Rentvesting allows investors to build property portfolios by renting where they want to live while buying investment properties in more affordable markets, optimizing cash flow and capital growth. Property flipping involves purchasing undervalued homes, renovating them, and selling quickly for profit, capitalizing on market demand and renovation expertise. Discover which strategy aligns better with your financial goals and market conditions.

Why it is important

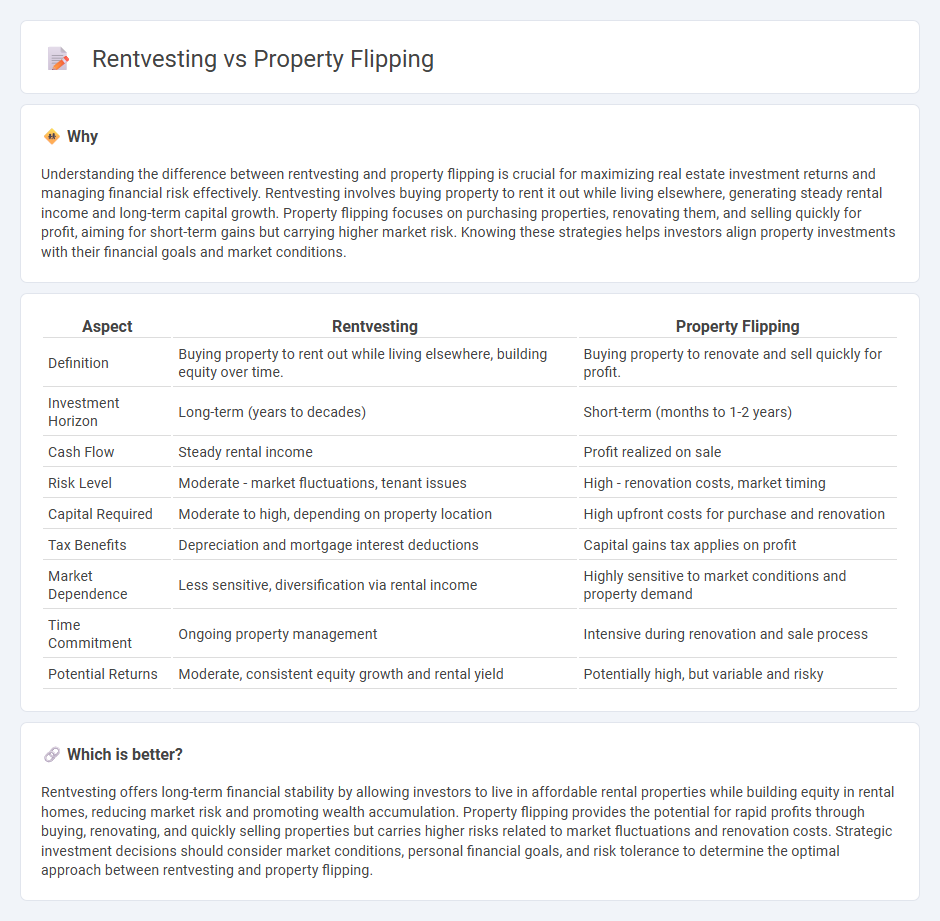

Understanding the difference between rentvesting and property flipping is crucial for maximizing real estate investment returns and managing financial risk effectively. Rentvesting involves buying property to rent it out while living elsewhere, generating steady rental income and long-term capital growth. Property flipping focuses on purchasing properties, renovating them, and selling quickly for profit, aiming for short-term gains but carrying higher market risk. Knowing these strategies helps investors align property investments with their financial goals and market conditions.

Comparison Table

| Aspect | Rentvesting | Property Flipping |

|---|---|---|

| Definition | Buying property to rent out while living elsewhere, building equity over time. | Buying property to renovate and sell quickly for profit. |

| Investment Horizon | Long-term (years to decades) | Short-term (months to 1-2 years) |

| Cash Flow | Steady rental income | Profit realized on sale |

| Risk Level | Moderate - market fluctuations, tenant issues | High - renovation costs, market timing |

| Capital Required | Moderate to high, depending on property location | High upfront costs for purchase and renovation |

| Tax Benefits | Depreciation and mortgage interest deductions | Capital gains tax applies on profit |

| Market Dependence | Less sensitive, diversification via rental income | Highly sensitive to market conditions and property demand |

| Time Commitment | Ongoing property management | Intensive during renovation and sale process |

| Potential Returns | Moderate, consistent equity growth and rental yield | Potentially high, but variable and risky |

Which is better?

Rentvesting offers long-term financial stability by allowing investors to live in affordable rental properties while building equity in rental homes, reducing market risk and promoting wealth accumulation. Property flipping provides the potential for rapid profits through buying, renovating, and quickly selling properties but carries higher risks related to market fluctuations and renovation costs. Strategic investment decisions should consider market conditions, personal financial goals, and risk tolerance to determine the optimal approach between rentvesting and property flipping.

Connection

Rentvesting and property flipping intersect as strategic approaches in real estate investment, where rentvesting involves purchasing property to rent out while residing elsewhere, creating rental income streams. Property flipping complements this by buying undervalued homes, renovating them, and selling for a profit, which can fund further rentvesting opportunities. Both methods leverage market timing and property appreciation trends to maximize financial returns within the economy.

Key Terms

Capital Gains

Property flipping generates immediate capital gains by buying undervalued properties, renovating, and selling them at a higher price within a short timeframe, often resulting in higher tax liabilities due to short-term gains. Rentvesting involves purchasing a property for rental income while living in a more affordable rental, allowing investors to benefit from long-term capital growth and potential tax advantages like negative gearing. Explore how each strategy impacts your capital gains and tax planning to determine the best approach for your investment goals.

Rental Yield

Rental yield plays a pivotal role in choosing between property flipping and rentvesting, with flipping aiming for capital gains from short-term sales while rentvesting emphasizes steady rental income streams. Rentvesting investors target high rental yields to maximize cash flow, often opting for properties in growth areas with strong tenant demand, whereas flippers prioritize market timing and renovation potential to boost resale value. Explore more about how rental yield influences investment strategies and financial outcomes.

Negative Gearing

Negative gearing allows investors to offset property investment losses against income, making it a key factor in both property flipping and rentvesting strategies. Property flipping aims for short-term capital gains but may limit negative gearing benefits due to shorter ownership periods. Understanding how negative gearing impacts cash flow and tax advantages can help investors optimize their approach; explore more to tailor your investment strategy effectively.

Source and External Links

How to Start Flipping Houses: A Step-by-Step Guide for Beginners - Property flipping involves buying homes at a low price, renovating them, and reselling for profit, requiring market research, budgeting, and renovation management to succeed.

Illegal Property Flipping - Illegal property flipping occurs when a buyer purchases a property, makes minimal improvements, and sells it at an artificially inflated price using fraudulent appraisals and straw buyers, deceiving lenders and causing financial harm.

What is the 70% rule in house flipping? - The 70% rule advises investors to pay no more than 70% of a property's after-repair value (ARV) minus repair costs when flipping houses, serving as a guideline to help maximize potential profits.

dowidth.com

dowidth.com