based on output, providing flexibility to control work pace and hours, which suits variable workloads. Zero-day work contracts, however, offer minimum job security but maximum flexibility for employers, as employment can be terminated with no prior notice, making it ideal for unpredictable labor demands. Explore how these employment models impact worker stability and employer adaptability further.

Source and External Links

Piece-rate pay: what it is, pros, cons, and how to calculate it - Rippling - Piece-rate employment compensates employees based on the number of units of work completed, with common systems including straight piece-rate, differential piece-rate, and a hybrid of hourly plus piece-rate pay.

Piece-Rate Employees: Minimum Wage, Overtime, and Other Issues - Piece-rate employees are paid per task or unit produced, but employers must also comply with minimum wage laws and overtime rules depending on jurisdiction and state regulations.

What is Piece Rate Pay? A Guide for Employers - Gusto - Piece-rate pay is a system where workers are paid per item produced or service rendered, commonly used in manufacturing, construction, and other output-driven industries, with legal requirements ensuring compliance with minimum wage and overtime.

dowidth.com

dowidth.com