Greenhushing refers to companies deliberately underreporting their environmental initiatives to avoid scrutiny or backlash, while SDG-washing involves exaggerating commitments to the United Nations Sustainable Development Goals for reputational gain. Both practices undermine genuine sustainability efforts and distort the economic impact of corporate responsibility on global development. Explore how these phenomena affect market transparency and investor trust in sustainability.

Why it is important

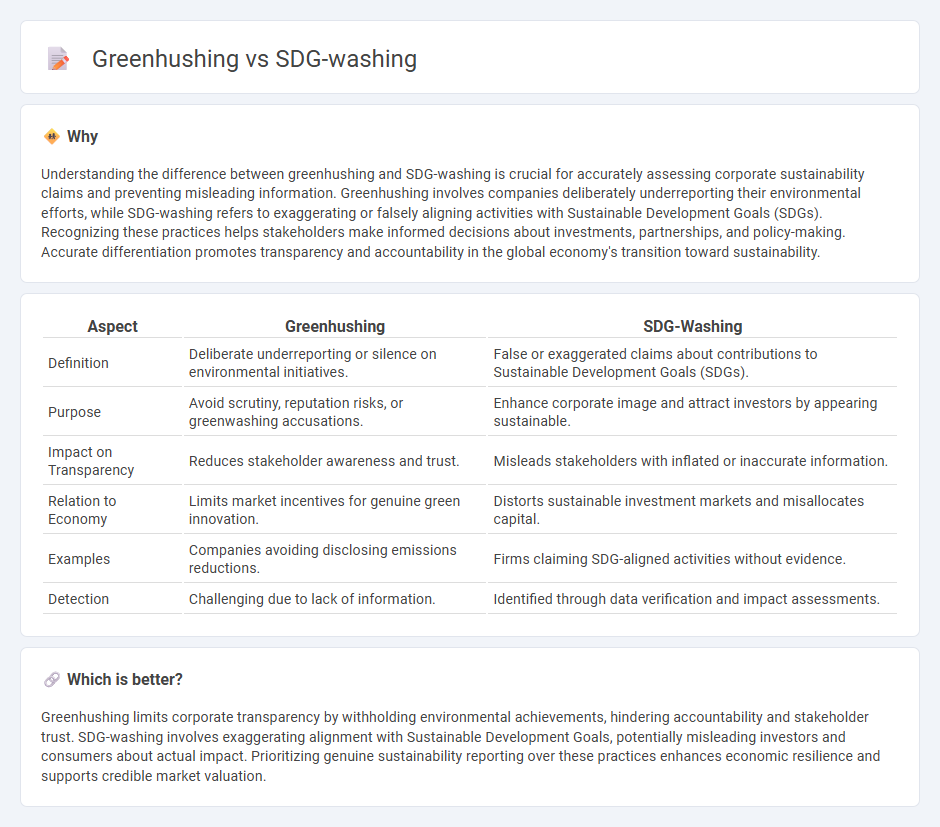

Understanding the difference between greenhushing and SDG-washing is crucial for accurately assessing corporate sustainability claims and preventing misleading information. Greenhushing involves companies deliberately underreporting their environmental efforts, while SDG-washing refers to exaggerating or falsely aligning activities with Sustainable Development Goals (SDGs). Recognizing these practices helps stakeholders make informed decisions about investments, partnerships, and policy-making. Accurate differentiation promotes transparency and accountability in the global economy's transition toward sustainability.

Comparison Table

| Aspect | Greenhushing | SDG-Washing |

|---|---|---|

| Definition | Deliberate underreporting or silence on environmental initiatives. | False or exaggerated claims about contributions to Sustainable Development Goals (SDGs). |

| Purpose | Avoid scrutiny, reputation risks, or greenwashing accusations. | Enhance corporate image and attract investors by appearing sustainable. |

| Impact on Transparency | Reduces stakeholder awareness and trust. | Misleads stakeholders with inflated or inaccurate information. |

| Relation to Economy | Limits market incentives for genuine green innovation. | Distorts sustainable investment markets and misallocates capital. |

| Examples | Companies avoiding disclosing emissions reductions. | Firms claiming SDG-aligned activities without evidence. |

| Detection | Challenging due to lack of information. | Identified through data verification and impact assessments. |

Which is better?

Greenhushing limits corporate transparency by withholding environmental achievements, hindering accountability and stakeholder trust. SDG-washing involves exaggerating alignment with Sustainable Development Goals, potentially misleading investors and consumers about actual impact. Prioritizing genuine sustainability reporting over these practices enhances economic resilience and supports credible market valuation.

Connection

Greenhushing and SDG-washing intersect as deceptive economic practices that distort corporate sustainability claims, misleading stakeholders about genuine environmental and social progress. Both tactics undermine the integrity of green investments by concealing or exaggerating a company's commitment to Sustainable Development Goals (SDGs), thus affecting market transparency and resource allocation. This connection hampers the momentum toward a truly sustainable economy by eroding trust in corporate responsibility disclosures.

Key Terms

Transparency

SDG-washing involves companies falsely portraying their efforts towards Sustainable Development Goals to gain public favor, while greenhushing is the deliberate underreporting of environmental initiatives to avoid scrutiny or criticism. Transparency plays a crucial role in distinguishing genuine sustainability efforts from misleading claims, as clear, verifiable disclosures build trust among stakeholders. Explore how enhanced transparency frameworks can combat both SDG-washing and greenhushing to ensure accountable corporate sustainability.

Corporate Social Responsibility (CSR)

Corporate Social Responsibility (CSR) faces challenges from SDG-washing, where companies exaggerate contributions to Sustainable Development Goals (SDGs), and greenhushing, the practice of downplaying environmental efforts to avoid scrutiny. SDG-washing distorts genuine sustainability efforts, while greenhushing undermines transparency and stakeholder trust. Explore strategies to enhance authentic CSR communication and reporting to better align with global sustainability standards.

Impact Measurement

SDG-washing involves exaggerating contributions to the United Nations Sustainable Development Goals, compromising credible impact measurement and reporting. Greenhushing denotes the intentional underreporting of sustainability achievements to avoid scrutiny or backlash, hindering transparency in impact assessment. Explore effective strategies to enhance authentic impact measurement and promote genuine sustainability communication.

Source and External Links

Check out our five tips to avoid SDG washing and make sure your company achieves a real positive sustainability impact - SDG washing occurs when a company markets its positive contribution to some Sustainable Development Goals (SDGs) while ignoring its negative impact on others; to avoid it, companies should align activities to specific SDG targets, set measurable goals, be transparent, and avoid cherry-picking SDGs to report on.

Putting the SDGs Back on Track - SDG washing is when companies claim contributions to societal sustainability goals without proper evidence or action, and it is more expansive than greenwashing since it covers social, economic, and governance areas; research shows many companies use SDGs superficially, with only a small fraction fully integrating them into their operations.

SDG washing: what it is & how to avoid it - SDG washing refers to vague or false claims about contributions to SDGs for marketing purposes without meaningful action; preventing SDG washing involves aligning efforts to specific, measurable SDG targets and indicators rather than broad goals alone.

dowidth.com

dowidth.com