Shadow bailouts involve indirect financial support to failing institutions through off-balance-sheet mechanisms, often avoiding immediate transparency and fiscal impact. Recapitalization refers to the direct injection of capital into banks or companies to restore solvency and stabilize the financial system, usually reflected clearly in government budgets. Explore the distinctions and implications of these approaches to understand their impact on economic stability.

Why it is important

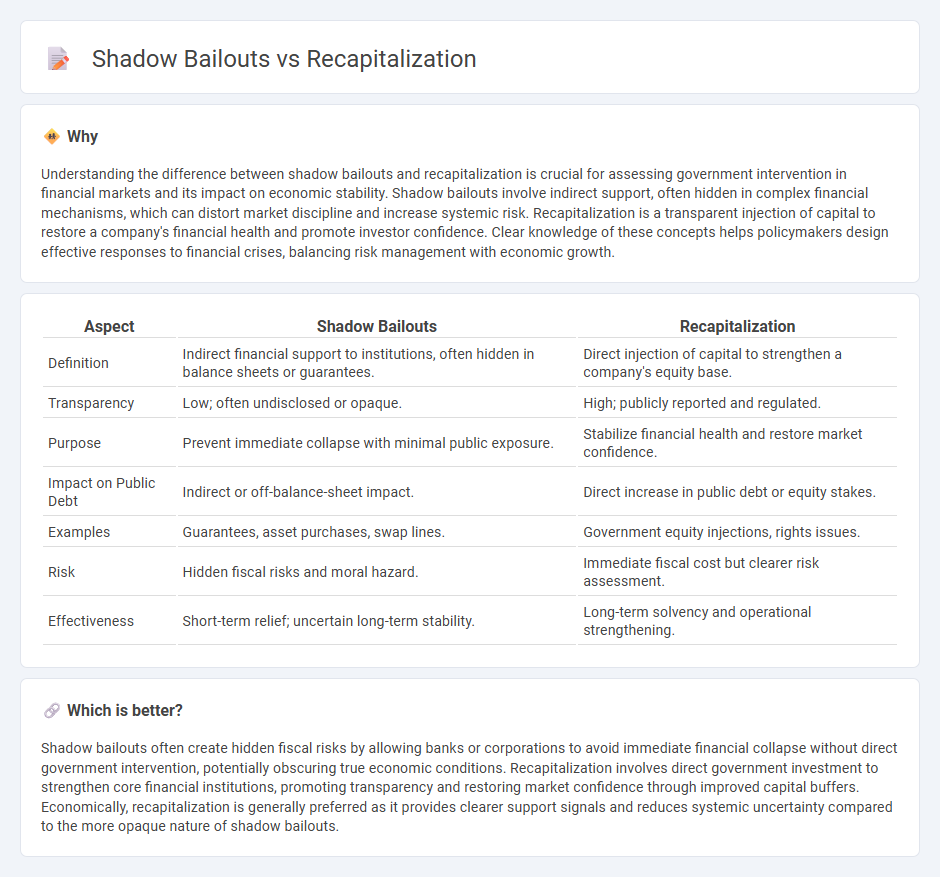

Understanding the difference between shadow bailouts and recapitalization is crucial for assessing government intervention in financial markets and its impact on economic stability. Shadow bailouts involve indirect support, often hidden in complex financial mechanisms, which can distort market discipline and increase systemic risk. Recapitalization is a transparent injection of capital to restore a company's financial health and promote investor confidence. Clear knowledge of these concepts helps policymakers design effective responses to financial crises, balancing risk management with economic growth.

Comparison Table

| Aspect | Shadow Bailouts | Recapitalization |

|---|---|---|

| Definition | Indirect financial support to institutions, often hidden in balance sheets or guarantees. | Direct injection of capital to strengthen a company's equity base. |

| Transparency | Low; often undisclosed or opaque. | High; publicly reported and regulated. |

| Purpose | Prevent immediate collapse with minimal public exposure. | Stabilize financial health and restore market confidence. |

| Impact on Public Debt | Indirect or off-balance-sheet impact. | Direct increase in public debt or equity stakes. |

| Examples | Guarantees, asset purchases, swap lines. | Government equity injections, rights issues. |

| Risk | Hidden fiscal risks and moral hazard. | Immediate fiscal cost but clearer risk assessment. |

| Effectiveness | Short-term relief; uncertain long-term stability. | Long-term solvency and operational strengthening. |

Which is better?

Shadow bailouts often create hidden fiscal risks by allowing banks or corporations to avoid immediate financial collapse without direct government intervention, potentially obscuring true economic conditions. Recapitalization involves direct government investment to strengthen core financial institutions, promoting transparency and restoring market confidence through improved capital buffers. Economically, recapitalization is generally preferred as it provides clearer support signals and reduces systemic uncertainty compared to the more opaque nature of shadow bailouts.

Connection

Shadow bailouts and recapitalization are connected through their roles in stabilizing financial institutions during economic crises. Shadow bailouts involve indirect government support, such as guarantees or asset purchases, to prevent bank failures without explicit public acknowledgment. Recapitalization complements this by injecting capital into troubled banks, restoring their balance sheets and enabling continued lending to support economic recovery.

Key Terms

Capital Injection

Recapitalization involves direct capital injections into financial institutions to strengthen their balance sheets, enhancing stability and restoring confidence in the market. Shadow bailouts refer to indirect support mechanisms, such as guarantees or asset purchases, that provide liquidity without immediate capital allocation but often increase contingent liabilities. Explore the distinctions and impacts of these interventions to better understand their roles in economic resilience.

Off-balance Sheet Support

Recapitalization involves direct equity injections to strengthen a company's balance sheet, improving financial stability and investor confidence. Shadow bailouts, often through off-balance sheet support mechanisms like guarantees or contingent liabilities, provide indirect assistance without formal capitalization, risking hidden financial exposure for governments or institutions. Explore the nuances and impacts of these strategies to understand their role in financial crisis management.

Regulatory Forbearance

Recapitalization involves injecting capital into distressed financial institutions to restore stability, while shadow bailouts refer to indirect government support through regulatory forbearance, allowing banks to defer loss recognition and avoid immediate recapitalization. Regulatory forbearance can mask true financial health, potentially delaying necessary market corrections and increasing systemic risk. Explore the implications of regulatory forbearance on financial stability and effective policy responses in depth.

Source and External Links

Recapitalization - Wikipedia - Recapitalization involves restructuring a company's capital, often by swapping equity for debt or vice versa, to address financing needs, takeover risks, or ownership strategies.

What is Recapitalization: Small Business Specifics - TAB Bank - Recapitalization is a process that adjusts a firm's debt-to-equity ratio, allowing companies to exchange debt for equity or vice versa to strengthen their capital structure and respond to market conditions.

A Guide to Recapitalization - Wilcox Investment Bankers - Recapitalization is a financial strategy to optimize the mix of debt and equity funding, supporting growth, reducing leverage, or allowing owners to partially cash out.

dowidth.com

dowidth.com