Greedflation occurs when rising corporate profits drive up prices beyond cost increases, fueling persistent inflation. An asset bubble, in contrast, involves sharp, unsustainable rises in asset prices like real estate or stocks driven by speculative investment. Explore the distinct economic impacts and risks of greedflation versus asset bubbles.

Why it is important

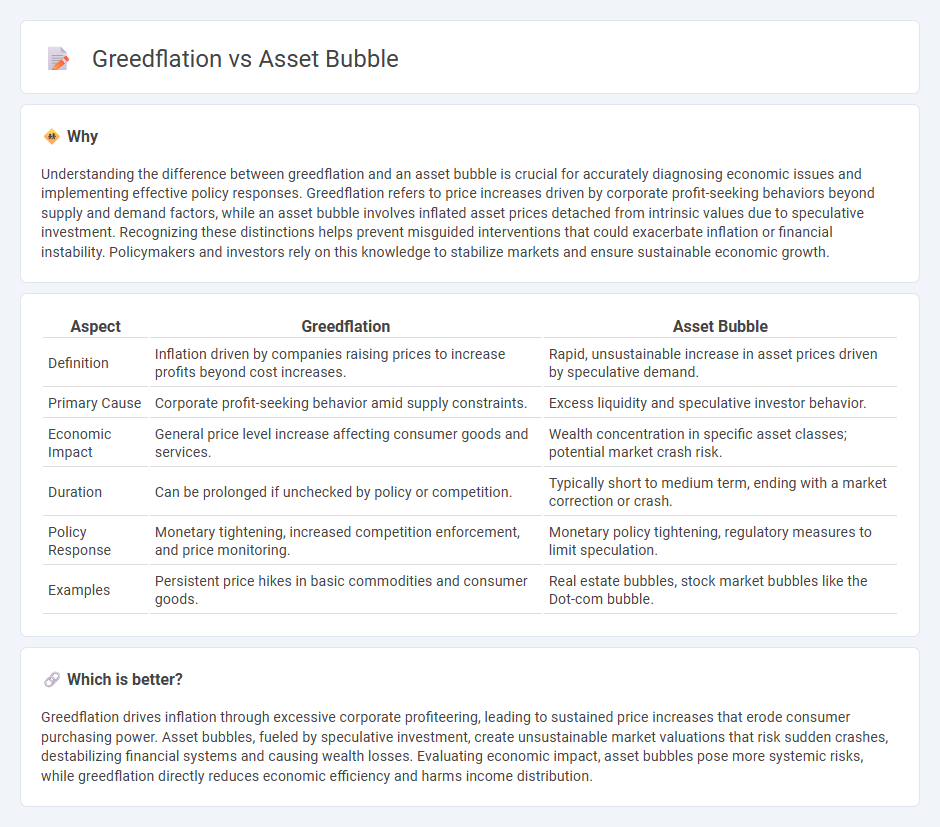

Understanding the difference between greedflation and an asset bubble is crucial for accurately diagnosing economic issues and implementing effective policy responses. Greedflation refers to price increases driven by corporate profit-seeking behaviors beyond supply and demand factors, while an asset bubble involves inflated asset prices detached from intrinsic values due to speculative investment. Recognizing these distinctions helps prevent misguided interventions that could exacerbate inflation or financial instability. Policymakers and investors rely on this knowledge to stabilize markets and ensure sustainable economic growth.

Comparison Table

| Aspect | Greedflation | Asset Bubble |

|---|---|---|

| Definition | Inflation driven by companies raising prices to increase profits beyond cost increases. | Rapid, unsustainable increase in asset prices driven by speculative demand. |

| Primary Cause | Corporate profit-seeking behavior amid supply constraints. | Excess liquidity and speculative investor behavior. |

| Economic Impact | General price level increase affecting consumer goods and services. | Wealth concentration in specific asset classes; potential market crash risk. |

| Duration | Can be prolonged if unchecked by policy or competition. | Typically short to medium term, ending with a market correction or crash. |

| Policy Response | Monetary tightening, increased competition enforcement, and price monitoring. | Monetary policy tightening, regulatory measures to limit speculation. |

| Examples | Persistent price hikes in basic commodities and consumer goods. | Real estate bubbles, stock market bubbles like the Dot-com bubble. |

Which is better?

Greedflation drives inflation through excessive corporate profiteering, leading to sustained price increases that erode consumer purchasing power. Asset bubbles, fueled by speculative investment, create unsustainable market valuations that risk sudden crashes, destabilizing financial systems and causing wealth losses. Evaluating economic impact, asset bubbles pose more systemic risks, while greedflation directly reduces economic efficiency and harms income distribution.

Connection

Greedflation occurs when companies raise prices beyond cost increases to maximize profits, fueling inflation driven by corporate greed. Simultaneously, asset bubbles form as excessive speculative investments inflate prices of stocks, real estate, or commodities beyond their intrinsic values. Both phenomena are interconnected through distorted market signals and excessive risk-taking, undermining economic stability.

Key Terms

Speculation

Asset bubbles arise from speculative investment driving prices far beyond intrinsic values, fueled by expectations of quick financial gains. Greedflation reflects price increases driven by corporate profit-seeking behaviors, often exploiting inflationary conditions rather than genuine demand growth. Explore how speculation distinctly impacts these phenomena and shapes economic outcomes.

Price distortion

Asset bubbles arise from speculative investment driving prices above intrinsic values, creating unsustainable inflation in markets like real estate or stocks. Greedflation refers to price distortion caused by firms exploiting inflationary environments to raise prices excessively, beyond cost increases. Explore the subtle differences in pricing dynamics and their economic impacts for deeper understanding.

Market manipulation

Market manipulation plays a critical role in both asset bubbles and greedflation, where inflated asset prices or excessive corporate pricing strategies distort market fundamentals. Asset bubbles often arise from speculative trading and artificial demand amplification by large investors, while greedflation is driven by firms exploiting market power to push prices beyond cost increases, harming consumer purchasing power. Explore the mechanisms and effects of market manipulation to understand how these phenomena impact economic stability and investor behavior.

Source and External Links

The asset price bubble in Japan in the 1980s: lessons for financial ... - An asset bubble is a rapid rise in asset prices beyond fundamental values that builds financial and macroeconomic risks, which often trigger severe downturns when the bubble bursts, as exemplified by Japan's 1980s experience.

Asset price bubbles - Federal Reserve Bank of Chicago - Asset bubbles occur when asset prices exceed fundamental values, often fueled by excess liquidity and leverage, and policy measures are suggested to curb credit growth to prevent bubbles.

Economic bubble - Wikipedia - An economic bubble is a phase when asset prices far exceed their intrinsic worth, driven by overly optimistic growth expectations or disregard of fundamental valuations, leading to eventual sharp price declines.

dowidth.com

dowidth.com